Solana's actions were witnessed (GROUND) significant price movements, and market participants seek to understand the potential evolution of this asset.

This article examines the current market performance of Solana, analyzing various metrics and graphical indicators to provide a comprehensive overview.

Market recovery: Solana bullish indicators

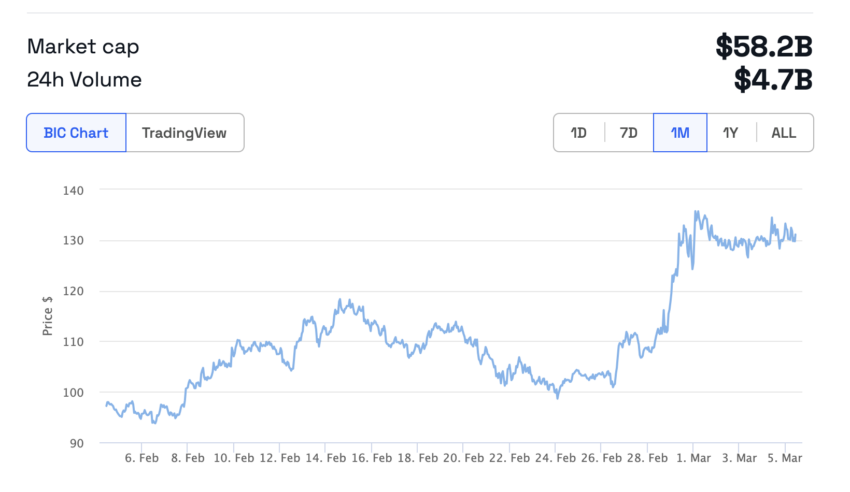

AndSolana price rose to $128.60, This is a notable rebound considering its all-time high of $258.67 and cycle low of $8.28. This represents a staggering 1,486.15% rally from its low.

The trading volume, which surpassed $1 billion in the past 24 hours, highlights growing investor interest and market liquidity that could fuel further price swings.

Is Solana overbought or oversold?

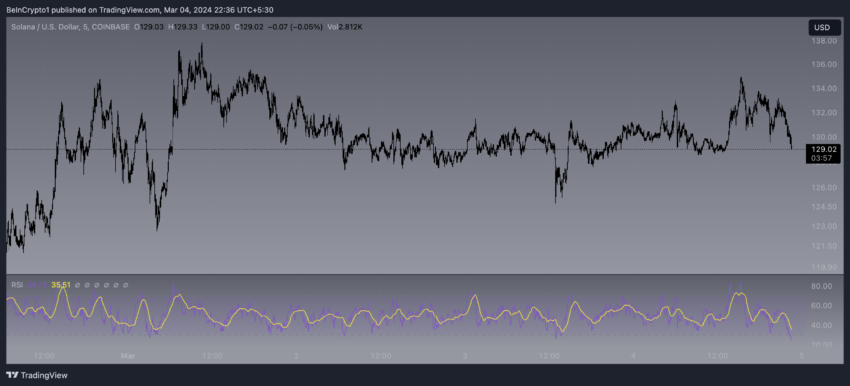

For Solana, the relative strength index (RSI) remaining near 35 below and falling into the oversold zone could indicate that the selling pressure is not strong enough to push it into the overbought state, and that neither does the buying pressure push it into the overbought zone. This could mean that Solana is at a potential turning point, waiting for a catalyst to guide the next price movement.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and variability of price movements. It oscillates between zero and 100, and a threshold of 70 is generally used to indicate an overbought condition and 30 to indicate an oversold condition. When the RSI is around 35, as it is for Solana, it indicates that the asset is slightly below the neutral zone.

This neutrality can refer to two scenarios:

- Cohesion: The market may be hesitant, leading to a period in which the price stabilizes as traders look for signs of the next significant move.

- Prepare to be hacked: A neutral RSI can also precede a breakout if it is following a trend or if there are external factors in the market that can affect investor sentiment.

Solana’s on-chain activity continues to rise

Single transaction signers witnessed the Solana Significant growth over the last six months. The chart shows that this trend has held true over the past 14 days.

As can be seen, on February 20, this number was around 400,000 per day. By March 4, it reached nearly 600,000.

Although this is not a price metric, it shows that users are actively using Solana applications, which can affect network activity, and therefore its price.

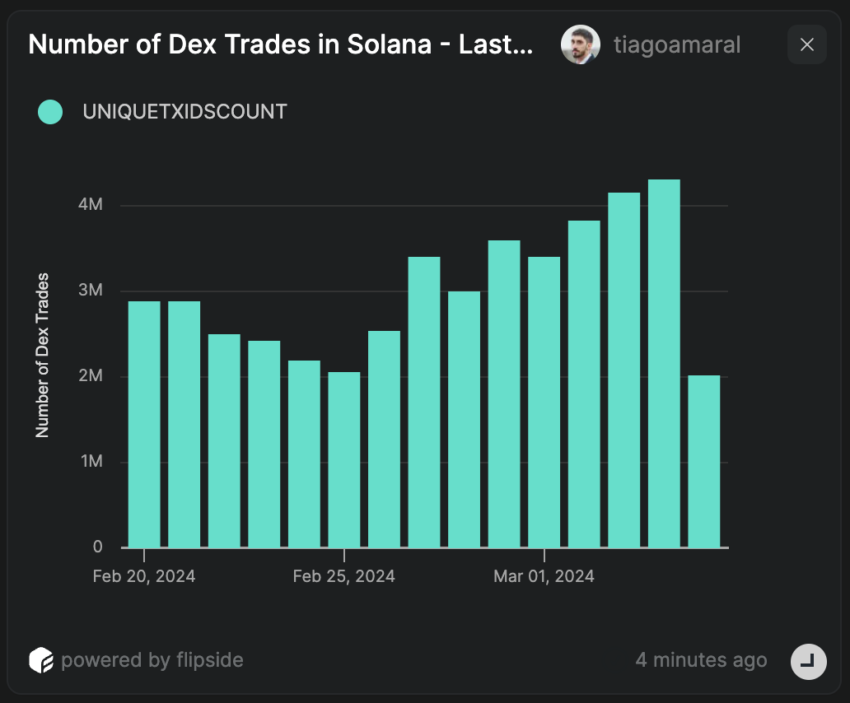

Shows the number of transactions Decentralized Exchange (DEX) Solana has a similar image. It has risen sharply since September 2023 and has increased over the past 14 days.

On February 20, the number of DEX transactions on Solana reached 2.88 million transactions. This figure increased to 4.31 million on March 4, an increase of 66% in just 14 days.

This indicates that users are willing to spend more time using Solana dApps, and as the majority of tokens launched on Solana decentralized exchanges are traded using SOL, this could have a direct impact on their price, as more and more users are speculating on Chin Solana blockchain tokens.

SOL Price Prediction: New Yearly High or Correction Ahead?

A recent look at the SOL/USD 5-minute chart suggests a potential resistance level at $133. If the price rises above this point, the uptrend could continue.

On the contrary, a support level formed around $128, where the price showed resilience. This support level is a crucial threshold that can dictate price direction in the short term.

Solana is still 49.26% below its all-time high. This suggests that it has plenty of room to grow in the coming months. However, strong resistance levels and the intersection of the exponential moving averages could indicate that a correction will occur before seeing a new annual price higher.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بلوك تشين

Comments

Post a Comment