In a few days, the Bitcoin community will be faced with (BTC) The long-awaited halving has taken place. This change will reduce the block mining reward from 6.25 to 3.125 BTC.

This will affect miner profitability and potentially cryptocurrency market prices.

10x Research Gives $122,000 Target for Bitcoin Bull Market Peak

Power Markus Thelen of 10x Research light on The major changes that occurred in the market after the decline. He notes that miners could flood the market with up to $5 billion worth of Bitcoin by liquidating their reserves to handle reduced rewards.

“The cryptocurrency market could face a major challenge during the six-month summer lull. Bitcoin miners preparing to sell a significant portion of their Bitcoin stocks, which have been painstakingly built up over the past few months, could be disruptive. the dynamics of the... market".

Historically, Bitcoin often experiences a price rally before halving, after which it enters a period of limited price movement. Although the value increased by 32% before the previous events, the market typically experiences long periods of sideways movements that last for several months.

Read more: Countdown to half houseQuinn

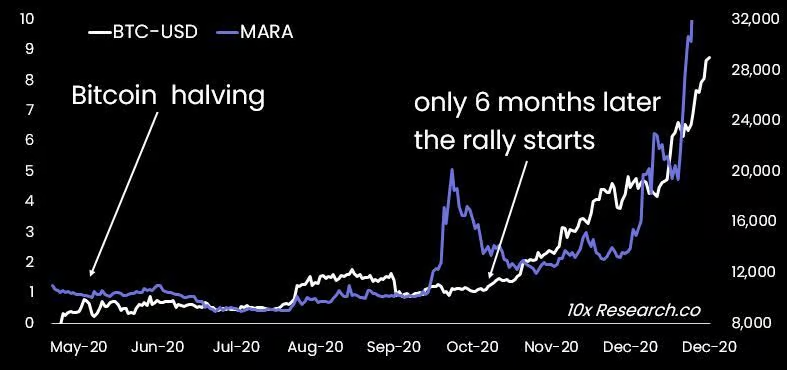

Additionally, SpotOnChain's Hannah Fong discusses the delayed effects of supply reduction on prices. She notes that significant price increases typically occur 6 to 12 months after the halving.

For example, after the first halving in November 2012, the price of Bitcoin rose from around $12 to over $1,000 by the end of 2013. After the second halving in July 2016, the price of Bitcoin rose from around $650 to almost $20,000 in December 2017. Similarly, the third halving in May 2020 saw the price rise from around $8,000 to an all-time high of $69,000 in November 2021 .

Additionally, Bitcoin's dominance has increased by 15% since its lowest bear market in November 2022. This has cast a shadow over altcoins, which have not shown similar strength. This slow response from the altcoin market could indicate a longer wait for its expected rebound after the halving.

Additionally, post-lockdown production costs will almost double for many miners, compounding financial pressures. For example, Marathon Digital reported that its production cost per bitcoin would increase from $23,000 to $46,000. These higher costs are likely to increase selling pressures as mining companies strive to remain financially solvent.

Mining efficiency and hash price reduction also have a significant impact on market dynamics after the halving. The hash price, or average revenue earned by miners per block, is expected to decrease as the block reward decreases. This drop will put additional pressure on miners' profits, forcing them to sell their Bitcoin.

Read more: What happened in the last Bitcoin halving? Forecast for 2024

However, after short-term volatility, 10x Research gives a target of $122,000 for the Bitcoin bull market peak.

“Bitcoin could trade at around 2.5 times its cost of production (around $122,000) at the height of this bull market (after hell). This post-hell $122,000 level could be the north star if Bitcoin's price rally continues; This appears to be (for this cycle) very unlikely based on historical analysis of the Bitcoin/cost of production ratio.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار انخفاض البيتكوين (BTC) إلى النصف

Comments

Post a Comment