He succeeded Bitcoin price BTC It broke the $50,000 barrier and continued to rise until it approached the $53,000 level before falling again, surprising some market participants. However, as expectations for the future of cryptocurrency prices become increasingly optimistic, this could indicate the timing of a potential correction.

Cryptocurrency analyst and market expert Michael van de Poppe believes that this correction could reach 40%.

Emotions May Tell You the Wrong Story About Bitcoin

V Published On the platform Market sentiment. Michael van de Poppe explained that "market sentiment is always a poor indicator" and investors should apply this to their strategies.

To further illustrate this point, the cryptocurrency analyst provided two examples in which the opinion was proven wrong. The first is the approval of exchange-traded funds (ETFs) for spot Bitcoin, which has sparked calls for a new Bitcoin high.

Despite the strong and sharp growth... Bitcoin price BTCHowever, he never reached his highest level.

“The strength of the markets is already reflected in the actual price movements,” explains the analyst. “But emotions always go too far because emotions are reflected in scenarios, so emotions have a negative impact on trading and investing.”

Michael van de Poppe also pointed out another scenario where sentiment was wrong: the price fell from $49,000 to $39,000.

And this was the result for liquidity outflow From Grayscale Bitcoin Trust (GBTC), which the market expected to persist. However, outflows will eventually slow, causing Bitcoin's price to rise.

Another important point is the current market trend, which the analyst believes is of great interest. This interest among investors is expected to continue, but a cryptocurrency expert explains that in cases like this, “emotion always trumps reality, and emotion trumps price action by a mile, so people start losing money.”

Will Bitcoin Price See a 40% Correction?

Following the significant rise in Bitcoin prices over the past few weeks, the cryptocurrency analyst advises investors to have a plan of action when entering the market, whether for trading or investment purposes.

This indicates that there is potential for a market correction following changes in macroeconomic events. One such event is the Consumer Price Index (CPI). What a rose last week. Additionally, inflows declined as investors began withdrawing their money from the market.

Michael van de Poppe explains that the influx of venture capital is not limited to Bitcoin exchange-traded funds (ETFs). There are other methods of influx of funds in which investors can also begin to sell their currency.

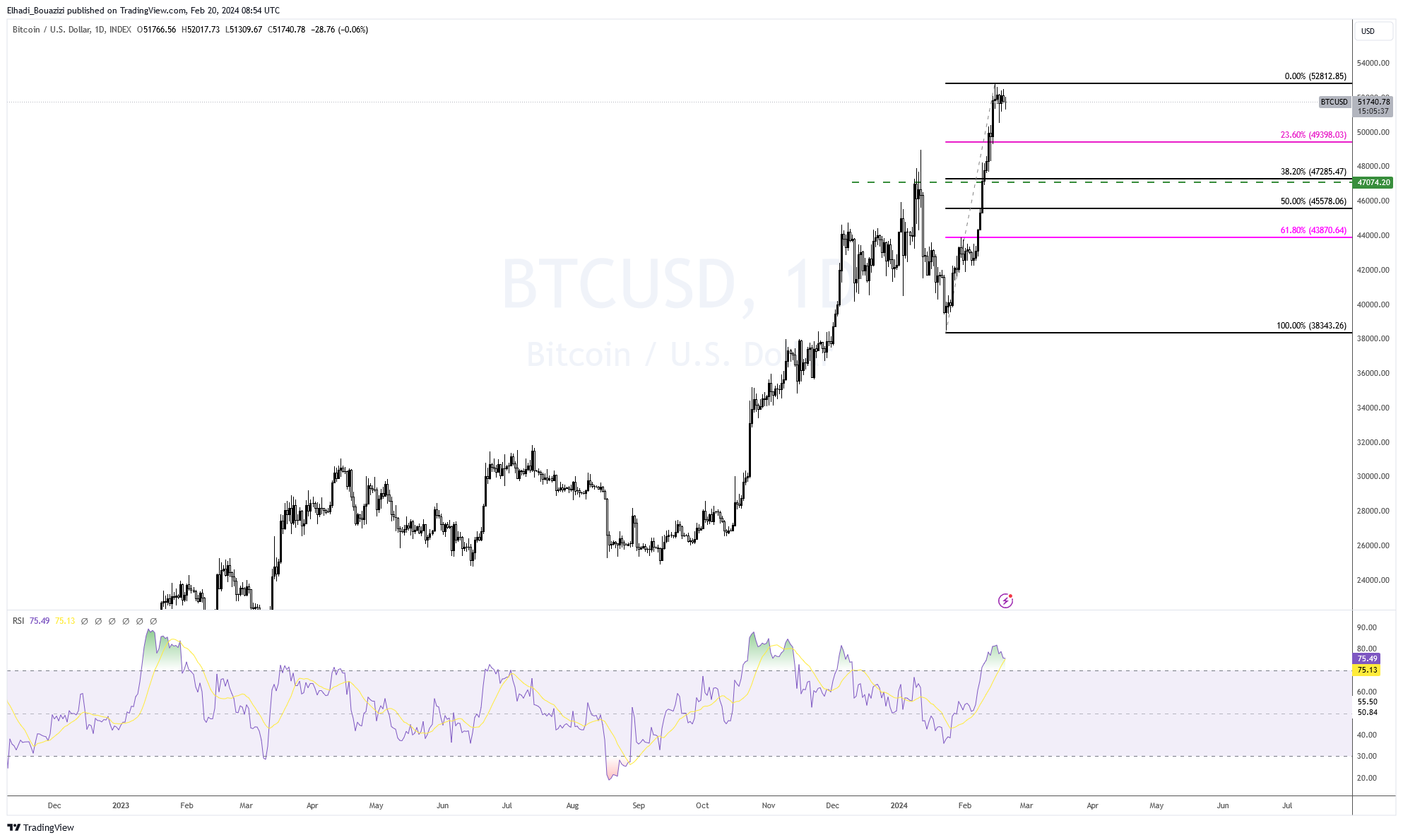

“These corrections, given the current sentiment, will be rapid,” the analyst warns. “I don’t know exactly where these corrections will come from, but looking at the data, there is reason to suspect that markets will peak between US$53.” 58K and see a correction of 20-40%.”

Looking at the daily chart, we notice that Michael van de Poppe's forecast is based on the 38.2% Fibonacci levels. And levels BTC price At the moment, the correction may decrease to $47,000. And the previous peak, below which the price is stuck.

Denial of responsibility

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, conduct or decision taken by the reader in reliance on this information is solely the responsibility of it and its affiliates individually, and the site does not bear any legal liability for these decisions.

Comments

Post a Comment