Bitcoin (BTC) started the new year with a strong rise, crossing the $70,000 mark and seeing significant participation on its blockchain network. However, recent developments point to a slowing trend at these scales. Over the past couple of months, the price of the leading digital asset has faced challenges and on-chain activity has declined.

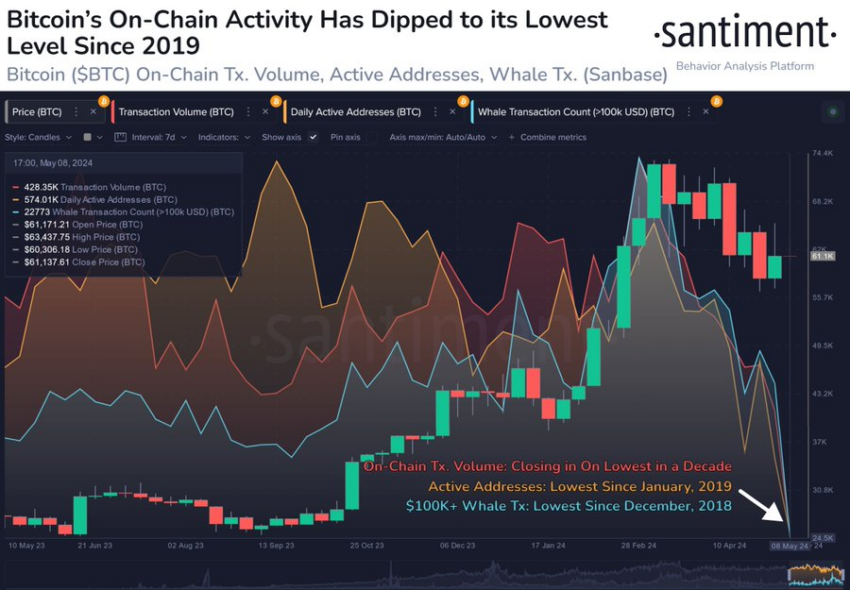

On-Chain Bitcoin Activity Falls to 5-Year Low

Data released by blockchain analytics firm Santiment indicates that on-chain Bitcoin activity has reached its lowest point since 2019. The decline indicates a decrease in merchant interest, which stands in stark contrast to the enthusiasm previous.

The company noted that the recession could reflect a broader sense of fear and uncertainty among market participants. This sentiment is consistent with historical trends, where declining trading often coincides with periods of market volatility. It is worth noting that the price of BTC has fallen by more than 11% over the past month to... 61.3 thousand dollars At the time of writing this article.

“This is not necessarily a sign of further decline in BTC, but rather a sign of fear and hesitation from the crowd.” »wrote Santiment analysts.

👈Read more: A Practical Guide to Bitcoin BTC Transactions & Your guide to buying Bitcoin (BTC)

At the same time, some market observers have pointed out that the decrease in on-chain activity coincides with a slowdown in transactions. Runic Protocol (runes) after its initial rise. The protocol's launch on Bitcoin halving day resulted in record fees and transaction volumes for the blockchain network. Despite this promising start, recent data indicates a marked decline in user engagement and transaction volume.

“After Runes Protocol generated $135 million in fees in its first week, only two of the last 12 days have exceeded $1 million – with May 10 seeing the lowest activity.” - He said Budhil Vyas, cryptoanalyst

Additionally, enthusiasm for Bitcoin exchange-traded funds (ETFs) appears to be fading. Reveal Data CoinShares reported a notable slowdown in trading volume for spot Bitcoin ETFs. Over the past month, several funds have experienced outflows and dead days.

Amid the ecosystem slowdown, two long-dormant Bitcoin addresses, originating from the early days of Satoshi Nakamoto, recently came to life.

Depending on the platform Lookonchain Blockchain Analysis These wallets have been inactive for almost 11 years. She then transferred her entire holdings of 1,000 BTC, which are currently valued at $60.9 million.

The wallets – called “16vRqA” and “1DUJuH” – received initial deposits of 500 BTC each in September 2013, when Bitcoin was valued at a modest $124 per coin.

👈Read more: Satoshi Nakamoto without a mask: the story of the most important man in the world of cryptography!

Today, these stocks have seen a significant rise in value, boasting an astronomical profit margin of nearly 50,000%.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بتكوين

Comments

Post a Comment