The United States Securities and Exchange Commission (SEC) has postponed its decision on Hashdex and ARK 21Shares cash exchange-traded funds (ETFs).

Ethereum fans are watching (ETH) These developments are eagerly awaited as the deadline approaches.

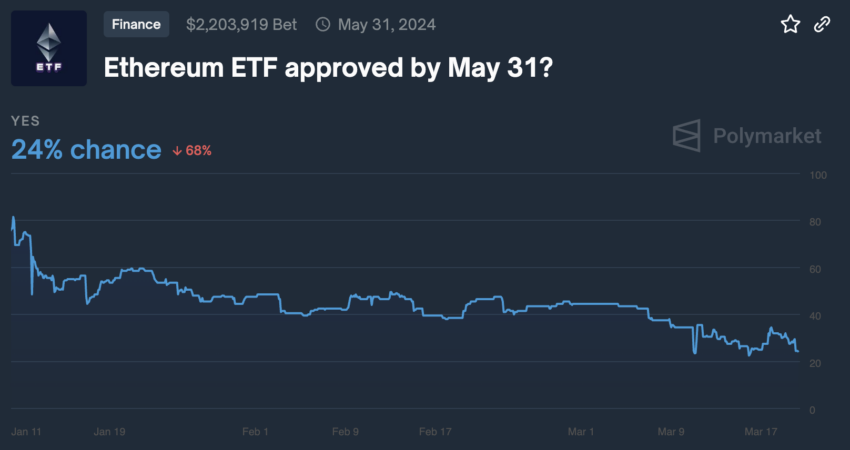

Chances of approval of Ethereum ETFs are significantly reduced

This postponement was announced on Tuesday March 19, extending the decision deadline until the end of May. Specifically, the SEC set May 24 and May 30 as final decision dates for ARK 21Shares and Hashdex, respectively.

She says SEC: “The Commission believes it is appropriate to set a longer deadline for issuing an order approving or disapproving a proposed rule change so that it has sufficient time to consider the proposed rule change and the issues therein. are raised. »

Following the SEC's announcement, the price of Ethereum fell by approximately 8%. Which indicates the sensitivity of the market to regulatory decisions. Currently, Ethereum is trading at around $3,100. This reflects the uncertainty surrounding the approval of its ETFs.

This delay is also impacting many Ethereum exchange-traded fund proposals, with notable inquiries from industry giants such as BlackRock, Graycale, and Fidelity. Sentiment has changed recently, with analysts expressing doubts about the likelihood of approval.

Read more: How much will the price of Ethereum increase with the launch of the Ethereum Futures ETF?

For example, ETF analyst James Seyphart noted that there is a concerning lack of engagement between the SEC and Ethereum ETF issuers. Unlike proactive discussions about Bitcoin ETFs. This lack of dialogue has led to a more pessimistic view of Ethereum ETFs.

“My cautiously optimistic stance on Ethereum ETFs has changed in recent months. We now believe they will ultimately be rejected on May 23 for this cycle.” As published Seyfart.

Additionally, the chances of approval have decreased. Market expectations showed a significant decline in confidence. According to Polymarket, the probability of an Ethereum ETF being approved in May fell to 24%. This stands in stark contrast to the 75% odds after the SEC approved Bitcoin ETFs in January.

Amid these developments, Coinbase has become a strong supporter of Ethereum exchange-traded funds. Last month, Paul Grewal, Coinbase's chief legal officer, published a detailed letter outlining the reasons for approving an Ethereum ETF.

It also upheld Ethereum's classification as a commodity, a view supported by the Commodity Futures Trading Commission (CFTC) and numerous SEC and court rulings. This argument is part of a larger effort to prove the stability and viability of the Ethereum market as an exchange-traded fund.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار الإيثيريوم (ETH)

Comments

Post a Comment