With Bitcoin mining rewards halving just a month away, the cryptocurrency market is seeing a flurry of activity that could shape its course for months to come. Key industry figures have begun to sound the alarm on recent trends indicating a potential shift in market dynamics.

Why Bitcoin Halving in One Month is So Important

A Bitcoin halving is a significant event scheduled in the Bitcoin protocol that occurs approximately every four years or after mining. Every 210,000 blocks. During this event, the reward for mining new blocks is halved. This means that Bitcoin miners receive 50% less Bitcoin to verify transactions and add them to the blockchain.

When Bitcoin was first created by Satoshi Nakamoto in 2009, the block reward was 50 bitcoins. The first halving in 2012 reduced the reward to 25 BTC. Then it reduced it in the second half in 2016 to 12.5 bitcoins, and in the last half in 2020 it reduced it to 6.25 bitcoins.

Similarly, the 2024 Bitcoin halving is expected to follow the same basic principles as previous halvings, with the mining reward halving to 3,125 BTC per block.

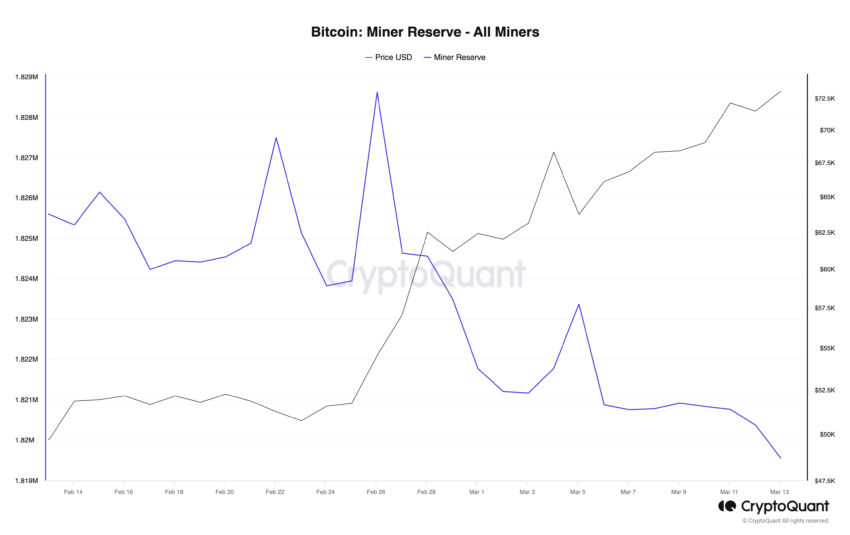

As the next Bitcoin halving approaches, which is expected to take place between April 17 and 20, He expressed Ki Young Joo, CEO of CryptoQuant, has expressed concerns over the notable increase in selling activity among Bitcoin miners. In fact, Joe said miners unloaded around 6,145 bitcoins, worth around $384 million, in the last month alone.

This increase in selling activity raises questions about the near future of Bitcoin price stability.

👈 Read more: Bitcoin: Why is everyone waiting for the new digital gold halving?

Suspicious activity from whales and Bitcoin miners... What is happening?

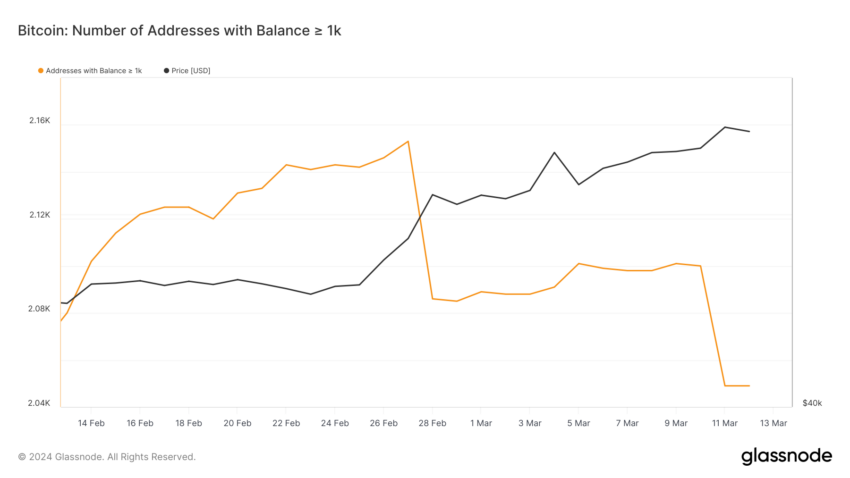

Adding to this complexity, the analyst highlights the chain Allie Martinez Highlighting a worrying trend among Bitcoin whales. Martinez's analysis found that holders of more than a thousand BTC are increasingly liquidating their holdings, with a 4.83% drop in such addresses seen over the past two weeks.

This notable selling by major stakeholders adds to the selling pressure, which could negatively impact the price of Bitcoin. In fact, Jan Abel, CEO of Glassnode, warned that "nothing goes up in a straight line. Not even Bitcoin."

Abel noticed this. He expects a corrective decline in the Bitcoin price between $59,000 and $58,000, warning investors that this does not indicate a market peak but rather a necessary adjustment.

"There is no move without a countermove. The opposite move appears to be near. We are seeing negative divergence as Bitcoin makes highs in a 3-wave structure. Sentiment is hot at 89! It's time to to calm down. "

Feelings of optimism prevail over the crypto ecosystem

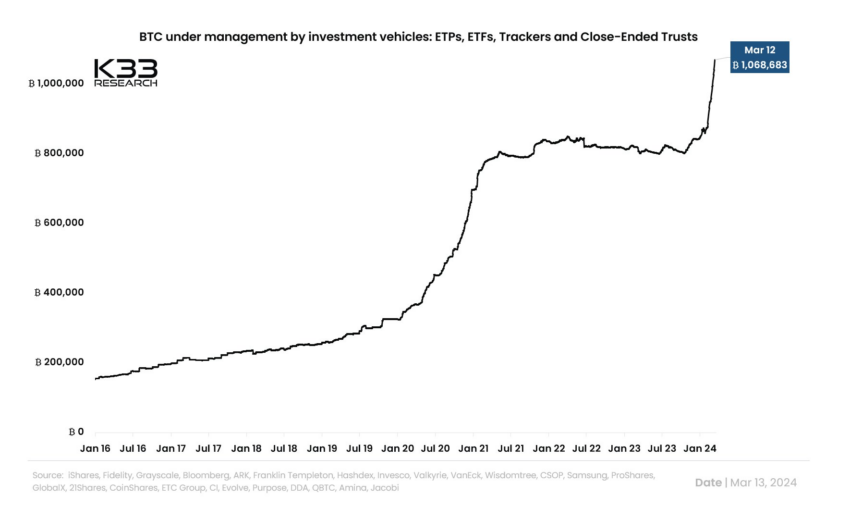

Given the selling pressure, some analysts remain optimistic about Bitcoin's potential after the dip. Technical analyst DaanCrypto noted the significant net inflow into Bitcoin exchange-traded funds, with over $1 billion recorded in a single day. Therefore, these accumulation levels could balance selling pressures, thus favoring a continued rally:

"Bitcoin ETFs attracted a net inflow of over $1 billion yesterday. For reference, after the halving, we will see $33 million worth of Bitcoin mined per day. So this single day of inflow represents a full month of Bitcoin mining supply after the next cut.

In confirmation of this opinion, it is based React Capital Historical data indicates that Bitcoin is far from reaching the market top. According to his analysis, Bitcoin could reach its next bull market peak between December 2024 and February 2025. This is based on its performance trends after its previous all-time highs.

👈Read more: What is Bitcoin Halving and Why is it Important? How does it control the price?

As the Bitcoin halving approaches, investors are closely monitoring these developments. While the near-term outlook may present challenges, the underlying sentiment among some experts suggests that Bitcoin's long-term trajectory remains strong. The coming weeks will be crucial in determining whether Bitcoin can weather the current halving event storm.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

مقالات الرأي,بيتكوين,تنصيف بيتكوين,صناديق الاستثمار

Comments

Post a Comment