Arthur Hayes, former CEO of BitMEX, suggests that the Federal Reserve implement an unlimited dollar-yen swap agreement with the Bank of Japan (BOJ) to limit yen depreciation.

The move could lead to a sharp decline in the value of the US dollar, thereby increasing the liquidity of the global dollar, which could benefit the crypto market, particularly Bitcoin.

Arthur Hayes' view on the dollar-yen exchange

It's clear Arthur Hayes The proposed dollar-yen swap would work similarly for yield curve control. The Federal Reserve will exchange dollars for yen with the Bank of Japan indefinitely.

“A decline in the value of the US dollar means a large increase in global liquidity in US dollars. This will benefit the crypto market, led by Bitcoin.” Hayes said.

As the company's former CEO points out BitMEX The Bank of Japan and Japan's Finance Ministry will use these dollars to stabilize the yen by buying it, avoiding the need to sell U.S. Treasuries to raise dollars. This strategy helps Japan avoid raising interest rates, which would negatively impact its financial institutions that invest heavily in Japanese Government Bonds (JGB).

👈Read more: The Federal Reserve's press doesn't stop... Is the dollar no longer enough to tackle the American crisis?

Geopolitically, a stronger yen could affect China, Japan's direct export competitor. If Japan strengthens the value of the yen through this swap agreement, China could devalue the yuan to maintain its export competitiveness.

Macroeconomic context and market reactions

The macroeconomic context remains crucial for cryptocurrencies, particularly Bitcoin. Recent US data has reduced the likelihood of further interest rate hikes. At the same time, China has significantly increased its stimulus measures, adding positive momentum to liquidity.

The People's Bank of China recently announced plans to issue ultra-long-term bonds and a historic bailout plan to stabilize the real estate sector, which essentially amounts to quantitative easing of real estate.

Increasing liquidity from the United States and China creates a favorable environment for Bitcoin. Flows have increased BTC spot ETF, with $716 million in net inflows last week, reversing April's outflows. Large institutional investors are also interested, with Millennium Management holding significant stakes in Bitcoin ETFs.

👈Read more: Everything you need to know about the digital currency USDT and how to buy it

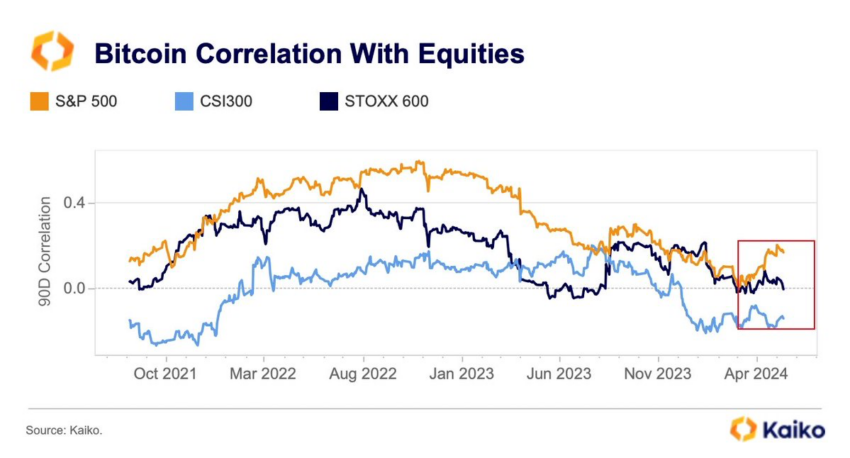

The correlation between Bitcoin and US stocks remains a key metric to watch. Last week, Bitcoin's 90-day correlation with U.S. stocks rose to 0.17, up from a multi-year low of 0.01 in March. This development highlights the importance of active monitoring and analysis in today's market environment.

In conclusion, the Fed's potential implementation of an unlimited dollar-yen swap represents a major policy change. This could have far-reaching consequences for global liquidity, asset prices and competitive dynamics between major economies like Japan and China.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,البيتكوين,الدولار الأمريكي

Comments

Post a Comment