In a dramatic turn of events that echoes the warnings of Satoshi Nakamoto, the creator of Bitcoin BTCThe financial system has witnessed another stark contrast between the declining traditional banking sector and the growing digital currency market.

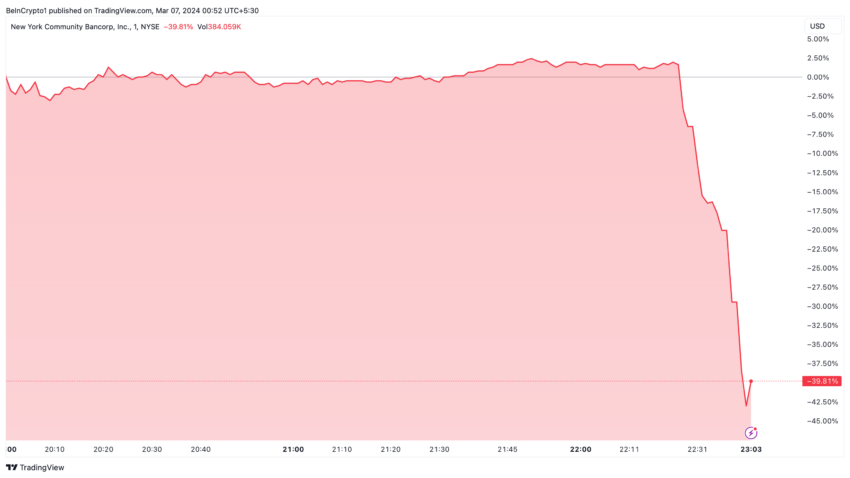

The spotlight has been on New York Community Bank (NYCB), which has seen its stock value fall sharply. It fell by more than 40% following disturbing revelations about its financial health and management turmoil. This disruption occurred as Bitcoin rose 58% year-to-date to hit a new all-time high of $69,000.

NYCB collapses as Bitcoin hits record highs

The fate of NYCB, a regional lender headquartered in Hicksville, New York, became public when... reveal “Significant weakness” in its internal controls. This resulted in a staggering $2.4 billion loss for shareholders last quarter.

A change in management exacerbated the bank's problems. Alessandro Dinello took over as chairman and CEO just as a series of credit downgrades pushed NYCB's debt into junk territory.

This series of misfortunes mirrored the previous collapse of First Republic Bank. Therefore, this hinted at a potential systemic problem within the regional banking sector. However, the New York City Bank was dealing with its own internal troubles. And he got A massive injection of liquidity against a backdrop of potential erosion of depositor confidence.

"When evaluating this investment, we considered the bank's credit risk profile. With over $1 billion of capital invested in the bank, we believe we now have sufficient capital in the event where reserves are expected to be increased in the future to be in line with our peers' coverage ratio." New York International International or higher than that of its major banking peers."

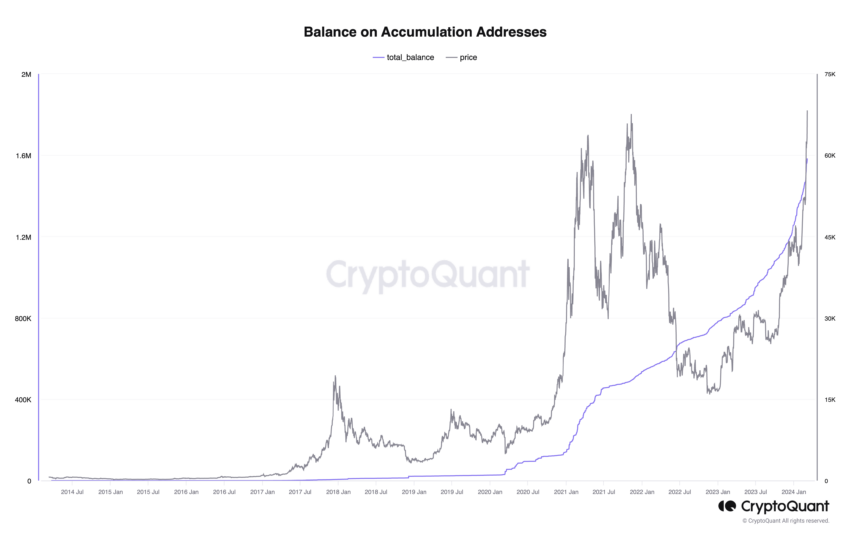

This financial distress contrasts sharply with... The boom in the digital currency market. Bitcoin's unprecedented investment and accumulation indicated a strong vote of confidence from new and seasoned investors.

Large inflows of accumulated addresses also support Bitcoin's resilience and growth. Likewise, they reflect growth in exchange-traded fund (ETF) holdings Demand on the rise on Bitcoin contrasts with the instability plaguing the traditional banking sector.

This gap reflects a broader shift in investor sentiment. Those seeking refuge in what many see as a more decentralized and secure financial future.

"Total Bitcoin holdings from accumulator addresses have also reached record levels. Total holdings in these addresses now stand at 1.5 million Bitcoin. These addresses refer to investors who only accumulate Bitcoin and have never sold. So the accelerated growth of their Bitcoin holdings is a sign of the strength of demand,” CryptoQuant analysts told BeInCrypto.

However, not everything is smooth sailing for Bitcoin. Despite the growing demand and reaching new price highs, there are other indicators that suggest that Bitcoin could be entering a feverish phase. These measures reveal a complex period where rapid gains can lead to equally rapid declines.

"A short-term pause/correction could be brewing. Prices have risen too quickly relative to key on-chain indicators. Additionally, traders' unrealized profit margins are now above extreme levels. Which could lead to expectations of selling pressure from these participating markets.

As Bitcoin continues to chart its course, the fate of traditional banks may serve as a cautionary tale for an industry at a crossroads. Where you wade through the difficult waters of modern finance under... Declarations Satoshi Nakamoto.

"We should trust banks to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with almost no reserves. We should trust them with our privacy and trust them not to let the identity thieves empty our accounts." Satoshi Nakamoto wrote.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار البيتكوين (BTC)

Comments

Post a Comment