Shows the price of a stock Chain link (LINK) Signs of an uptrend shaped by compelling market data. The convergence of major indexes indicates a rally that seasoned and novice investors are following with keen interest.

Dive into analysis of LINK stock's recent stock data, EPS, and community sentiment to understand why the $24 price target could be reached soon.

Shareholders pile in LINK

Recent observations on the net change in net transactions of the LINK exchange reveal Narrative Convince yourself to accumulate. The significant rise in LINK tokens on the stock exchanges between February and March indicates a tendency of investors to sell. This trend generally indicates their desire to liquidate their assets.

This particular trend saw a significant shift on March 3, marking a major shift in the trajectory of LINK's net position change on exchanges. More than eight consecutive days after this pivotal date, the measurement showed a constant evolution towards negative values.

A negative indicator within this variable generally indicates a tendency of investors to actively withdraw their LINK holdings from trading platforms. This behavioral pattern is a notable indicator of holder sentiment, indicating a deliberate reluctance to hastily liquidate their token holdings in the near future.

Instead, it indicates a more optimistic outlook or a calculated decision to hold on to one's investment in hopes of reaping the potential long-term benefits.

Negative sentiment for Chainlink is declining

On March 9, the LINK Weighted Sentiment Index fell to -1.46, marking its largest negative position since August 2023. This measure saw a significant adjustment between March 9 and March 11, dropping to -0, 88 compared to its previous negative value.

The Weighted Sentiment Barometer is a strategic tool designed to deepen the overall mood of the LINK ecosystem.

Although the LINK Sentiment Weighted Index was initially characterized by negative sentiment, the notable two-day rise from -1.46 to -0.88 subtly indicates a shift in market perceptions. This gradual change indicates the possibility of an imminent shift towards a more optimistic feeling.

LINK Price Prediction: Preparing to Hit $24 Soon?

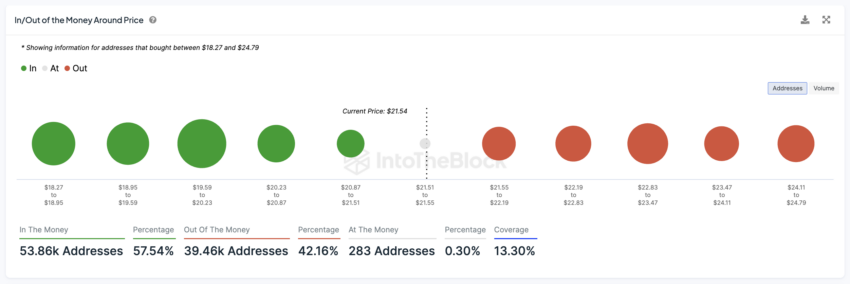

LINK's "In/Out of the Money Around Price" chart shows many buyers taking profits right now, with the strongest support between $18.27 and $20.87. This means that if the price starts to fall, it will likely stop and rebound.

Above the current price of $21.54, we reach areas where more investors might be waiting to sell, marked by red bubbles from $21.55 to $24.79, or 15%. These areas can make it more difficult for prices to rise, as investors may sell to make small profits.

As buyer interest continues to outpace sales, LINK could clear the hurdles towards $24, its highest price since December 2021.

The bullish outlook will be invalidated if LINK price falls below the strong support level at $20.70. If it breaks this support level, we can set a downside target around $20, or even $19.45.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment