Uniswap (UNI) price has shown green candles over the past five weeks, during which it has made significant gains. However, despite a 164% increase, the decentralized exchange token (DEX) is still below this figure.

What will it take for UNI to join the cryptocurrency league and set all-time highs?

Can Uniswap price continue to rise?

Uniswap price, which was trading at $15.82 at the time of writing, is up more than 25% in the last 24 hours. These gains contributed significantly to the continued rise of the DeFi token. UNI is up 164% from $5.97 to its current price.

This brought significant benefits to its users, but not to everyone. This is because the price of Uniswap is far out of its previous all-time high At $42.66, recorded in April 2021. The altcoin would need to rise another 170% to cross this level and reach new highs.

Although a massive rally is uncertain, given that UNI is coming off a rally, it can still bounce a bit and turn the $19.20 resistance level into support. This would allow UNI to test the $20 barrier and possibly break through the key psychological price level.

This would reinforce existing conviction in the market and initiate further gains. Investors refrain from selling their holdings and instead seek to accumulate. Increased buying pressure can be seen in light of the diminishing supply on the stock market.

This indicates that UNI is likely exiting exchanges and entering wallets, showing a bullish signal.

DEX Users Jump on the Ladder Bandwagon

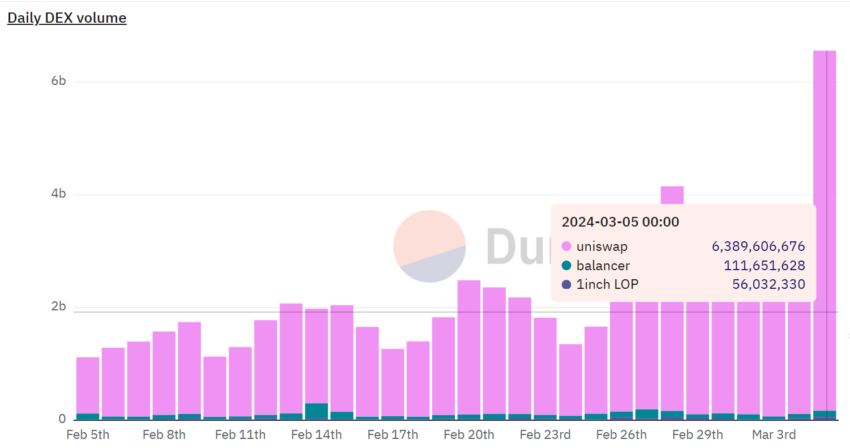

Beyond network participation, Uniswap DEX usage has also increased, with users actively transacting on the platform. Daily trading volume on the Uniswap exchange exceeded $6.3 billion over the past 24 hours.

This is not only the largest single-day trading volume in the past month, but also the largest trading volume in over three months. In general, users tend to pull back after big rallies due to a potential correction, but Uniswap user conviction is much stronger than skepticism.

UNI Price Prediction:

The price of Uniswap is as likely to fall as it is to rise. The reason is the gains made by investors over the past month. The market value to realized value ratio (MVRV) estimates the average profit or loss of investors who purchased an asset. The 30-day market value to realized value ratio (MVRV) measures this for those who purchased within the last month.

For Uniswap stock, the 30-day MVRV is 44%, suggesting new investors are making a profit of 44%. They may dump their holdings to preserve their gains, which could cause a selloff. Historically, UNI sees large corrections when MVRV reaches the 11% to 33% zone, referred to as the "danger zone" in the chart below.

Since the ratio is currently beyond the danger zone, it is likely to see corrections. This will likely push UNI below $12, which could push Uniswap price to $10, with the next support at $7. Losing one of these key support zones would invalidate the bullish thesis.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment