Analysts have increased their chances of endorsing the Ethereum exchange-traded fund (ETF). This change in sentiment comes amid renewed optimism about regulatory approval from the U.S. Securities and Exchange Commission (SEC). The move signals a potential breakthrough in the long search for an Ethereum ETF.

Renewed Optimism with Immediate Approval of Ethereum ETF

Eric Balchunas and James Seyphart, ETF analysts at Bloomberg Intelligence, recently announced that they are increasing the chances of immediate approval of an Ethereum ETF from 25% to 75%. Balchunas explained the reason for their renewed optimism.

"Hearing this afternoon that the SEC might do a 180 on this growing political issue has everyone scrambling now. But again, we're staring at the cat at 75% until we see more, c 'that is, providing updates,' he said. books Balchunas on his X account (Twitter).

The SEC has reportedly asked asset managers who want to list Ethereum spot ETFs to update their 19b-4 filings before this week's deadline. The move has sparked speculation and activity within the industry, with stakeholders anticipating the potential approval.

👈Read more: The best central platforms for trading digital currencies...5 main factors

Balchunas also highlighted a statement from Nate Geraci of ETF Shop. BeInCrypto reported that Geraci expects “SEC approval of 19b-4s, then slow play on S-1s.”

The 19b-4 filings propose rule changes necessary for new products, such as Bitcoin or Ethereum spot ETFs, to be listed on exchanges. Meanwhile, S-1 registration forms provide detailed information about new securities offered to the public. Including fund structure, management and investment strategy. It is important to note that issuers must obtain approval of both forms to officially launch ETFs in the market.

However, Seyffart noted that their increased ratings are only "19b-4, May 23 cutoff," referring to VanEck's immediate approval of Ethereum ETFs.

He added Seyfart: “It could take weeks, if not months, before we see S-1 approvals and, by extension, a live Ethereum ETF. »

This development is particularly interesting given that Seyffart and Balchunas have downplayed their chances in recent months. Additionally, prominent industry figures, including Jan Van Eck, CEO of VanEck Asset Management, immediately expressed pessimism about the approval of the Ethereum ETF.

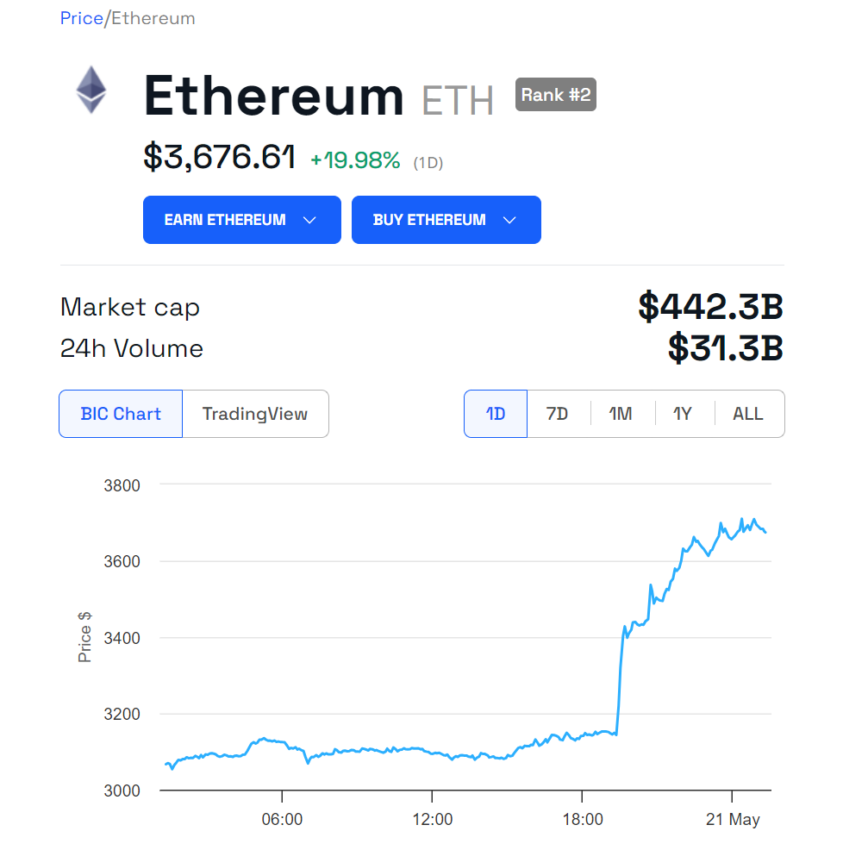

After this news, it increased Ethereum (ETH) Price Significantly. According to data from BeInCrypto, the price of ETH increased by 19.98% in the last 24 hours. At the time of writing, ETH is now trading at $3,676.

👈Read more: Optimism Project and Gas Fee Reduction on Ethereum

Market optimism extends to beta

Market optimism extends to Ethereum beta – the altcoins in the Ethereum ecosystem – including Polygon (MATIC) and Optimism (OP). Over the past 24 hours, MATIC and OP prices have increased by 9.4% and 19.7%, respectively.

Overall, this increased likelihood of approval has renewed market enthusiasm. As the SEC's decision approaches, industry stakeholders are closely monitoring updates.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,إيثريوم,العملات الرقمية

Comments

Post a Comment