Bitcoin Cash (BCH) is currently riding a bullish wave, but a fall below the daily Ichimoku cloud could signal a shift to a downtrend. Investors should closely monitor key support and resistance levels to adjust for potential market changes.

Technical Forecast for Bitcoin Cash

is being exchanged Bitcoin Cash (BCH) Currently $507 in Daily Ichimoku Cloud. The exit of the daily Ichimoku cloud to the downside could lead to a reversal of the downtrend.

A successful breakout above this level could indicate further bullish momentum.

Key Fibonacci resistance levels to watch include the 0.382 level at $576.9, the 0.236 level at $631.1, and the 0.618 level at $489.4, which serves as crucial support.

On a 4-hour time frame, BCH is trading above the Ichimoku cloud, indicating a short-term uptrend.

👈Read more: Copy Trading: How to become a better Copy Trader?

The price is currently hovering around the 0.618 Fibonacci level at $489.4, which serves as support. The 100-period exponential moving average (EMA) at $475.9 also provides support, strengthening Bullish outlook.

Ichimoku Cloud It is a tool used in technical analysis to help identify market trends. Here's a little detail:

- Cloud: The shaded area on the chart shows potential support and resistance levels.

When the price is above the cloud, it indicates a bullish (bullish) trend. When the price is below the cloud, it indicates a bearish (bearish) trend.

- linesThere are several lines in Cloud Ichimoku:

- Transfer line (Tenkan): Displays the average price over the last 9 periods (candles).

- Baseline (Kijun): Displays the average price over the last 26 periods (candles).

- Main extension A and B: They form a cloud and display future support and resistance levels.

BCH Price Analysis: Demystifying On-Chain Data Insights

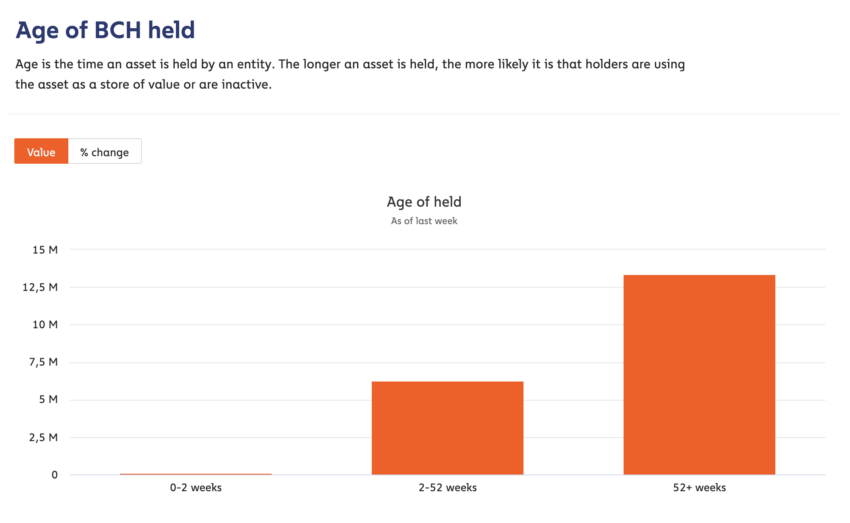

Investors have held the majority of BCH, approximately 13 million coins, for over 52 weeks, demonstrating strong long-term confidence. This indicates that a significant portion of the supply is held by investors who believe in the long-term potential of BCH, thereby reducing selling pressure and ensuring price stability.

Around 6 million BCH is held for 2 to 52 weeks, suggesting that medium-term holders could expect more. Price increase Before thinking about selling.

This combination improves overall holding power, reduces volatility and increases the potential for a sustained uptrend. Less than 700,000 BCH is held for 0-2 weeks, indicating minimal activity from short-term holders.

👈Read more: Guide to Using MetaMask Wallet for Beginners

This indicates less speculative trading, which is a positive sign of market stability, as it indicates less sudden selling and more consistent price action driven by long-term investors.

Strategic Recommendations: Bullish to Neutral Outlook

Monitor key resistance and support levels: Monitor the resistance level of $516.4 for possible bullish breakouts and ensure BCH holds above the critical support levels of $489.4 and $475.9 to maintain it. Positive expectations.

Bitcoin Cash (BCH) is currently in the Ichimoku daily cloud, facing a major resistance level at $516.4. A bearish exit from the daily Ichimoku cloud could invalidate the bullish outlook.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,بيتكوين كاش

Comments

Post a Comment