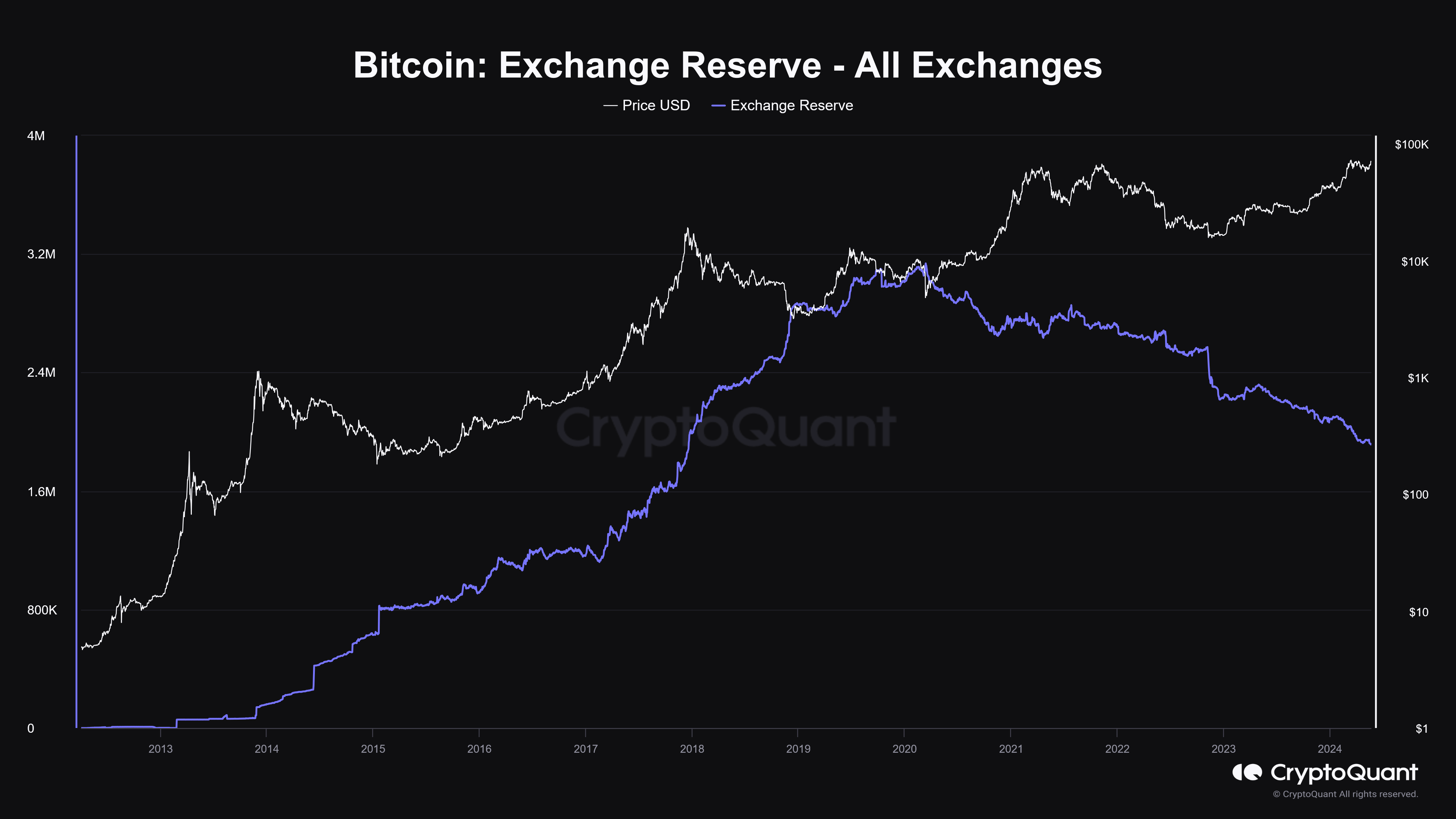

Bitcoin reserves have fallen (BTC) on trading platforms at unprecedented levels, reaching less than 2 million BTC units, according to Data crypto platform. Amidst great expectation of a strong upward move after the recent halving event. This striking decline indicates the possibility of an imminent rise in the price of Bitcoin.

Thomas Fahrer, one of the founders of Apollo, highlighted this idea in... Tweeter on Twitter, noting that BTC reserves are decreasing Cryptocurrency Exchanges Centralization may be an indicator that a significant price rise is approaching, especially with the expected influx of ETF investments.

Indicators of the rise of Bitcoin

Farrer claimed in his article that current low levels of Bitcoin on exchanges could lead to a surge in the price of BTC, driven by a strong combination of “inelastic demand and supply shock.”

These statements reflect the growing optimism of investors who see the decreasing supply of BTC on exchanges as an indication of a rally to come. This trend indicates that many investors are withdrawing their BTC holdings from exchanges and holding them in their own portfolios for the long term in anticipation of a price rise.

Furthermore, the changing dynamics of BTC supply on exchanges is part of a larger pattern involving significant institutional interest, raising speculation of a second wave of ETF inflows to come.

These inflows are expected to further reduce the available supply of BTC, exacerbating the supply crisis and driving up prices.

Institutional players, including hedge funds and public pension funds, are increasingly turning to Bitcoin via ETFs. This trend represents a major shift in how traditional financial institutions view these assets.

For example, Thomas Farrer points out that Horizon Kinetic Asset Management has made a significant commitment to Bitcoin, investing $913 million in IBIT and GBTC, representing approximately 14% of its total assets of $6.5 billion. .

Market distribution between individual and institutional investors

while Institutional investors are flocking On Bitcoin ETFs, retail investors seem more cautious. A recent report from blockchain data platform IntotheBlock reveals a divided market in which hedge funds and pension funds are actively increasing their Bitcoin holdings through ETFs, while the average investor remains on the sidelines.

This dichotomy is highlighted by the recent activities of “whales” (large investors) who added 250,000 BTC to their holdings, bringing their total holdings back to pre-FTX collapse levels in 2023.

Hedge funds, which are expected to play a major role in institutional adoption, have also invested billions of dollars in Bitcoin ETFs, demonstrating their confidence in the potential of the digital currency.

Public pension funds have also entered the picture, with the state of Wisconsin investing $160 million in Bitcoin ETFs, highlighting the growing acceptance of Bitcoin in traditional investment portfolios.

Additionally, recent Morgan Stanley filings reveal significant investments in the Bitcoin ETF market. The bank purchased 31,712 shares of Ark's 21Shares ETF (ARKB) and allocated $269 million to Grayscale Bitcoin Trust (GBTC).

These investments were made Morgan Stanley The third largest holder of GBTC stock and a top 20 investor in the Ark ETF, indicating strong institutional interest in Bitcoin.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,تحليلات,العملات الرقمية,بورصات العملات الرقمية,بيتكوين

Comments

Post a Comment