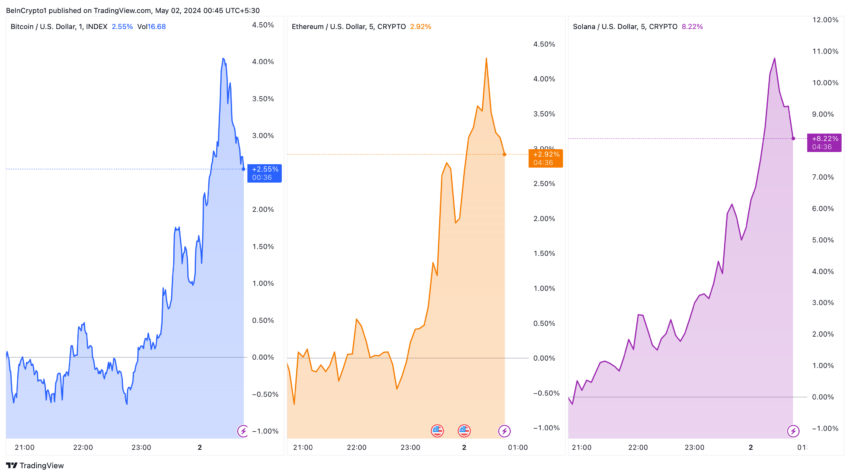

The price of Bitcoin, Ethereum and Solana saw significant rebounds following the recent Federal Reserve announcement by Chairman Jerome Powell.

I witnessed Bitcoin And Ethereum And Solana A significant increase in prices, coinciding with Powell's ideas at the Federal Open Market Committee meeting.

Cryptocurrency market rises as Jerome Powell speaks

The Federal Reserve maintained its current benchmark interest rate, opting for a wait-and-see approach despite lingering inflation concerns. Powell highlighted the continuing challenges in bringing inflation back to the Fed's 2% target, indicating that the central bank's next move is unlikely to be a rate hike.

Instead, the focus will remain on a prudent monetary strategy, echoing the Committee's desire to make necessary adjustments to protect economic stability.

“So far this year, the data has not given us any greater confidence, in particular, and as I noted earlier, the inflation numbers have been better than expected. Gaining such trust will likely take longer than expected.

Amid these developments, the cryptocurrency market has responded positively, indicating investor optimism about a stable interest rate environment. pink Bitcoin currency It increased by 5% to $59,440 Ethereum By 5.02% to $3,015, he saw Solana 11% increase to $136.

This stability in interest rates often results in increased investment in riskier assets such as cryptocurrencies, as evidenced by the significant rise in major digital currencies.

Furthermore, the Federal Reserve announced a slowdown in the reduction of its balance sheet, which should begin in June. This adjustment aims to avoid market fluctuations similar to those experienced in September 2019.

Starting June 1, the Fed will reduce the monthly Treasury drawdown to $25 billion, down from $60 billion. However, it will continue to allow $35 billion a month in mortgage-backed securities to circulate, redirecting the excess into Treasuries.

This strategic shift reflects a broader intention to primarily hold Treasury securities, with the aim of simplifying the central bank's balance sheet operations and improving its ability to respond to market dynamics. Concluding his speech, Powell reiterated the Fed's vigilance regarding inflation risks and its commitment to a restrictive policy aimed at lowering economic activity.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,العملات الرقمية,العملات المشفرة

Comments

Post a Comment