Render (RNDR) is about to cross the upper line of an ascending triangle in continuation of its most recent uptrend.

Recording a 10% price rise over the past two days, the bulls can breach this resistance level if the current overall market trend continues.

The rendering may encounter some difficulties

May see an increase Rendering price Double-digit declines over the past 24 hours as some key symbolic indicators showed bearish influence remains dominant.

At press time, the points that make up the RNDR Parabolic SAR are above its price. This indicator identifies the potential trend direction and reversals in the price of the token.

When its points are higher than the price of the asset, the market is said to be falling. This indicates that the price of the asset has fallen and may continue to fall. Market participants interpret this as a sign to exit long positions and open sell transactions.

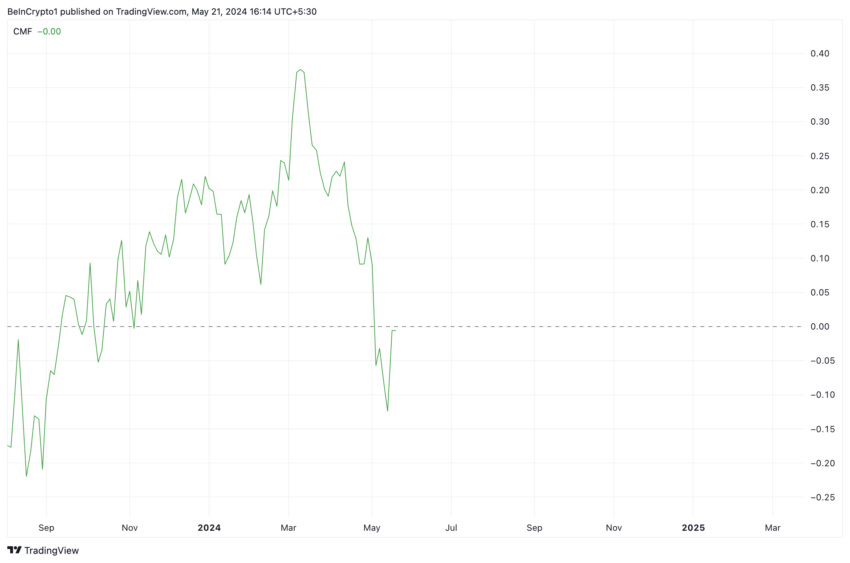

Additionally, the Chaikin Money Flow (CMF) value of RNDR was -0.01 at the time of writing. This indicator measures the flow of funds into and out of the RNDR market.

A bearish signal, indicating a weak uptrend or a developing downtrend, appears when its value drops below zero.

RNDR Price Forecast: Negative Sentiment Meets High MVRV

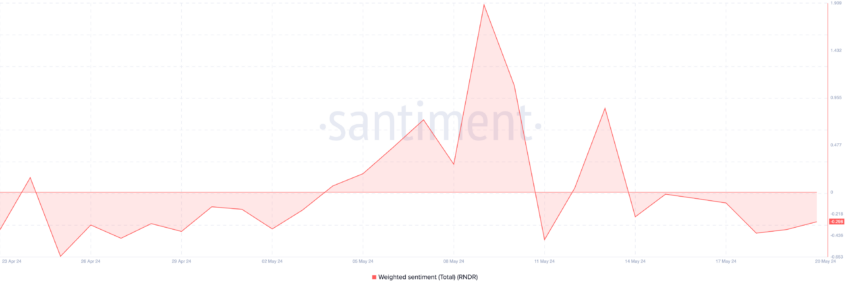

Bad sentiments are currently represented after RNDR in their weighted negative sentiments spotted on the channel. Then, at -0.29 at press time, this metric shows a dominant negative bias in online discourse around the asset.

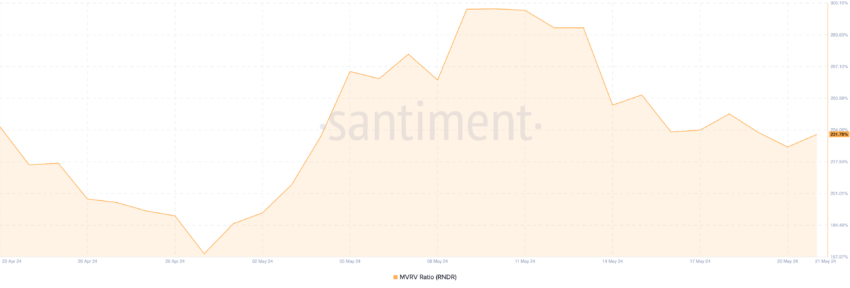

This negative sentiment comes at a time when the token’s market capitalization to realized value (MVRV) ratio is high. As of this writing, this represents 231.78%

A high MVRV ratio already indicates a possible correction if the price becomes unsustainable. Therefore, negative sentiment reinforces this anxiety, highlighting potential selling pressure that could lead to lower prices.

On the other hand, if it is acquired Selling pressure is momentumThe token might prove impossible to break the upper border of the ascending triangle and move back towards the $9.8 level.

Learn more: Rendering (RNDR) Price Forecast for 2024, 2025, 2026, 2027

However, if this bearish forecast reverses, the price of the token could exceed $12.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment