Bitcoin is approaching another crucial milestone: the planned halving event. This is a scheduled reduction in the rewards miners receive for verifying transactions.

The halving is a pivotal event that has historically impacted the value of Bitcoin and the broader cryptocurrency market.

Growing scarcity meets growing demand

Halving occurs approximately every four years and is part of Bitcoin's unique monetary policy. It simulates the scarcity of precious metals like gold and maintains its value.

“Over the past various cycles, we have seen increasing demand for Bitcoin, while supply remains the same. So if you look at it from a macroeconomic perspective, increasing demand and equal supply results in a price increase." said Shiraz Ahmed, Managing Partner at STORM Partners, BeInCrypto.

Indeed, since halving reduces the rate at which new bitcoins are generated, this adjusts the supply side of the equation. This has traditionally led to bullish sentiment among investors. Essentially, a reduced inflow of new currencies intensifies competition for existing currencies.

Read more: 30 days before the Bitcoin halving: what you need to know now

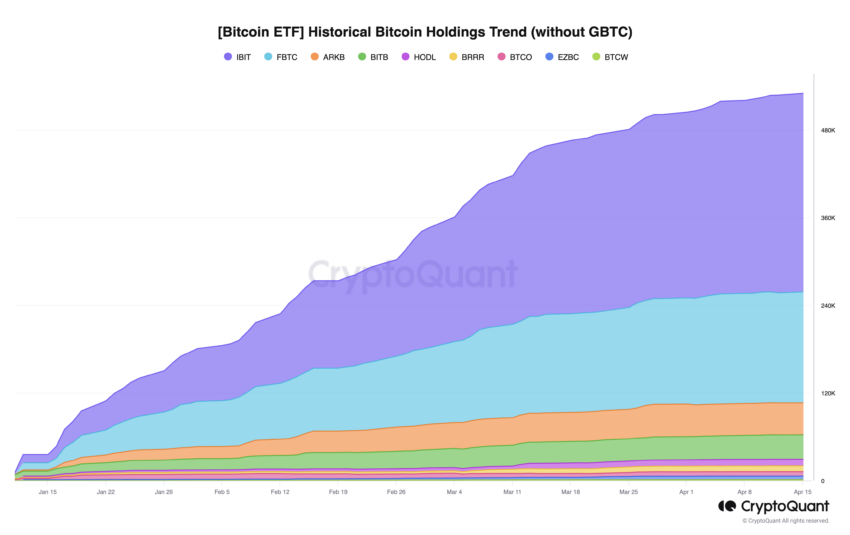

The upcoming halving could further exacerbate this trend, given the growing participation of large institutional investors via Bitcoin exchange-traded funds (ETFs).

“If you look at Bitcoin exchange-traded funds in the United States, they are seeing strong demand from players such as pension funds and small institutional players. They buy a lot of Bitcoin, sometimes as much as they can afford. daily. The fact that the price reduction “Bitcoin halving will result in a halving of the number of Bitcoins minted. This will mean it will be more difficult for them to meet this demand. »

Likewise, countries like El Salvador have already started to diversify part of their treasury assets into Bitcoin. This indicates broader acceptance and normalization of Bitcoin as a traditional financial asset. Additionally, government involvement could amplify demand pressures post-lockdown, STORM analysts note.

Bitcoin Steady Rise After Halving

This massive purchase could stabilize fluctuations in the price of Bitcoin. "I don't think we will see a dramatic rise or fall. However, it will be quite stable and will rise constantly," Ahmed suggested, citing his confidence in the maturing market and a less volatile Bitcoin.

Although some market participants use halving events to predict Bitcoin price movements and trading strategies, they also recognize that now is a good time to think about Bitcoin's technological and regulatory developments. Many jurisdictions are developing regulatory frameworks more favorable to Bitcoin than other speculative crypto assets, which bodes well for its widespread adoption.

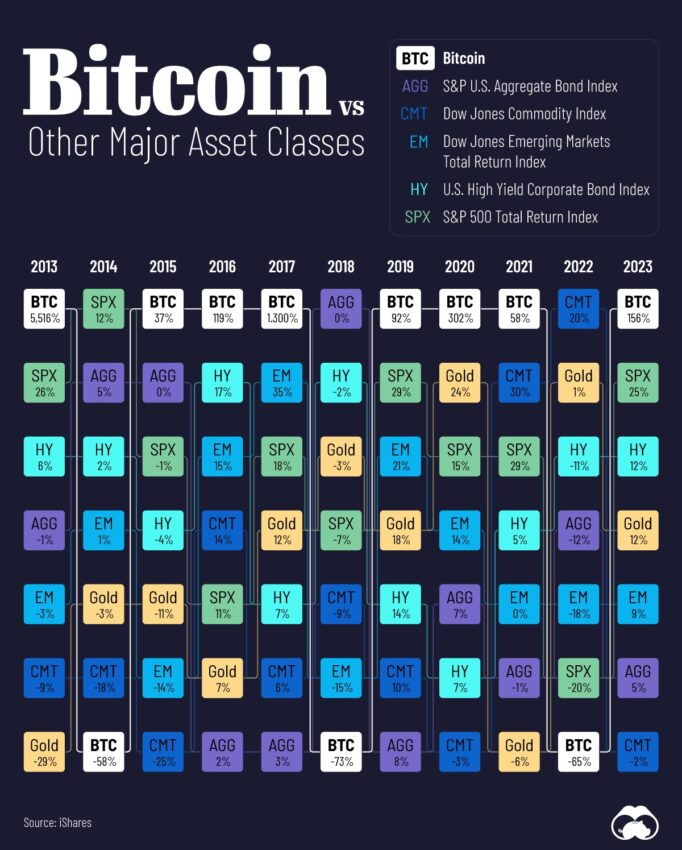

For this reason, there is a growing belief that Bitcoin must be reclassified and no longer be just another cryptocurrency.

“I don't think Bitcoin should be in the league with other cryptocurrencies. Bitcoin is its own beast, very different from Ethereum and other currencies. Bitcoin only has a market share of around 52% today. He strongly believes that it should “graduate from the “school of cryptocurrencies” and become a real asset that can be traded with other commodities such as gold, silver, copper, etc. .

Looking ahead, Bitcoin's maximum total supply – just 21 million coins that can be mined – raises fascinating economic questions about what happens when all the coins are minted. This scarcity could lead to major changes in Bitcoin's role in the financial and technology sectors.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,البيتكوين,العملات الرقمية,العملات المشفرة

Comments

Post a Comment