Bitcoin Price History (BTC) recently hit a new all-time high and has been trying to do it again ever since.

Looking at the chart, a long-term bullish outlook seems to be the likely outcome. However, investor behavior suggests the opposite.

The price of Bitcoin now records at 4:30 p.m. Dubai time and 3:30 p.m. Riyadh time $72,260 per symbol, an increase of 4.3%.

Bitcoin breaks important resistance

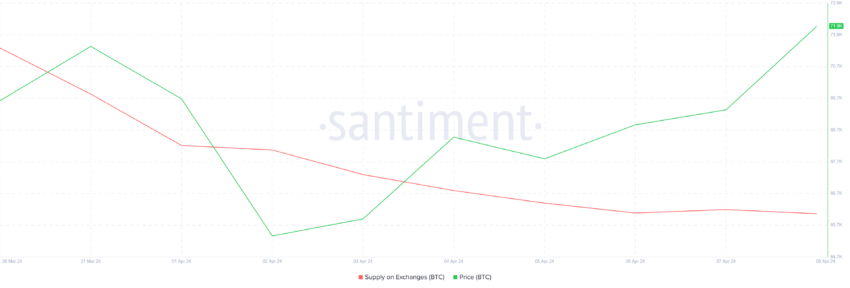

Bitcoin started the week on a positive note as it managed to rise continuously thanks to the continued accumulation noticed by investors. In the last week alone, the total supply across all exchanges increased from 812,000 BTC to 799,000 BTC. This indicates that approximately 13,000 Bitcoins worth over $926 million moved from exchanges to investors' wallets.

This is a sign that Bitcoin holders are expecting further price appreciation, which appears to be the case based on this trend.

On the 3-day chart, Bitcoin validates the Wyckoff model, a technical analysis concept that identifies trends and potential reversals in financial markets. It analyzes price and volume movements to distinguish accumulation, distribution or markup phases.

Read more: How to buy bitcoins

Currently, Bitcoin price is breaking through the resistance pattern, which indicates that Bitcoin will continue to rise in the coming trading sessions.

Bitcoin Price Forecast: Another Rise Is Coming

Although the long-term target is somewhat difficult to determine due to unprecedented and unaccounted for factors, it appears that the short-term target for Bitcoin price will be $85,000. This is derived from the symmetrical triangle trading model that Bitcoin currently follows.

This pattern is characterized by the convergence of trend lines, forming a triangular shape. This indicates a period of hesitation in the market, as prices consolidate between higher lows and higher highs. A breakout could lead to a significant price movement.

Based on this trend, the target is set at 21% above the breakout point, or just above $85,000. Therefore, investors should expect a downward recovery.

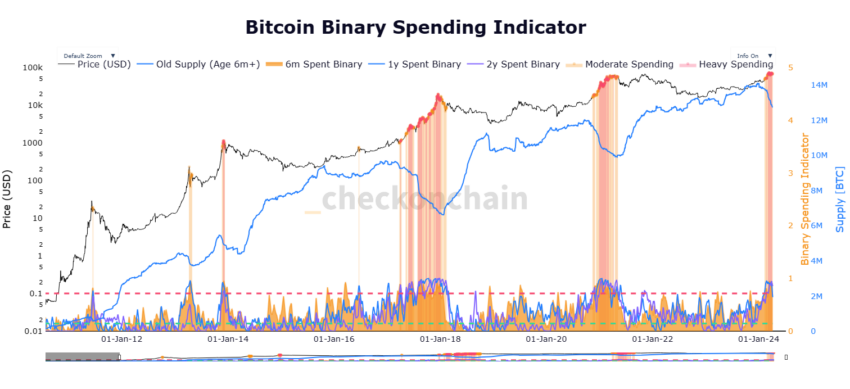

However, another major factor that could invalidate this bullish thesis is the long-term profit potential of the holder. Historically, after new all-time highs, these holders tend to take profits, leading to a Bitcoin price correction over the next few weeks.

Read more: How to get USDT in the Arab world

If this is also the case for Bitcoin after the halving, the Bitcoin price could correct, potentially falling to $60,000.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment