There are two most important the explanation why Bitcoin broke by means of the main resistance degree at $48,000 in February and reached ranges above $52,000. It is taken into account QCP Capital Analysts.

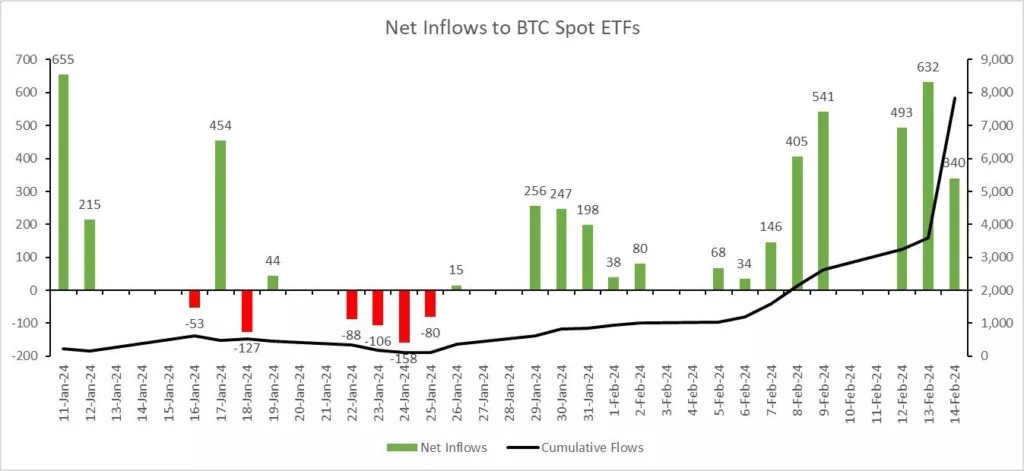

One issue was the inflow of cash into spot ETFs primarily based on the primary cryptocurrency. At the tip of January, the market returned to the “net flow zone.” On February 13, the each day determine reached $631 million, equal to the primary file buying and selling day for the merchandise.

Experts identified that "the huge volume of spot demand inevitably led to higher prices."

They take into account the second driver to be the rise Continuing medical schooling Profit necessities. Short Bitcoin merchants utilizing leverage had been pressured to supply larger protection in a comparatively low-liquidity atmosphere resulting from Chinese New Year celebrations.

“This led to an increase in spot and forward prices,” QCP Capital specialists confirmed.

As anticipated, dangerous property started to be bought off in all instructions. However, this turned out to be short-lived, because the market greater than purchased the dip the subsequent day, particularly in cryptocurrencies.

QCP Capital expects Bitcoin to return to historic highs in March.

Stay in contact! Subscribe to Cryptocurrency.Tech at cable.

Bitcoin

Comments

Post a Comment