U.S. spot Bitcoin ETFs saw a notable rebound last week, seeing net inflows of $948.3 million. Thus, the total net flows since the start of trading in these funds last January has exceeded $12.5 billion.

Seen last week Flows continue to improve Investing in spot Bitcoin ETFs as there were no net outflows on any day of the week. Grayscale's GBTC fund was the only fund to see net outflows of $50.9 million on Tuesday, but it made up for that loss with net inflows of $63.2 million over the rest of the week, marking its first weekly net inflows since its conversion to an ETF.

Fidelity's FBTC fund topped the net inflows list for the second week in a row, adding $344.5 million. Ark Invest's ARKB fund came in second with net inflows of $243.7 million. BlackRock's IBIT fund came in third with net inflows of $131.8 million, after being dominant in previous weeks.

Coinciding with the increase in weekly net inflows, the price of Bitcoin increased by 8% over the past seven days, reaching $67,236 according to the price page of The Block website.

Most flows came after inflation data

James Butterville, head of research at CoinShares, noted that last week's capital inflows were an immediate reaction to... U.S. Consumer Price Index Report Published on Wednesday, the Fed's main inflation indicator, the last three days of the week represent more than 80% of total weekly flows.

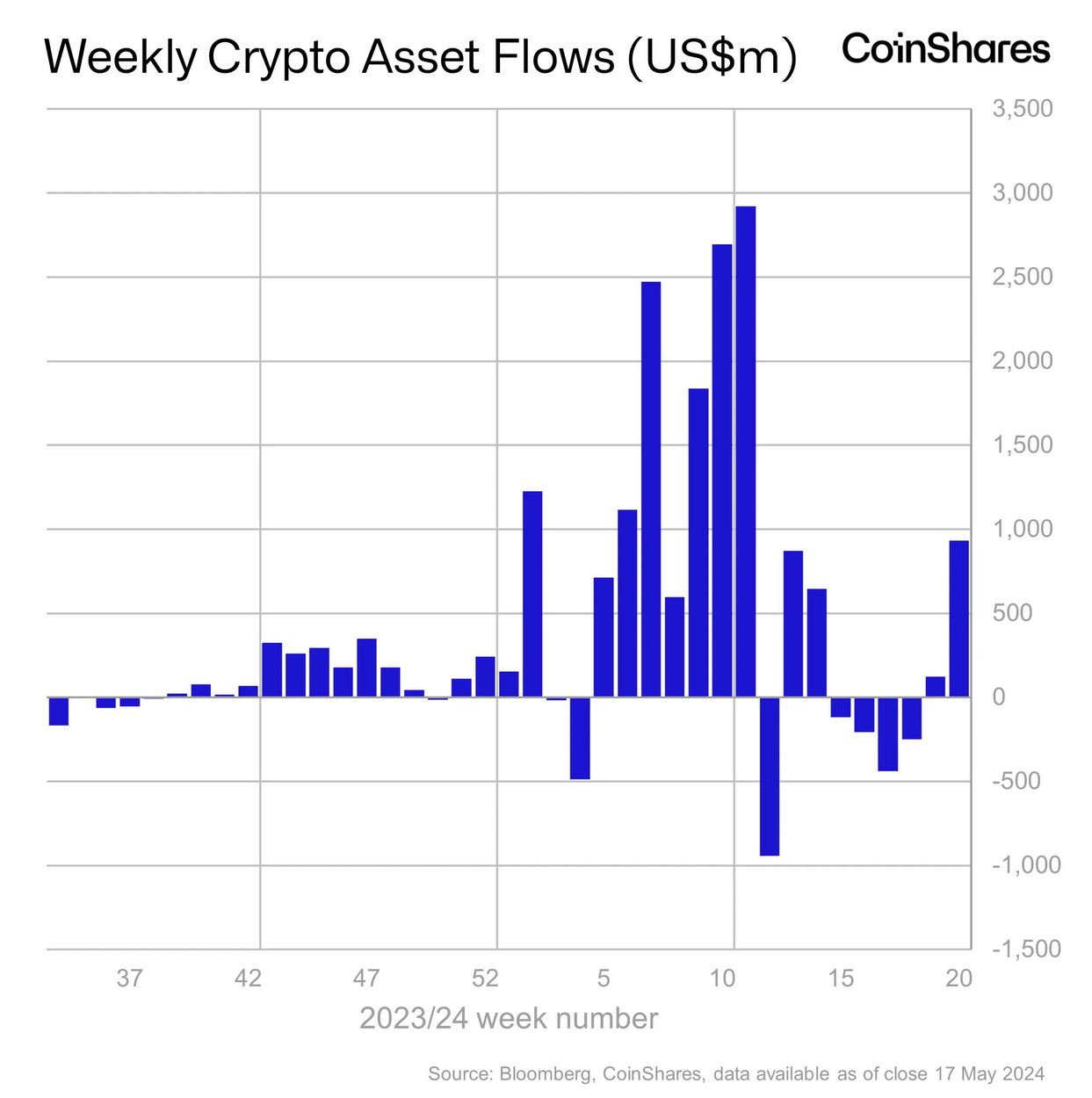

In contrast, outflows from cryptocurrency investment funds in Hong Kong, Canada and Sweden led to total global cryptocurrency investment fund inflows reaching $932 million last week, according to the report. a report CoinShares.

While Bitcoin dominates BTC On flows, Ethereum remains ETH he suffers from Pessimism about approval prospects The U.S. Securities and Exchange Commission (SEC) approved a cash ETF this week, with additional outflows of $23 million (last week), Butterville added.

Trading volume for U.S. spot bitcoin ETFs also increased slightly last week to $8.5 billion, after reaching $7.4 billion the week before, according to data from The Block.

Despite losing flow dominance in recent weeks, BlackRock's IBIT fund hit a record market share on Thursday with 55.2% trading volume, further eroding the market share of Grayscale's GBTC fund, which has fallen from 50.5% to 18.5% since the launch of the fund. on January 11. Fidelity's FBTC fund comes in third place with a market share of 17.7%.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,تحليلات,العملات الرقمية,بيتكوين,صناديق ETF

Comments

Post a Comment