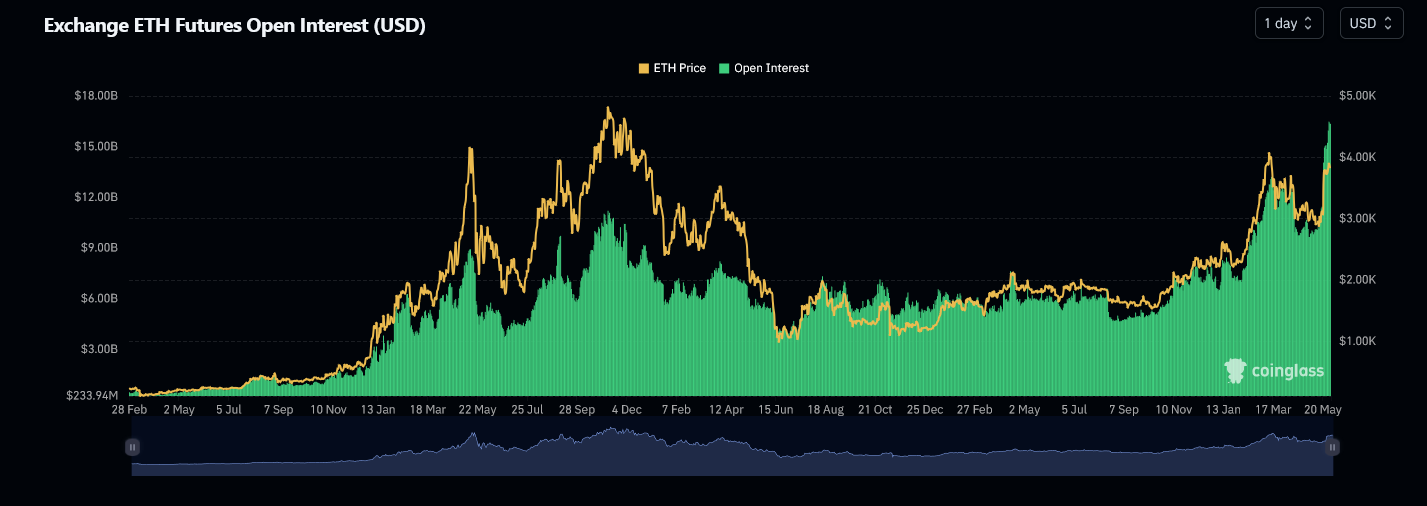

The futures market saw For Ethereum (ETH). Unprecedented surge to record highs following initial approval of Ethereum ETFs in the US. Although this approval did not lead to a significant increase in the price of Ethereum itself, it did lead to a notable increase in the derivatives market.

This is considered SEC Approval An important regulatory milestone in the cryptocurrency market, providing a new level of legitimacy and ease of access to Ethereum.

Impact of Ethereum ETF Approval

The effect of this approval is clearly visible in Derivatives marketespecially futures, which had a relatively quiet year at the start of the year, total open futures for Ethereum stood at just under $7 billion, with options contracts open at $6.45 billion.

She stayed These numbers remained relatively stable until early March, when they increased Ethereum Price Significantly, reaching $3,343 on March 29. This price increase was accompanied by an increase in total futures contracts open to $10.57 billion and options contracts open to $10.72 billion.

However, real momentum began to build in late April when the market took off Approvals are awaited Ethereum ETF. By April 29, the Ethereum price had surpassed $3,500 and the total open futures contracts stood at $13.01 billion.

Total open options contracts hit an all-time high of $15.34 billion – a high point of speculative activity as traders took positions to capitalize on the expected ETF approval.

After the official news was released, the total open futures contracts reached an all-time high of $17.12 billion on May 28. In contrast, the options market has not seen a significant increase in the total number of open contracts.

Participation of financial institutions in the derivatives market

The large volume of open contracts at CME – $1.30 billion – shows strong institutional participation in the Ethereum derivatives market, likely due to the regulated environment offered by CME. Although total open options contracts are still lower than futures, overall options trading mirrors the trend seen with Ethereum futures.

. Total options open peaked at $13.44 billion on May 24, and despite a slight decline to $12.67 billion on May 28, the overall trend remains bullish.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

Hedi Bouazizi has been a professional trader for 15 years in the Forex and Cryptocurrencies sectors. Hadi graduated from the Faculty of Engineering, but specialized in the field of digital economy and trade, and has been professionally writing economic content and technical and fundamental analysis for a long time. Al-Hadi also helps enrich Arabic educational content related to cryptocurrencies and blockchain in many global centers and financial markets.

Hedi Bouazizi has been a professional trader for 15 years in the Forex and Cryptocurrencies sectors. Hadi graduated from the Faculty of Engineering, but specialized in the field of digital economy and trade, and has been professionally writing economic content and technical and fundamental analysis for a long time. Al-Hadi also helps enrich Arabic educational content related to cryptocurrencies and blockchain in many global centers and financial markets.

READ THE FULL BIO

Sponsored

أخبار,الأسواق,إيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment