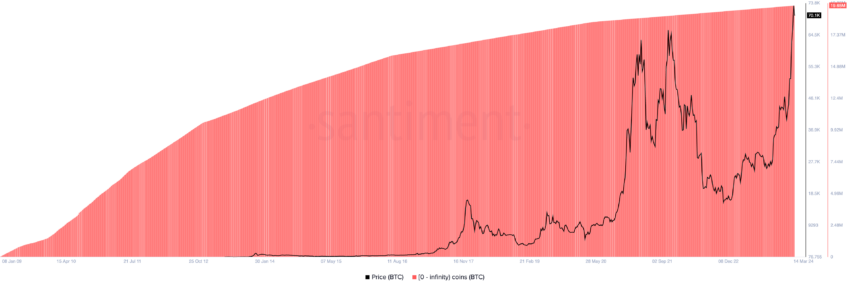

Bitcoin is emerging as a leading contender in the cryptocurrency sector, with analysts predicting a considerable increase in its adoption rates. According to famous analyst Willie Wu, BCT is poised for a huge leap, one that is expected to follow the Internet's growth trajectory from 1997 to 2005.

What does a billion Bitcoin holders mean?

Wu believes this seismic shift in adoption has been years in the making. For this reason, Confirm Wu said that “one billion people will own Bitcoin by the end of this cycle.” He highlighted the accelerated adoption rate of digital currency, which exceeds the adoption rate of the early days of the Internet.

Given the accelerated acceptance of Bitcoin around the world, propose Crypto expert Adam Back says the market is eyeing a much higher target, with $100,000 considered “too late”.

"Bitcoin broke above $73,000 on Tuesday. No one said anything. It spent most of Wednesday above $73,000. I think the reason things are quiet is because $100,000 seems very late, a few years ago now, so there's not much" Euphoria in a bull market with green candles ranging from $1,000 to $5,000.

- Read more: Bitcoin Price Forecast 2024/2024/2025/2030

It is also worth noting that the motivation behind this BTC price prediction is largely due to institutional demand.

ETFs introduced the first cryptocurrency as a viable institutional investment

as underlines CryptoQuant CEO Ki Young Joo noted that a “sell-side liquidity crisis” was looming if institutional inflows continued. This increase in demand, coupled with the successful launch of Bitcoin spot exchange-traded funds (ETFs) in the United States, validated BTC as a viable institutional investment and presented a model in which demand could soon exceed l 'offer.

In fact, Bitcoin spot ETFs have become the best performing ETFs in history. This raised almost $30 billion. As Joe explained, this influx could create a supply-induced price shock. So this is a scenario where the available BTC fails to meet the growing demand.

- Read more : Will Bitcoin Reach a New High in 2024?

Last week's net inflows into spot ETFs exceeding 30,000 BTC exacerbated a potential liquidity crisis.

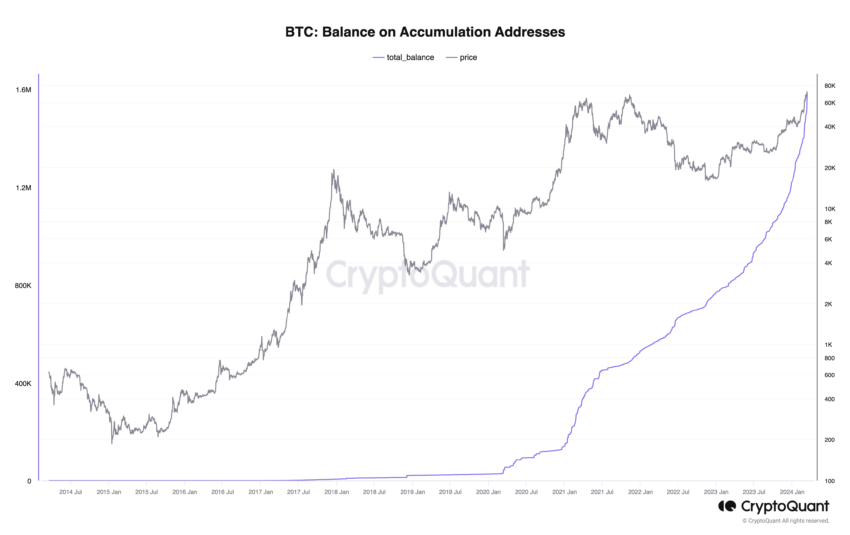

Additionally, Joe's analysis highlights the accumulation of Bitcoin by wallets that only receive transactions. This upward trend in hoarding headlines indicates increased hoarding behavior. If this persists, it could herald the start of a liquidity crisis on the sales side.

As the BTC adoption curve rises sharply toward the $1 trillion mark, the interplay between growing demand, particularly from institutional investors, and decreasing supply could catalyze price impacts unprecedented.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,بت كوين,بتكوين,بيتكوين

Comments

Post a Comment