Two Chinese investment giants, Harvest Fund and South China Fund, are reportedly looking for Bitcoin spot exchange-traded funds (ETFs) in Hong Kong.

The move coincides with a decline in investor interest in Bitcoin spot exchange-traded funds in the United States. This is evidenced by the slowdown in weekly flows.

Chinese investment giants target Hong Kong Bitcoin ETFs

Reports indicate Securities Time noted that the Hong Kong subsidiaries of Harvest Fund and South China Fund are actively involved in the Bitcoin ETF implementation process. Additionally, they participate in the publishing process.

The Harvest Fund, in particular, has submitted a proposal for a spot bitcoin ETF to the Securities and Futures Commission (SFC) in Hong Kong. Additionally, Hong Kong-based China Asset Management has partnered with the custodian of a Hong Kong Bitcoin ETF.

👈Read more: Why is it better to invest in digital currencies in 2024 than to trade?

Industry analysts expect these applications to be approved in the second quarter of 2024. With $230 billion and $280 billion in assets under management, respectively. The Harvest Fund and South China Fund will significantly increase participation in Bitcoin-related investment products.

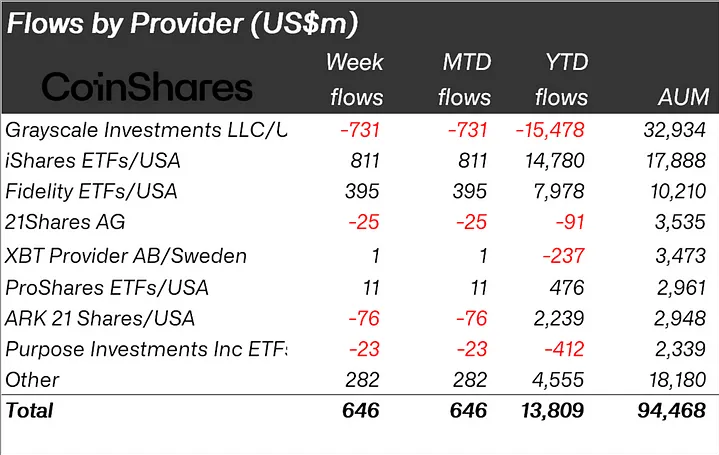

The timing is consistent with a report Published by CoinShares notes “signs of moderation in ETF hype.” Last week, the influx of digital asset investment products, including spot Bitcoin ETFs approved in the United States, reached only $646 million. This figure reflects a decline from $862 million two weeks ago.

Despite this short-term decline. Year-to-date entry figures for digital asset investment products show growth. Two weeks ago, total inflows stood at $13.14 billion. Last week, that amount rose to $13.81 billion.

Questions about the long-term sustainability of Hong Kong's favorable regulatory environment

These may be requests Spotting Bitcoin ETFs in Hong Kong By reputable Chinese funds, a bullish signal. Hong Kong's determination to establish itself as a cryptocurrency hub, combined with its unique relationship with China, suggests a possible softening of China's overall stance on cryptocurrencies.

This could have positive long-term effects on digital currency markets. Additionally, key industry figures have praised the regulatory clarity in Hong Kong.

However, Hong Kong's autonomy under the "one country, two systems" agreement with China will end in 2047. This raises questions about the long-term sustainability of Hong Kong's favorable regulatory environment.

👈Read more: Trading strategies in an uptrend or how to buy cryptocurrencies in the event of an increase?

Bobby Lee, founder and CEO of the Ballet, expressed this concern In an interview Made in August 2023 with BeInCrypto. Lee asked about the pace of integration between Hong Kong and China over the next 23 years, highlighting the possible unification of currencies, systems and possibly surveillance under a single framework.

"The question is: what will happen in the next five years (in Hong Kong)? The next 10 years? The next 20 years? Or even the next 24 years? Is this going to change? I think (the regulatory environment in Hong Kong) will change."

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بت كوين,بتكوين,بيتكوين

Comments

Post a Comment