As the cryptocurrency market continues to adapt to its complex models, competition between Ethereum (ETH) and Bitcoin (BTC) a focal point for traders and investors.

Recent analysis indicates a power struggle between Ethereum and Bitcoin next month. Can ETH Recover Its Bullish Price Action Against BTC in May?

Ethereum/Bitcoin analysis: traders' views on cryptocurrency price trends

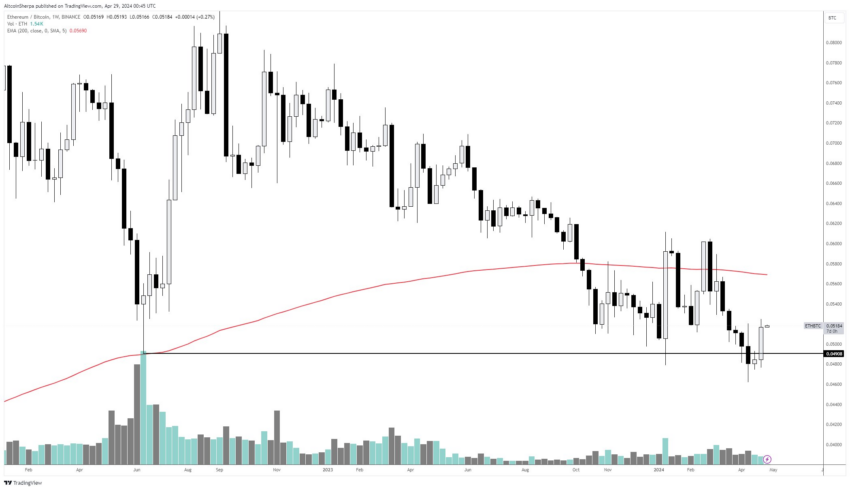

Ethereum recently regained a critical trading range, indicating strong support around 0.049 in its association with Bitcoin (ETH/BTC). This recovery is crucial because it indicates Ethereum's resilience and the potential for upward movement if it maintains this threshold. Rolling shows Cryptocurrencies DaanCrypto ETH is still trading in a range with BTC.

“Besides, I don’t overcomplicate things.” » added Dan Crébot.

Analysts are closely monitoring these levels, suggesting that simplicity in trading strategies may be the best approach.

In contrast, sentiment around Bitcoin's current trajectory is more ambiguous. Observers express as AltcoinSherpa They expressed doubts about a strong reversal, suggesting that while some upside may be visible in the short term, it is too early to declare a bottom.

"I think we see a little more upside potential in the near term, but we don't expect it to be a 'bottom' just yet." Altcon Sherpa noted.

This cautious stance is echoed by others who note Ethereum's promising volatility and trading volume, which could work in its favor against Bitcoin's relatively recent but unexciting market performance.

In addition to the Ethereum narrative, there is speculation about regulatory impacts, particularly discussions about the impact of the Securities and Exchange Commission on market dynamics. With Ethereum potentially benefiting from these regulatory outcomes – through ETF rejections or approvals – its price could benefit significantly from the resulting trading volatility.

She added Anbessa Commenting on the ETF's potential approval or rejection of ETH as a catalyst for what happens next.

“Is the SEC trying to get rid of you before the reversal? » said Anbesa.

Additionally, the trader mentioned that even though the downside target on ETH/BTC was reached, he could retest the support before seeing further upside.

“We could still see a retest of support and consolidation for a few months. High volatility to benefit from the ETF rejection and subsequent domestic trade approval before the SL is sent unchanged.” Anbesa concluded his speech

The ETH/USD pair also does not show bullish momentum

However, not all signals are optimistic. Comments from market observers such as: ColdbloodedShill Ethereum has struggled to “hold on” in recent months, facing difficulties in maintaining a consistent upward trajectory. Such thoughts are essential because they highlight the ongoing challenges and competitive advantage required to truly outperform Bitcoin.

Read more: Ethereum (ETH) Price Forecast for 2024, 2025, 2026, 2027

The ColdBloodSchel chart shows how ETH failed to hold key support and essentially turned it into resistance. The chart once again indicates the possibility of a further decline to the $3,100 area.

Although Ethereum is showing promising signs of potentially outperforming Bitcoin in May, the inherent unpredictability of the crypto market means that results remain fluid.

The battle between Ethereum and Bitcoin is not just about pricing and technicalities, but also about the impact of broader market dynamics, including regulatory news and economic indicators, on these two leading cryptocurrencies.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار الإيثيريوم (ETH),تحليل الإيثيريوم (ETH)

Comments

Post a Comment