The price of Bitcoin, and with it the digital currency markets, experienced a strong recovery on Wednesday, after positive figures on US inflation, in line with expectations and falling after months of increase. This has increased investor optimism in global financial markets that interest rates will be cut quickly this year.

Over the past two months Upward momentum has diminished In the crypto market, after the US Federal Reserve announced a review of its plans to cut interest rates this year, due to the return to rising inflation rates. The importance of these figures is underlined by the fact that participants in the digital currency market are watching them closely.

Data U.S. Bureau of Labor Statistics The consumer price index (CPI) fell to 3.4% year-on-year in April, compared to 3.5% in March. Likewise, the core CPI, which excludes food and energy prices, fell to 3.6% from 3.8% in the previous period. Both figures were in line with market expectations, with monthly increases of 0.3%.

Inflation and Fed Confidence

It is important to note that the Federal Reserve remains cautious on inflation and any decision to cut interest rates will depend on upcoming economic data and the extent to which inflation continues to fall.

Since the May 1 meeting of the Federal Open Market Committee, figures have been released indicating a slowdown in the US economy. Given weak labor market data and moderate economic growth, there has been talk of lowering interest rates. However, the inflation rate is the Federal Reserve's main target.

In his commentary, Jerome Powell, Chairman of the Federal Reserve, called the producer price index data "somewhat mixed," noting that the issue of "confidence" remains a major topic within the Federal Reserve.

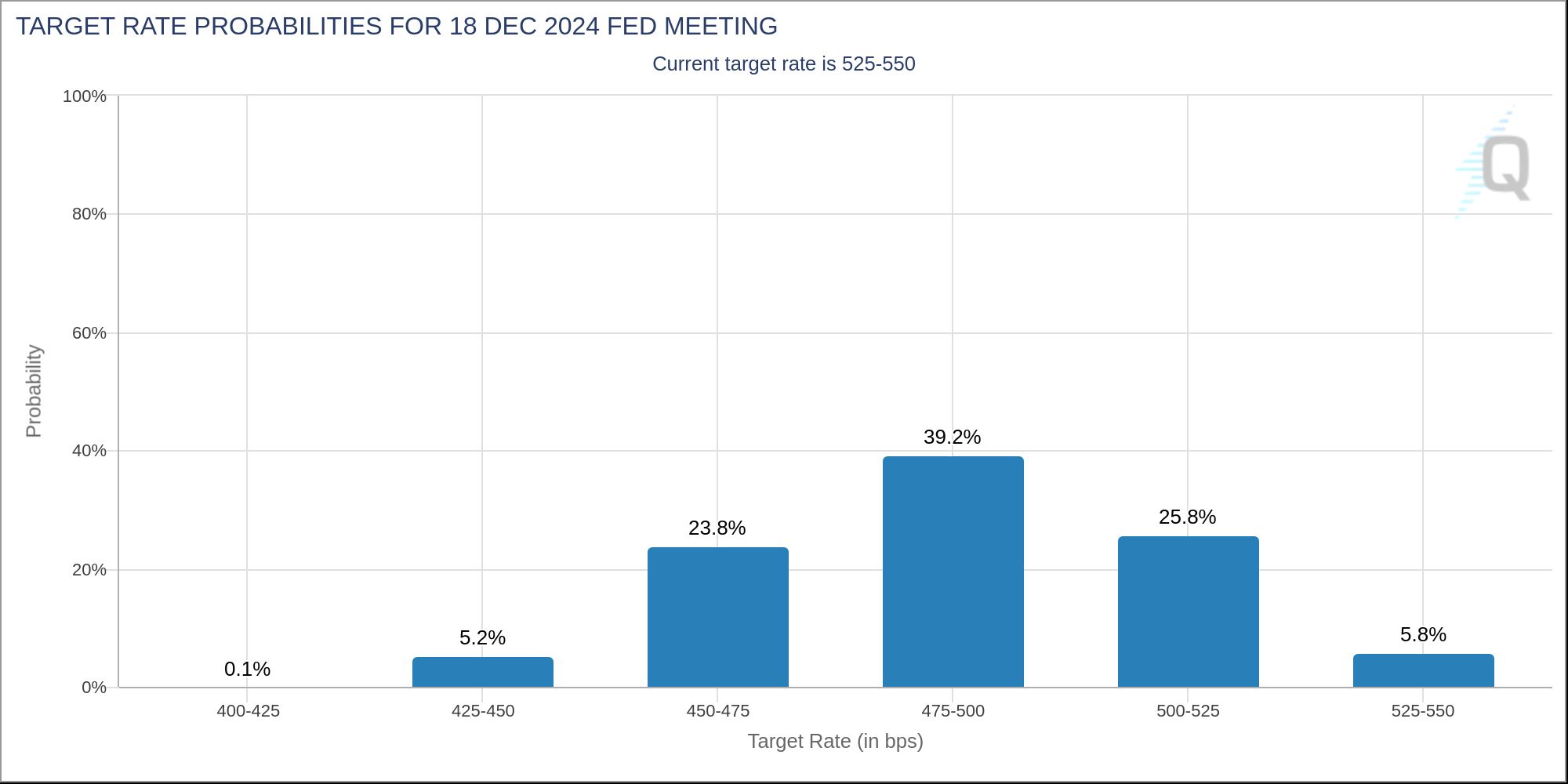

Recent increases in inflation rates have undermined the Fed's confidence. This will likely require a number of monthly data showing lower inflation, before the committee feels confident enough to make the first interest rate cut that the market expects to take place next September, with the possibility of a second reduction in December.

With the reversal in inflation, investors now estimate the probability of a rate cut at 75% in September, 85% in November and 95% in December, according to For the CME FedWatch tool Tool.

Analysts: Bitcoin may have reached bottom

It may be Bitcoin (BTC) has left the post-halving “danger zone” – the three-week period following the halving event. As stated by technical analyst Rekt Capital in his latest article. This suggests that Bitcoin has entered the accumulation phase.

If historical trends continue, the next bull market could peak between mid-September and mid-October 2025, the analyst noted.

“Right now, Bitcoin is accelerating in this cycle about 200 days now,” the analyst said. He added: “The longer the consolidation period lasts after the halving, the better it is to resynchronize this current cycle with the traditional halving cycle. »

“Investors view this as a positive change in the market. This represents the first decline in CPI inflation in the last three months,” Bitfinex analysts said in a report. This, combined with the Fed's previously announced intention to scale back its asset purchase program, "is seen as a positive for risky assets," they added.

Swissblock analysts noted that the current rise in Bitcoin prices represents an exit from the downtrend that has capped prices over the past few weeks.

“Finally, Bitcoin is taking a bigger step. We have been waiting for a catalyst to unleash a larger structure since the March high, and today we got it,” Swissblock said, highlighting the CPI and retail sales.

The analytics firm said this breakthrough paves the way for Bitcoin to reach $69,000 initially. Then, it could head towards new all-time highs, targeting the $84,000 level. During the next phase of the rally, “altcoins will follow strongly,” the report adds.

Technical analysis of Bitcoin BTC price

technically, Bitcoin BTC Price It has crossed the upper limit of the descending price channel (blue). However, we may see the formation of a new, less inclined, descending price channel (yellow) with the upper boundary below the 23.60 Fibonacci level priced at $68,500.

This is the area that could see strong resistance to the upside, if the price reaches it and does not stop around $67,200.

Despite the current strong rise, I don't think the current numbers are enough to push the market above the previous all-time high. As we have said, the Reserve Bank will wait at least two months to ensure that inflation comes back down. We will then see the markets react positively to this and we will see prices start to rise again.

And until this time can stay Bitcoin Prices BTC is trading in sideways ranges. Of course, this will happen in the absence of further developments, particularly on the downside, which remains a significant risk.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,العملات الرقمية,بيتكوين والتضخم,سعر بيتكوين

Comments

Post a Comment