Coded DYDX It is an integral part of the dYdX chain, which focuses on decentralized financial instruments (Challenge) and derivatives. It underwent major changes after Ethereum moved to the dYdX chain, bringing new features and expanding its usage. Here's what you need to know.

From Ethereum to Cosmos

On October 26, 2023, at 5:00 p.m. UTC, the dYdX chain was born, launching its first block. DYdX has decided to manage its own chain within the Cosmos ecosystem, going beyond its initial deployment on Ethereum. This development constitutes a major step in its development, aiming to benefit from the connectivity and efficiency of the Cosmos network.

Blockchain-based Proof of stake (PoS), built on the Cosmos SDK and using CometBFT for consensus, adopted DYDX as its primary token, serving as a key to securing the network, a way to reward stakeholders for securing the chain and enabling community governance. Holders can delegate their assets to validators or become validators, thereby strengthening the security of the blockchain. Additionally, they have the power to shape the future of the dYdX channel by voting on key proposals, from contractual software updates to community fund allocations.

Migration included from Ethereum to the dYdX chain Smart contract For a one-way bridge, ethDYDX tokens are locked and corresponding DYDX tokens on the dYdX chain are allocated to users. This process is designed to be automated and permissionless, to ensure a smooth transition for token holders.

Main differences and new functions

Quotas and security

The DYDX token offers a deeper level of engagement to its holders, allowing them to improve network security through an active staking mechanism. This participation can take two forms: the holders can either assume the role of auditor themselves, or

Delegate their actions to existing listeners. The system design improves network defense mechanisms. As the volume of encrypted tokens increases, a wider range of validators improves network resilience against coordinated attacks.

The staking process involves locking cryptocurrency tokens into a smart contract to support network operations, such as transaction processing and verification, in exchange for rewards. It is a way for users to earn passive income while contributing to the security and efficiency of the blockchain network. The stakes are at the heart of proof-of-stake blockchains, because the consensus mechanism relies on the participation of token holders rather than computational work.

DYdX distributes 100% of protocol fees to stakers In US dollars USDC Instead of native code, this is a completely unique model with many real-world use cases. To date, holders have staked 148.83 million DYDX at an APR of 17.88%.

Judgement

The migration to dYdX V4 represents a move toward a more democratic system of governance, giving DYDX token holders the ability to directly influence the future of the network by submitting proposals and voting. Unlike the latest version of the protocol, holders only need 2,000 unstaked DYDX and a small amount of gas to vote. This development significantly improves the function of the code, moving it from its traditional roles to a key role in shaping the strategic development of the dYdX series. Since the start of 2024, the number of government votes has been 52, compared to 30 for the whole of 2023.

Community governance in DeFi plays a crucial role in democratizing financial systems, allowing token holders to directly influence decisions and policies. This commitment aligns the development of the platform with the needs of its users, promoting transparency and trust. Furthermore, it can intensify security and innovation by pooling collective wisdom and resources.

Economic mechanisms and rewards

As mentioned, the dYdX on-chain economic framework rewards validators and stakers with 100% of the protocol fees. This rewards system encourages continued participation and supports the expansion and long-term sustainability of the network. It also ensures a stable development path and strengthens security through broad and committed stakeholder support.

The protocol has distributed $19.7 million to 18,800 stakeholders as of this writing.

If you want to know how to stake DYDX coin, follow This guide how to bet.

Symbolic economy

Refers to the monetary economy tokenomics to the cryptocurrency economy, explaining how tokens are issued, distributed and managed within its ecosystem. It includes the provision of tokens, a distribution mechanism and incentives for holders. Understanding the token economics is crucial to assessing the long-term viability of the token and the potential impact on the success and value of the project to investors.

The total supply of DYDX tokens is limited to 1 billion tokens, with a current circulating supply of 464,677,529 at the time of writing. The latest statistics on circulating supply can be found at CoinMarketCap.

After the launch of ethDYDX, several proposals (immersion 14, immersion 16, immersion 17, immersion 24) by modifying these initial allocations. This decision reflects the dynamics of the project's distribution strategy to support its ecosystem and governance framework.

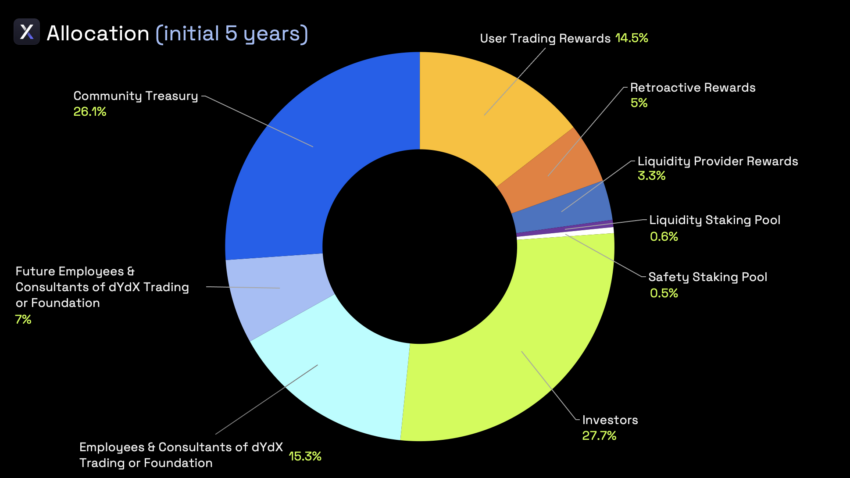

Currently, customizations include:

- 27.7% for investors

- 15.3% for employees and advisors of dYdX Trading or Foundation

- 7.0% for future dYdX employees and consultants

- 14.5% trading bonus for users

- 5.0% for retroactive bonuses

- 3.3% for liquidity provider rewards

- 26.1% to the community treasury

- 0.6% for the liquidity quota pool

- 0.5% for the security issues pool

Customize – DYDX Coin Staking

Moving the DYDX token to the dYdX chain, now part of the Cosmos ecosystem, significantly improves its functionality and overall value. T

This move is part of the DeFi sector's drive towards more scalable, secure and community-led platforms. Unlike ethDYDX, which was only used as a governance token, DYDX allows its holders to have enhanced roles in governance, staking, and ensuring network security, marking a notable shift from its initial configuration on Ethereum.

Where to buy DYDX coin?

You can buy native DYDX token on centralized (CEX) and decentralized (DEX) platforms.

Some notable options include:

- OKX — one of the largest centralized exchanges where DYDX is available for trading.

- KuCoin – Another large centralized exchange offering DYDX trading pairs.

- Osmosis – a leading decentralized exchange built on Cosmos. Here you can trade DYDX directly from your wallet without the need for a broker.

These platforms offer different trading options, such as spot trading on centralized exchanges and wallet-to-wallet trading on platforms like Osmosis. Be sure to review the features and security measures of each platform before trading. For a more comprehensive list of where to buy DYDX and detailed market information, you can refer to Market page on CoinMarketCap.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment