Follow the Ethereum price (ETH) signals the broader market, falling on the chart after hitting a multi-month high last week.

The biggest question now is whether Ethereum holders will be able to hold onto their assets or succumb to the downside.

Will the price of ETH fall further?

Ethereum price at $3,357 failed to turn the two-year-old resistance block into a support block. Although the altcoin managed to break through the $3,582 to $3,829 range, it could not sustain above it for long as Ethereum had already reached the market top.

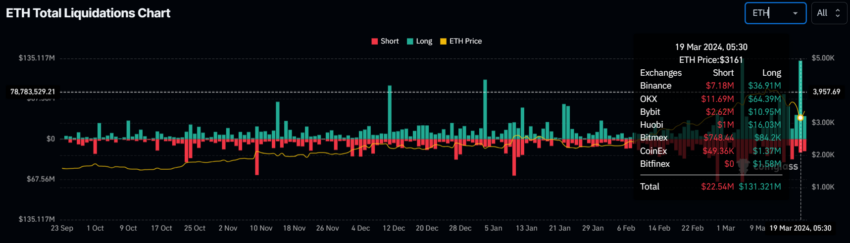

Thus, the overall decline has erased much of the recent gains, with most of the decline seen in the last 24 hours when the Ethereum price fell by over 10%. This led the second-generation cryptocurrency to record $170 million in long-term liquidations.

This means that over the next few trading sessions, investors hungry for higher prices will likely refrain from making a bullish bet. There will therefore be additional room for further declines.

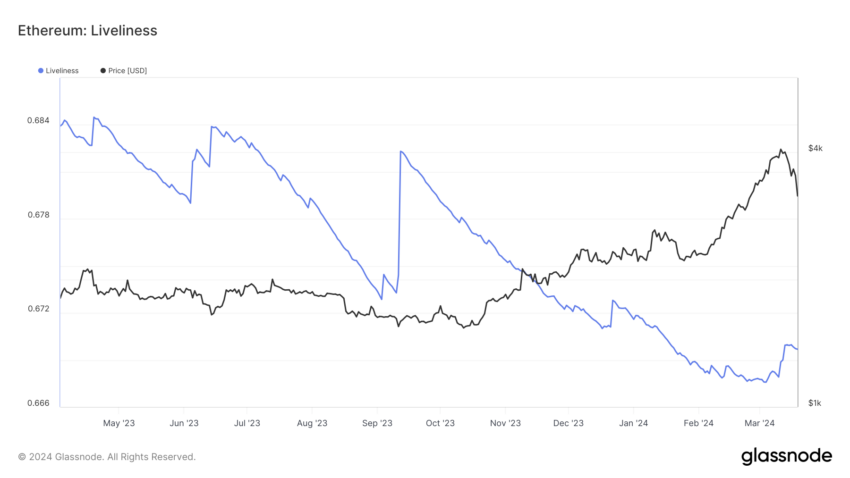

However, it is not only the derivatives market that is currently being forced to act downward. The same situation applies to another important group of investors: long-term stock holders. These investors are convinced by the market that when they hold Ethereum, they tend to perform better, while they tend to sell during excessively bearish periods.

This can be observed using a vitality meter. This indicates conviction when the indicator is rising and liquidation when the gauge is falling.

At the time of writing, the Liveline indicator is seeing a rise, meaning long holders are liquidating their positions and losing confidence.

Ethereum Price Prediction: A Drop to $3,000 Could Happen

Ethereum price is trading above the $3,336 support level after breaking through the resistance block. Considering the above developments, the downtrend could push ETH to breach the $3,336 support level and test the $3,031 support line.

However, this support line also represents the confluence of the 38.2% Fibonacci retracement from $4,626 to $2,539. This crucial support line can provide Ethereum with the momentum needed to bounce back and prevent excessive pullback. Thus, the bearish thesis will be invalidated.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,الإيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment