Cathie Wood's ARK Invest liquidated more than $24 million worth of Coinbase (COIN) shares on Monday, just as Bitcoin neared all-time highs.

As a result, Coinbase stock fell 5.2% to close at $216.77 on Tuesday.

Check out our Coinbase exchange review

Cathie Wood's Arc Investments sells Coinbase shares

ARK sold 110,896 shares in a transaction valued at approximately $24.03 million through the following funds:

- ARK Innovation ETF (ARKK)

- ARK Next Generation Internet ETF (ARKW)

- Ark Fintech Fintech Innovation ETF (ARKF)

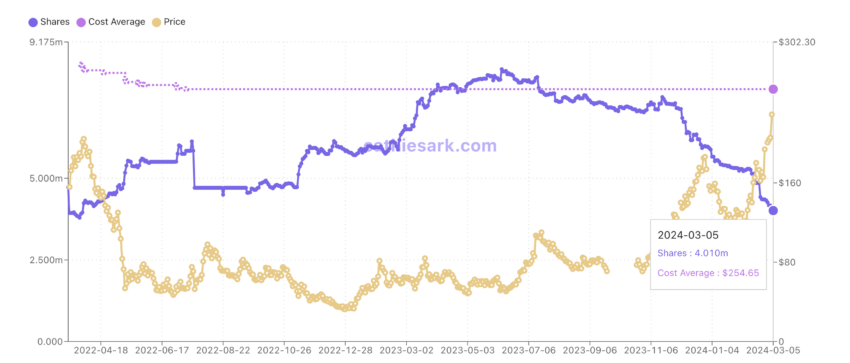

In response to the market's uptrend, Wood began reducing his stake in Coinbase. Specifically, ARKKK's holding of Coinbase shares has decreased by approximately half since October 2023. The ETF held approximately 7 million shares as of October 2023.

However, by Tuesday, the number was down to around 4 million shares, with the stock up nearly 175% during the period.

The decision to sell came following the rise in Bitcoin. Coinbase has experienced operational issues due to increased traffic on the platform. Notably, these issues left some users with inaccurate account balances. Amid these technical hurdles, a Coinbase user expressed his dissatisfaction with X. He expressed his frustration with the platform's unreliability during crucial trading periods.

"You literally cannot buy the low or sell the high (on Coinbase). You can only buy the (obscene) middle prices. I will do my best to sell their (obscene) shares when the time is right. I wish nothing but the worst,” he said. He said User X aka Rain.

Why has COIN increased?

This rise in the value of Coinbase shares was partly fueled by new demand for funds from BlackRock. Bitcoin Snapshot in July 2023, which notably included Coinbase as a partner. This partnership was important because it highlighted Coinbase's role amid SEC concerns over Bitcoin spot funds and the ongoing legal issues facing the exchange.

Additionally, the Chicago Board Options Exchange's application for Bitcoin exchange-traded funds managed by Fidelity has also brought Coinbase into the spotlight. The filing named Coinbase as a crypto platform to monitor market manipulation. In total, ten of the 11 newly approved Bitcoin ETFs have chosen Coinbase. As main custodian she has.

These updates also shattered many analysts' bearish expectations from last year. In June 2023, Berenberg Capital predicted a 50% drop in Coinbase shares and set a target of $39.

The bearish outlook also continued into January 2024, when JPMorgan analyst Kenneth Worthington set a price target of $80. Highlighting potential challenges ahead despite the strong recovery during the second half of 2023. This target indicated a significant decline of over 35% from its valuation at the start of the year.

In March 2024, Coinbase stock was still about 50% below its May 2021 all-time high.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين,كوين بيز

Comments

Post a Comment