The cryptocurrency market has recently experienced a decline, marked by a significant drop in the prices of major assets such as Ethereum and Bitcoin.

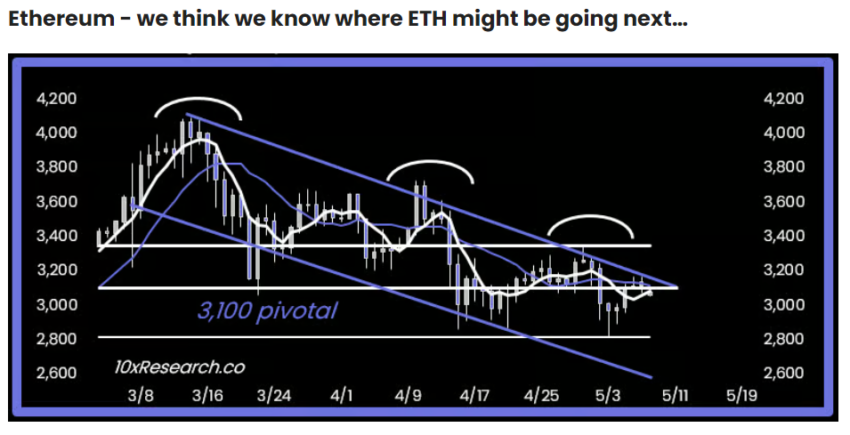

In particular, Ethereum (ETH) seems to be struggling with clearly downward trends. Which has prompted many cryptocurrency analysts to predict further declines for the second-largest cryptocurrency by market capitalization.

Ethereum Risk Falls to $2,500

According to a recent investor advisory from crypto research firm 10X Research, Ethereum's potential decline to $2,500 is concerning due to its weak fundamentals. They pointed to Ethereum's inconsistent performance during the current market cycle, a departure from its role as a bullish catalyst in previous cycles.

The company highlighted Ethereum's influence on Bitcoin's growth during this cycle, highlighting a strong correlation between the two, with an R-squared of 95%. Look at the basics Ethereum The decline is seen as an obstacle to the widespread flow of fiat currencies into the cryptocurrency ecosystem, thus hindering their rise. Bitcoin.

“Ethereum: The #2 token in the world continues to disappoint from both a fundamental and technical perspective. The daily chart below looks particularly weak to me if it goes above 2,950, we will easily see the 2,500- range 2,600 collapse. "He said Daniel Yan, founder and CIO of Kryptanium Capital.

Read more: Ethereum (ETH) Price Forecast for 2024, 2025, 2026, 2027

At the same time, the weak price outlook could stem from a decrease in network activity on the mainnet. The result is a record level of average transaction fees. According to blockchain analytics platform IntoTheBlock, the number is currently being settled growth of transactions on Ethereum Layer 2, with the three largest L2s accounting for a record 82% transaction share of all Ethereum transactions last month.

This coincides with developments related to Ether exchange-traded fund (ETF) applications. On May 10, Ark 21 shares Goodbye Instant Ethereum ETF Proposal, Abandoning Staking Plans.

Bloomberg ETF analyst Eric Balchunas suggested the change could be aimed at improving the application materials based on SEC comments, although there were no comments on the application.

“While it may appear that they are the ones formatting their documents based on comments from the SEC (which would be good news), there have been no comments. So their problem is either a Hail Mary or perhaps an attempt to give something to the SEC. less to use for “I’m not sure (yet),” he said. He said Balchunas.

Read more: Everything you need to know about Ethereum funds and altcoin season

Despite this, the amendment appears to have increased the likelihood of an immediate Ethereum ETF being approved by Polymarket, an on-chain prediction protocol. She emphasized data On the website, the odds of approval nearly doubled to 14% on May 10 after applicants moved in.

However, approval expectations remain low due to the SEC's conservative stance on Ethereum ETF applications.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,إيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment