Cryptocurrency exchange Kraken has dismissed rumors about delisting stablecoin Tether USDT for its European users.

Mark Greenberg, global head of growth and asset management at Kraken, explained this in a May 18 post on X (formerly Twitter).

Kraken continues to list USDT in Europe

BeInCrypto reported that Kraken It plans to stop support for USDT in the European Union if the stablecoin does not comply with upcoming market regulations regarding crypto assets (Mica), which is expected to come into force in July.

This regulatory framework is designed to provide clear guidance to crypto asset developers and service providers. Ensures compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

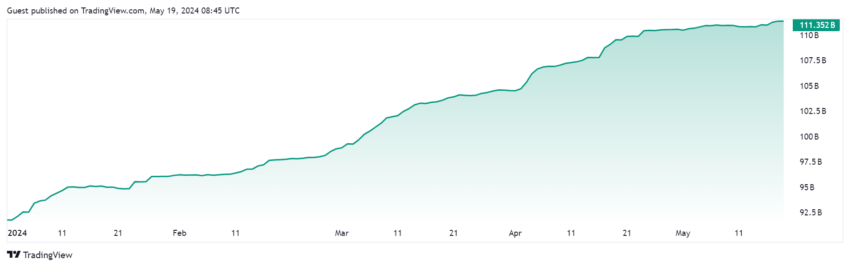

The news sparked reactions within the crypto community. They noted that USDT is the largest stablecoin and one of the most traded digital assets in the industry. Tether has a market capitalization of over $110 billion, which represents approximately 69% of the market share.

Learn more:

However, Greenberg responded to these concerns by stating that the platform intends to maintain support for USDT in Europe. He highlighted the value of USDT for European customers, adding that Kraken was exploring all options to offer USDT under the new regulatory regime. Regarding the MiCA regulations, Greenberg also confirmed that Kraken will comply with all legal requirements, even those with which it may disagree.

“We know our European customers value access to USDT and we continue to review all options to offer. USDT Under the next regime. We will of course comply with all legal requirements, even those with which we do not agree. But the rules have not yet been finalized and we continue to do everything possible to continue offering all relevant stablecoins to our European customers.

While the crypto community has praised MiCA's regulatory clarity, industry figures like Paolo Ardoino, CEO of Tether, have reservations. Arduino highlighted the need for stablecoin issuers to avoid uninsured cash deposits. Instead, it calls for maintaining 100% Treasury reserves to mitigate the risk of bank failure.

Ardoino cited previous incidents involving banks and stablecoins in the United States as examples of the risks associated with uninsured cash deposits. He emphasized the importance of learning from these events to ensure the stability and security of stablecoins in the future.

Learn more: A Detailed Guide to Buying USDT from Binance P2P

“We should learn from what happened with Silicon Valley Bank and another major stablecoin in the United States. If a bank fails, the uninsured funds should be able to hold 100% of the reserves in Treasury bonds, rather than being exposed to bank failures. while keeping a large portion of reserves in uninsured cash deposits. In the event of bank bankruptcy, the securities revert to their legitimate owner, "He stated Arduino.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment