Jeremy Huff, former chief operating officer (COO) of Morgan Stanley China, has entered the crypto industry. He joined No Limit Holdings (NLH), a venture capital firm focused on blockchain.

The move reflects the growing appeal of the crypto sector among traditional finance professionals and large institutions.

Former Morgan Stanley COO embarks on new crypto venture

Hof brings a wealth of experience from his time at Morgan Stanley. He has managed operations on the company's various platforms in mainland China since 2017.

His role included implementing strategy for Morgan Stanley's internal mutual fund business. He also participated in the investment committee of Morgan Stanley's RMB private equity fund.

Gene Zhao, partner and co-founder of NLH, highlighted the strategic importance of Hoff's appointment. He emphasized that Hof's ability to navigate complex concepts and turn them into concrete strategies will be invaluable to NLH's future projects.

He explained “Jeremy brings deep experience in corporate law, intellectual property and asset management that greatly complements NLH’s strengths as a local crypto investor,” Zhao said.

Read more: Your Guide to Marketing and Building Customer Lists in the Web3 Space

Additionally, Huff expressed his excitement for his new role. This highlights the transformative potential of blockchain technology. He highlighted NLH's commitment to supporting visionary founders and developing products that harness the decentralization and democratization potential of blockchain.

“As a believer in the power of blockchain to change our world for the better, I couldn’t be more excited,” Hof said.

No Limit Holdings' latest move also reinforces renewed interest from venture capitalists in the crypto, blockchain and Web3 sectors.

For example, I conducted Haun Ventures recently closed a $5 million seed funding round for Agora, an application designed to simplify voting and decision-making for decentralized autonomous organizations. This round also saw the participation of major players such as Coinbase Ventures.

Additionally, Galaxy Digital has expanded its investment strategy by launching a $100 million fund to support early-stage crypto startups. The fund, known as Galaxy Ventures Fund I, LP, plans to back up to 30 startups over the next three years. Investments will start at $1 million and focus on financial applications, software infrastructure and cryptographic protocols.

Besides venture capitalists, traditional financial institutions are also showing growing interest in cryptocurrencies. BlackRock's latest investment in physical tokenization company Securitize illustrates this trend.

On May 1, Securitize announced it had secured a $47 million investment round led by BlackRock. This investment round includes participation from Hamilton Lane, ParaFi Capital and Tradeweb Markets. Additionally, Joseph Shalom, global head of strategic ecosystem partnerships at BlackRock, will be appointed to the securitization board.

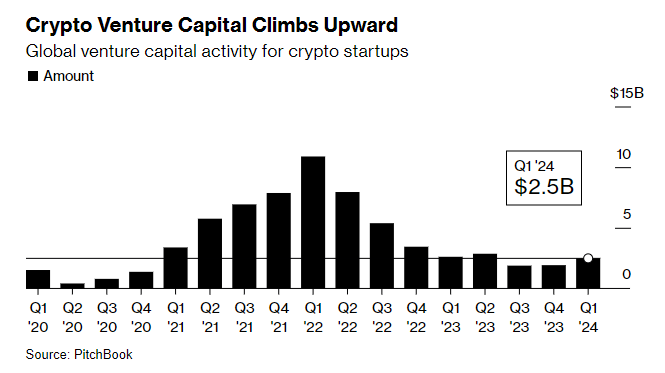

A recent PitchBook report reinforces this trend. Data reveals that venture capital investments in crypto startups reached $2.5 billion during the first quarter of 2024. This represents a 32% increase from the last quarter.

Read more: Crypto hedge funds: what are they and how do they work?

At the same time, crypto startups are raising more capital and investment firms are launching new digital asset funds. Robert Lee, a cryptocurrency analyst at PitchBook, attributes this renewed enthusiasm in part to the approval of exchange-traded funds (ETFs) in January. Additionally, Le also cited the growing interest in the intersection of cryptography and artificial intelligence as one of the motivations.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأعمال التجارية,العملات الرقمية,العملات المشفرة

Comments

Post a Comment