With high Bitcoin price BTC Above 52 thousand dollarsThe data indicates continued buying pressure from US institutional investors. To meet the current needs of spot Bitcoin ETFs. There is an important indicator that accurately explains this relationship between US capital flow and Bitcoin price movement and how it can help us in market analysis.

Coinbase Premium Indicator

In accordance with Tweet Ki Young Joo, founder and general manager of CryptoQuant, a platform specializing in the collection and analysis of blockchain data. US brokerage firms are buying on the Coinbase platform to meet Bitcoin purchase requests from their institutional clients.

The scale used here Coinbase Premium Indicator It tracks the percentage difference between BTC prices listed on the world's two largest cryptocurrency trading platforms, Coinbase and Binance.

Coinbase is best known for being used by US institutional organizations, while Binance has a more global user base.

The indicator measures the difference between Price (BTC) on Coinbase, one of the largest cryptocurrency exchanges in the world, and the price of Bitcoin on other trading platforms.

This indicator can show the extent of demand for Bitcoin in the US market compared to global markets. If the price of Bitcoin on Coinbase is higher, it can be considered a sign of high demand in the US market, and vice versa.

This indicator is important for traders and investors as it can help identify potential buying or selling opportunities when prices vary across different markets.

Therefore, this metric can give us insight into the differences in buyer and seller behavior between these two demographic groups.

Coinbase Premium Indicator Indicates Strong Buying Pressure From US Institutions

The Coinbase Premium Index chart over the past two weeks shows that the index has been mostly at positive levels, indicating that the price of Bitcoin on Coinbase has been higher than… Binance platform.

This happens when users are under pressure from buyers. Coinbase platform Increased buying pressure from Binance users. This could also come as selling pressure on Coinbase eases.

However, the most recent positive readings occurred when the price of Bitcoin rose. This means that there has been a net buying in the market.

Thus, the green Coinbase Premium indicator indicates relatively high buying pressure from US institutional traders.

In the first week of the month, the indicator was negative and the price moved sideways. However, as the indicator approaches positive levels, Bitcoin's latest rally has begun. Which indicates the role of these large entities in the market at present.

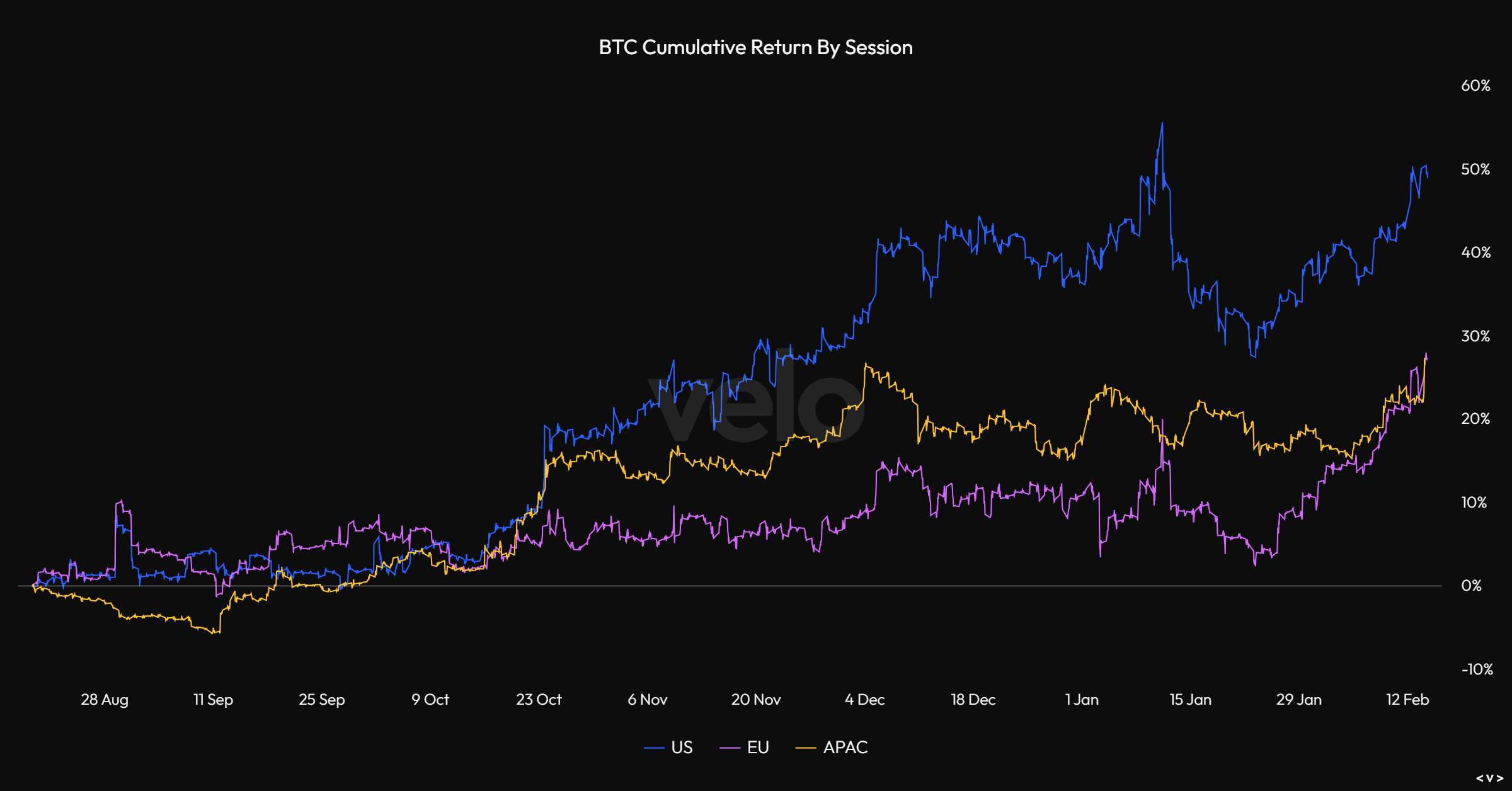

Data shows US investors are driving BTC higher. The graph shows that Share Will, co-founder of Reflexivity Research, said Bitcoin achieved its highest returns during US trading hours in months.

Given the correlation between institutional behavior on Coinbase and the price of BTC, the Coinbase Premium Index could become an important indicator in the coming days.

If the indicator remains in the positive zone, this may indicate continued growth in Bitcoin. Although its decline into negative territory may indicate that institutions are starting to sell Bitcoin.

Denial of responsibility

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in reliance on this information are solely the responsibility of it and its affiliates individually, and the site does not accept any legal liability for these decisions.

الأخبار

Comments

Post a Comment