Increased Bitcoin BTC Price In Thursday's trading, it failed to break technical support levels, especially the ascending trendline. But this increase remains within the sideways trading range in which the price has been fluctuating for several weeks. With the parity observed between the bulls and the bears in the market. Awaiting the release of US employment data today, Friday.

Currently, any price drop is seen by many participants as an opportunity to enter. Due to the very positive and optimistic outlook for the price of Bitcoin BTC Long-term. (Many expectations point to the possibility of surpassing the $100.00 level this year.)

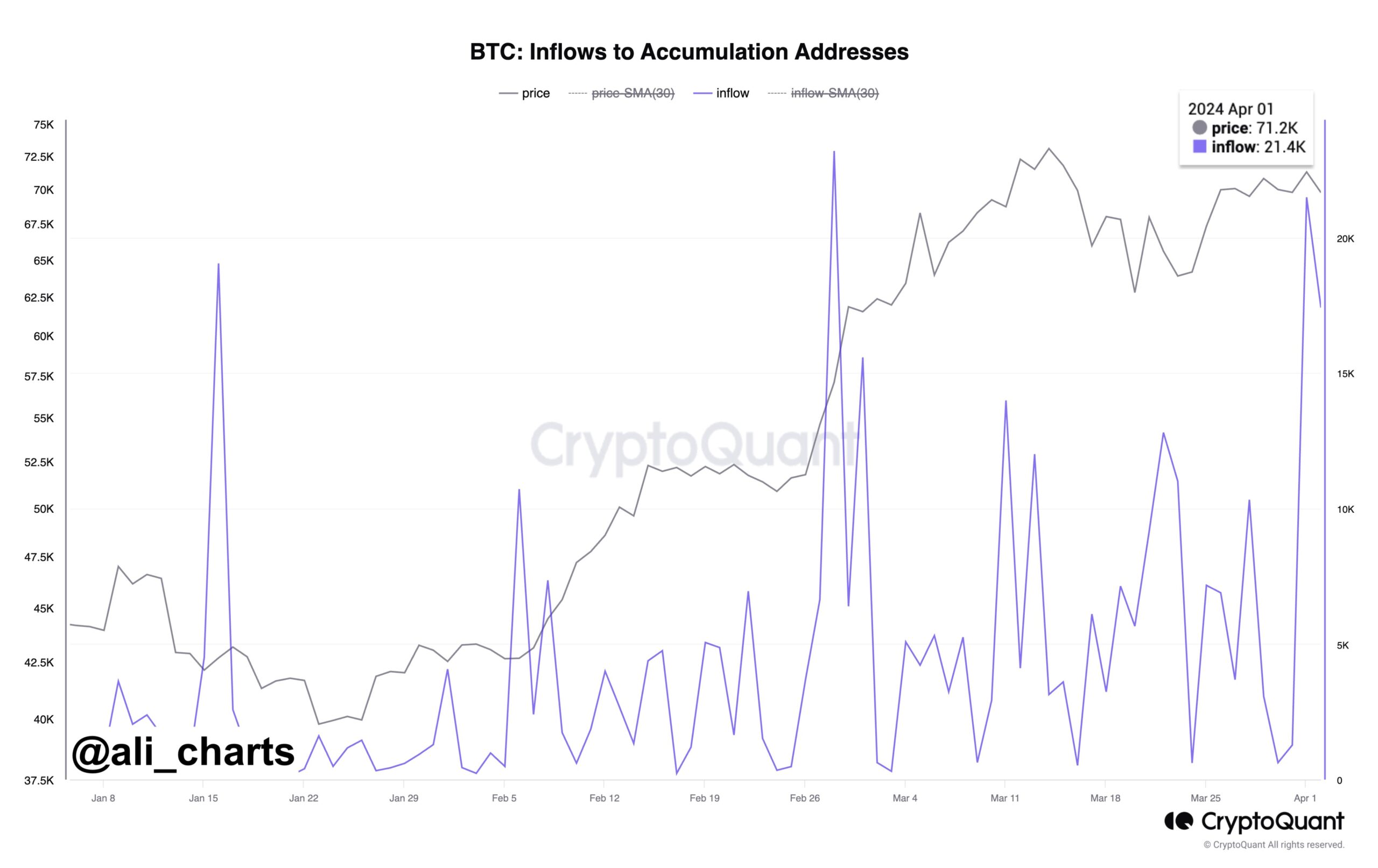

In this context, this indicates Data CryptoQuant is a platform specializing in blockchain analysis Post it Cryptocurrency Analyst @ali_charts. So-called “collecting addresses” continue to purchase large quantities of the main currency during the current month. With high rates of incoming flows to these addresses.

My Bitcoin Collection Address Keeps Buying

Bitcoin accumulation addresses are addresses that collect or hold Bitcoins for a long period of time without selling or transferring them. Investors typically use this strategy when they are optimistic about the long-term value of Bitcoin and want to hold onto their holdings while waiting for the price to rise. There are two main types of Bitcoin pool addresses:

- Save addresses: These addresses are like savings accounts where investors store Bitcoin for a long time. These addresses are generally active for receiving Bitcoin but rarely used for sending it.

- Long-term investment securities: Some investors use private addresses to accumulate Bitcoin as a long-term investment, believing that the value of Bitcoin will increase significantly over years or even decades.

Addresses fall into this category under certain conditions, the most important being that they do not sell currencies. In addition, his balance must exceed 10 Bitcoin. Portfolios linked to stock exchanges and mining companies are excluded from this category.

Analysts and investors use this information to understand market trends and investor sentiment.

According to CryptoQuant's chart, flows to "aggregator addresses" saw a significant spike this month, indicating that these investors continue to buy.

On the first day of the month, the index recorded a sharp rise of 21,400 bitcoins, which is equivalent to over $1.4 billion at the current exchange rate.

This value is remarkable compared to the record value of 25,300 Bitcoins reached by the index just a month and a half ago.

Of course, recent purchases are a positive signal for the currency's price. Bitcoin responded to these signals with a significant rise over the past 24 hours.

Most Important Technical Levels for Bitcoin BTC Price Ahead of Jobs Data

Despite the rise in the price of Bitcoin BTC However, this does not fall outside the scope of the technical levels that we explained in our previous analyses. The price rebounded from a strong support zone formed by the ascending trendline and the 38.2% Fibonacci level priced at $65,500.

is back BTC Price Now trading below the 23.6% Fibonacci level at $68,500.

Waiting for data to be published Report on employment trends in the non-agricultural sector (Non-farm payroll) which is Friday. We saw the market react to weaker ADP data on Wednesday.

Strong data recently pushed the 10-year US Treasury yield to a high of 4.43% in 2024. This also contributed to the US dollar rising to its highest levels since last November. Both can help limit the rise in prices of high-risk assets, including Bitcoin.

For a price that could come back to test the ascending trendline, if it is broken, the next target will be the 61.8% Fibonacci level at $60,500. This is the same level as the bottom of the previous corrective wave.

In case a sudden event occurs and Bitcoin price breaks this support zone. There is no technical support level until the $52,500 price point.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

تحليلات,تحليلات تقنية,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment