Witness Bitcoin BTC Price It recently surpassed $59,000, supported by positive expectations ahead of the next halving event, growing institutional demand, and the early success of spot Bitcoin ETFs. Some traders expect the price of Bitcoin to reach $69,000 by next March, its highest level ever.

History of price movements before and after the Bitcoin halving event

A Bitcoin halving event is a scheduled phenomenon that occurs in the Bitcoin network every 210,000 blocks (approximately 4 years) and cuts Bitcoin mining rewards in half.

This event is important in the world of Bitcoin because it affects supply and can have a significant impact on prices. Because this reduces the amount of new Bitcoins available on the market.

Historically, this event has been associated with significant increases in the price of Bitcoin.

NOW The next halving date is expected This will take place between April 17 and 18.

While the demand for Bitcoin is expected to remain stable or increase as acceptance and adoption of the digital currency increases. Institutions after the launch of ETFs.

What are the price movements before and after the Bitcoin halving event?

Before the halving event:

- Gradual Rise: Bitcoin prices tend to gradually increase in the months leading up to the halving event.

- Volatility: Bitcoin prices rise significantly ahead of the halving event.

- Media Hype: Media interest in Bitcoin increases significantly ahead of the halving event.

After the halving event:

- Sharp rise: Bitcoin prices often see a sharp rise after a halving event.

- Short-term correction: Bitcoin prices could see a short-term correction after a sharp rise.

- Uptrend: Bitcoin prices tend to follow a long-term uptrend after a halving event.

Figures on Bitcoin price movements from the previous three summer events

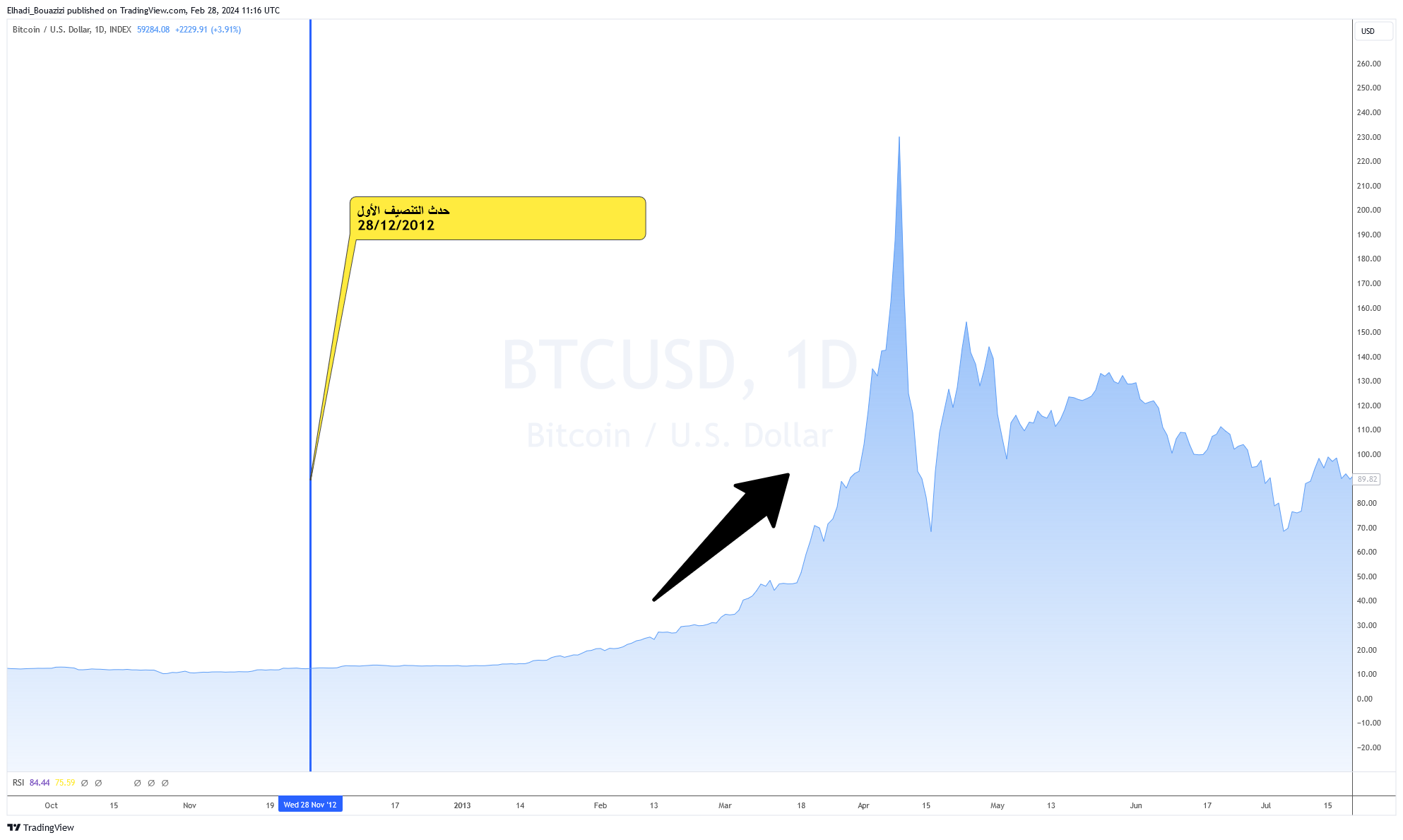

First half - 2012

In November 2012, the first Bitcoin halving took place, where the mining reward dropped from 50 BTC to 25 BTC per block. Before the halving, Bitcoin prices were moving in a relatively narrow range. After the halving, prices began to increase significantly. In the months immediately following the halving, prices saw a gradual rise, and in April 2013, the price of Bitcoin reached a new high of over US$100.

- Before the halving: Bitcoin price rose from $2 to $32.

- After the halving: Bitcoin price rose to $266 in one year.

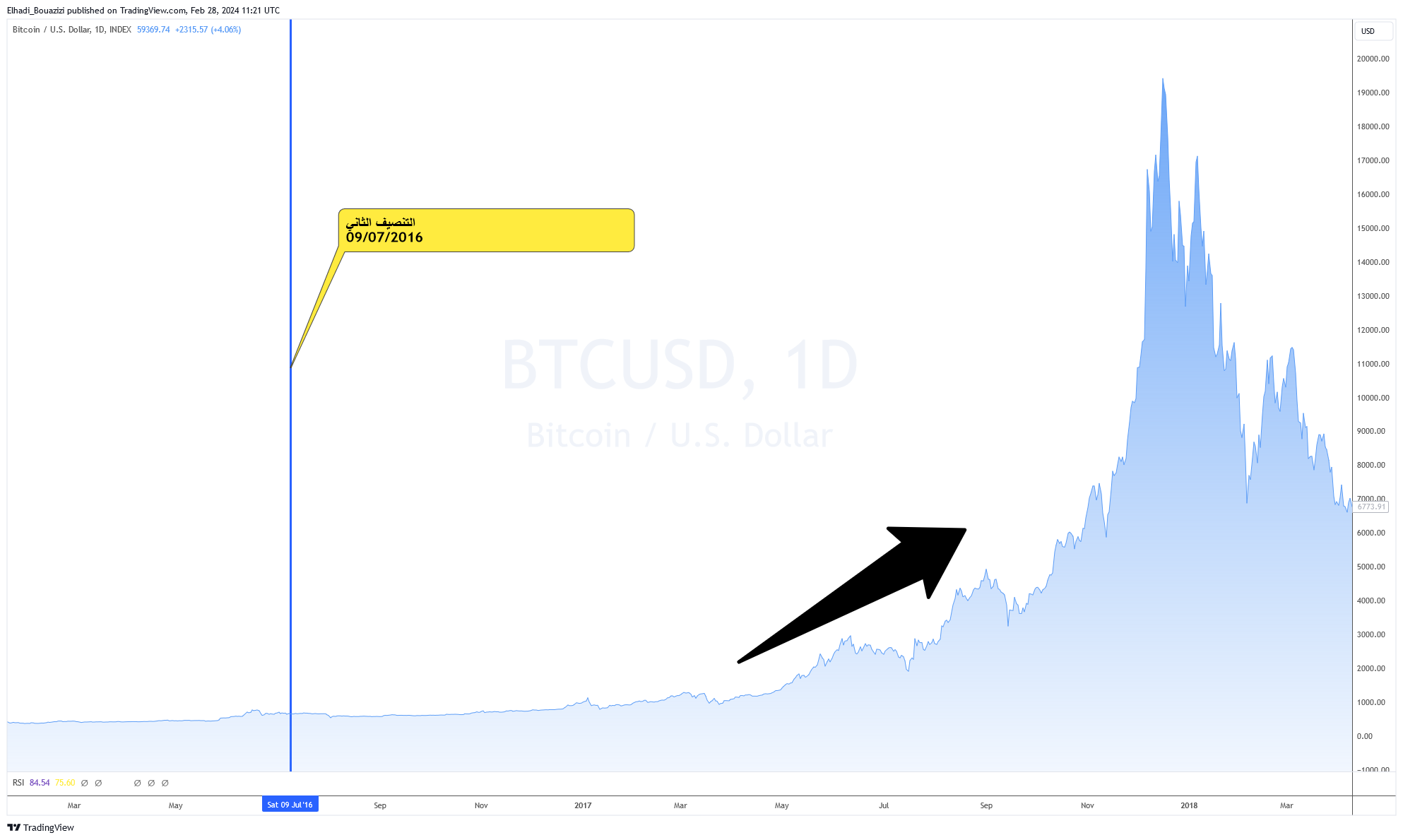

Second semester - 2016

The second halving took place in July 2016, where the mining reward decreased from 25 to 12.5 BTC. Before the halving, prices were gradually increasing. After the halving, prices continued to rise, leading to the start of a major bull market that lasted until the end of 2017, with the price of Bitcoin reaching around $20,000, which represented a massive increase by compared to prices before the halving.

- Before the halving: Bitcoin price rose from $314 to $774.

- After the halving: Bitcoin price rose to $20,000 in one year.

Third finalist - 2020

In May 2020, we saw the third halving, which reduced the mining reward to 6.25 BTC per block. Ahead of the event, the price of Bitcoin began to rise, partly due to expectations of the halving. After the halving, prices continued their upward trend, and in late 2020 and early 2021, markets recorded a new record high, with Bitcoin price surpassing US$60,000 in early 2021.

- Before the Halving: Bitcoin price rose from $3,122 to $10,000.

- After the Halving: Bitcoin price reached $68,000 in one year.

The Path to the $69,000 Summit

By adding the historical factors we mentioned, we increase Bitcoin BTC Price Before each halving event. This fourth time, the cyclical event coincided with the adoption of spot Bitcoin ETFs in the United States and the very strong momentum that this gave to the price.

Read also : Why did Bitcoin surpass $57,000 to reach its highest levels since 2021?

This opened the door for institutional capital to legally enter the Bitcoin market. This is what we have seen in recent weeks in terms of record flows into these funds, which have exceeded His holdings amount to over 300.00 BTC.

Trading volume of nine Bitcoin ETFs in the United States hit a new record high of $3.2 billion last week, indicating strong positive sentiment from institutions.

Therefore, some analysts expect Bitcoin to surpass its all-time high of $69,000 in March. That said, institutional demand and the success of spot bitcoin ETFs are likely to drive prices higher.

“Anticipation leads to increased purchasing activity or 'fear of missing out,'” says Brian Legend, CEO of Hectic Labs.

He added: "Investors expect a decrease in supply, which will lead to higher prices, and a rise in prices before the halving could contribute to the start of a new bullish wave as sentiments positive ones dominate."

“54 days away from the halving and an expected mid-year Fed rate cut, Bitcoin prices have a support level at $50,000 and could fluctuate towards record highs in March” , said Ryan Lee, principal analyst at Bitget Research.

Ultimately, nothing can be guaranteed in the world of investing, especially digital currencies, but the factors supporting the rise in the price of Bitcoin are strong, allowing it to reach $69,000 before the halving event.

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تقرير إخباري,العملات الرقمية,بيتكوين,تنصيف بيتكوين,سعر بيتكوين

Comments

Post a Comment