Hong Kong is exploring the possibility of enabling staking services for Ethereum-based exchange-traded funds (ETFs). This initiative could position the Asian financial center as a leader in the cryptocurrency investment market, regardless of the conservative American stance.

Can a bet revive Hong Kong's faltering Ethereum ETFs?

According to Bloomberg, the Securities and Futures Commission (SFC) and several local ETF issuers are actively discussing a merger. Betting Mechanisms (Staking) in these financial products. Staking involves pledging cryptocurrency holdings to support network operations, and in return holders earn a potential yield. Concretely, an Ethereum bet can yield around 4% per year.

“It will be an important step for Hong Kong to add stakes to spot ETH ETFs.” He said Sera Wei, CEO of Aegis Custody.

👈Read more: Cryptocurrency Staking | The 5 most common mistakes to avoid

The development is part of Hong Kong's broader strategy to reaffirm its position as a leading global financial center. After experiencing political unrest, city officials have proactively promoted a progressive digital asset environment. This initiative was marked last year by the creation of a dedicated regulatory system.

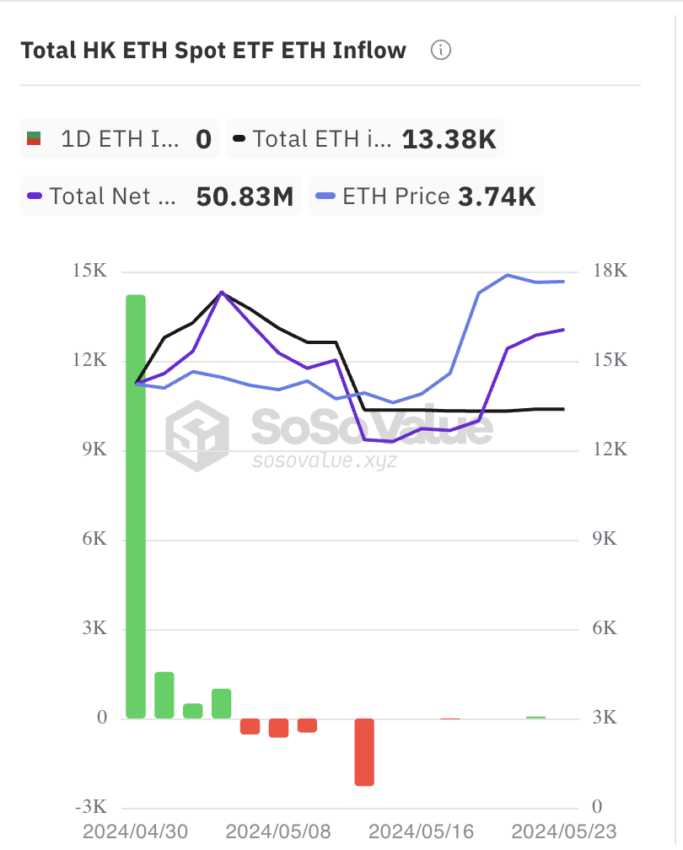

Despite these innovations, Crypto ETF in Hong Kong has received lukewarm demand since its debut in April. According to data from SoSoValue, the total net assets of all Ethereum spot ETFs in Hong Kong currently stand at around $50 million.

However, the potential introduction of storage options could increase the attractiveness of these ETFs compared to direct purchases of cryptocurrencies in... Scholarships.

Asset management giants opt out of including betting features in proposed Ethereum ETFs

In contrast, in the United States, financial giants such as Fidelity Investments, BlackRock, Grayscale, Bitwise and Arc Investment Management have recently backed away from including staking features in their proposed Ethereum ETFs. Aimed at facilitating smoother regulatory approvals, these decisions could make ETFs less attractive compared to other investment avenues offering higher returns through active cryptocurrency storage.

👈Read more: The secret to crazy profits in digital currency: How to create wealth in crypto!

Additionally, Hong Kong's ambition to establish itself as a crypto platform extends beyond ETFs. The region is also considering requests to expand the pool of licensed digital asset exchanges and is developing a framework for stablecoins. As this aims Cryptocurrencies Reduce price volatility by linking them to a reserve asset, such as fiat currency.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,إيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment