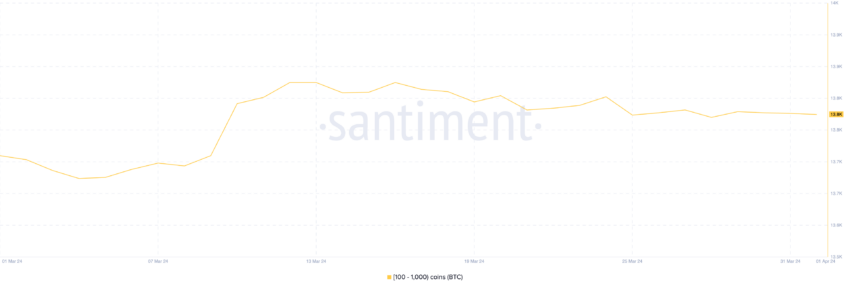

The future outlook for the Bitcoin price is characterized byBTC) are cautious as whales holding 100-1,000 BTC have stabilized their holdings since March 25, indicating a temporary pause in accumulation. At the same time, the relative strength index fell from 76 to 69, indicating short-term cooling.

Additionally, the EMA lines are approaching a death crossover, indicating an upcoming downtrend for Bitcoin. Together, these indicators indicate a cautious stance for Bitcoin's immediate future.

Bitcoin whale accumulation slows

Since March 24, the number of wallets holding between 100 and 1,000 bitcoins, often called "whales," has remained relatively stable, fluctuating slightly between 13,872 and 13,841. This stability indicates that these large holders are not currently accumulating more Bitcoin.

Whales are large holders of cryptocurrencies that have the ability to significantly influence market movements due to their sheer trading volume. Their activity is closely monitored because it can provide insight into market trends and potential price movements.

The consistent behavior of Bitcoin whales indicates that their interest may be fading, which is crucial in a market driven by sentiment and momentum. This pause in purchases may reflect a decline in confidence or a cautious attitude on the part of these major players.

This trend could soon lead to a bearish outlook for Bitcoin. If other investors think the whales are losing interest or becoming bearish, they may rush to sell, fearing a market drop. This reaction can trigger a cycle in which fear of decline leads to actual decline.

👈 Read more: How to manage the fall of Bitcoin in a bull market?

Relative Strength Index (RSI) Declines

Bitcoin's Relative Strength Index (RSI) is locatedBTC) for 7 days is at 69, which is far from the overbought but not oversold level. This balance may indicate a decline in interest in Bitcoin. This indicates a consolidation phase where neither buying nor selling forces dominate.

The Relative Strength Index (RSI) acts as a measure of momentum in technical analysis, evaluating recent price movements to determine whether an asset is overbought (above 70) or oversold (below 30).

This means that Bitcoin is at level 69, meaning Bitcoin is on the verge of being considered overbought, but its stability in this neutral zone indicates a lack of momentum in either case. Six days ago, the RSI fell from 76 to 69 where it started Bitcoin Price It is between $68,000 and $72,000.

This drop from previous highs indicates a cooling of enthusiasm around Bitcoin. Declining RSI, coupled with price stability, could be seen as an indicator of waning interest or a collective pause among investors, which could pave the way for a change in market dynamics if new buying or selling pressures do not appear.

Bitcoin Price Forecast: Drop Below $60,000 This Week?

Bitcoin's exponential moving average (EMA) lines are approaching a deadly crossover, a trend that is often seen as a bearish signal for the market. A death crossover occurs when the short-term moving average falls below the long-term average, indicating that recent momentum is diminishing relative to the broader trend. This change indicates that the market could move from bullish to bearish conditions.

Unlike simple moving averages, exponential moving average lines prioritize recent price movements in order to be more responsive to changes. It smoothes price data over time and tracks price trends based on past performance to simplify market trend analysis. This method improves the ability to distinguish market developments, making EMA lines extremely important in technical analysis.

Currently, if the downward trend indicated by the near death cross continues, Bitcoin price could fall to $59.2k, especially if the support level of $62.3k proves insufficient to sustain the decline. This potential decline may reflect increased selling pressure and weak market sentiment towards Bitcoin.

👈 Read more: Latest Bitcoin (BTC) price analysis from BeInCrypto

However, there is also the possibility of a reversal of this trend. If buyers regain control and push the market into an uptrend, Bitcoin could challenge the $71.7k resistance level. Overcoming this hurdle will require significant buying pressure, but could indicate a new uptrend and a potential reversal of the current bearish outlook.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

تحليلات,العملات الرقمية,العملات المشفرة,بت كوين,بتكوين,بيتكوين

Comments

Post a Comment