Vitalik Buterin, co-founder of the Ethereum network, has revealed plans to revamp the way transaction fees are assessed. This initiative, called Multi-Dimensional Gas Pricing, could revolutionize Ethereum's transaction mechanisms.

This mechanism would change the ways of calculating and processing transactions on the Ethereum network. This step is considered necessary to maintain the competitiveness of Ethereum in light of the increasing competition in the blockchain systems market. The need to attract users and developers, in addition to improving network efficiency.

Vitalik Buterin explains why the Ethereum network needs multidimensional gas pricing

Historically, the Ethereum network has relied on the unit "gas" to measure the computational effort required to process transactions and data blocks. This unit combined various aspects of processing requirements, such as arithmetic and storage operations, and placed them under a single unified metric.

Although this approach simplified operations to some extent, it led to inefficiency in resource allocation across the network. Because different types of resource requirements are treated as interchangeable, which is not true in practice.

To be present Suggestion to improve the network PEI-4844 An important change in this context by adopting the concept of “multidimensional gas pricing”. This proposal aims to allocate blockchain resources more accurately and efficiently to improve productivity and reduce operational costs.

This approach was embodied in the recent network upgrade called Name "DunkinThis process helped reduce the cost of solutions built on layer 2 of the network, which led to improved scalability of Ethereum. In this regard, Buterin highlighted that “the cost of Layer 2 solutions has become 100 times cheaper.” The volume of transactions on these solutions has more than tripled.

A compromise between efficiency and long-term sustainability

On the other hand, despite the improvement in the level of pricing and the efficiency of transaction processing. The reduction in transaction fees has had repercussions that have affected the sustainability and performance of the network in the long term.

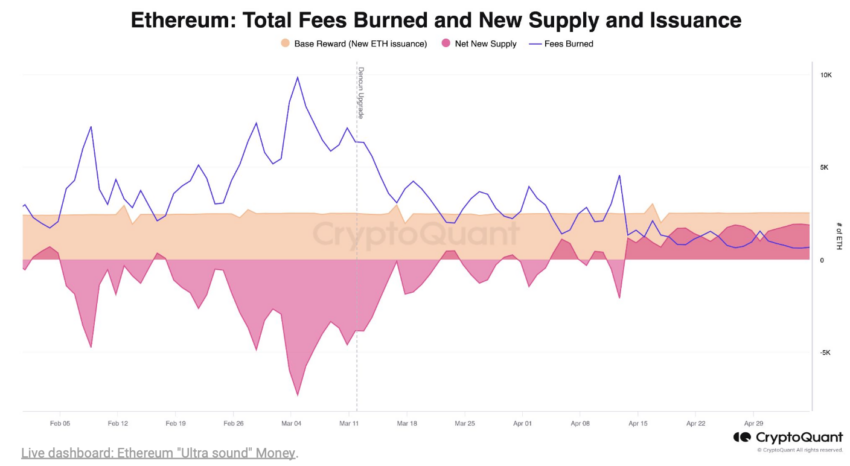

After the Dunkin update, the average transaction fees on the Ethereum network saw a sharp drop of over 90% across different Ethereum Layer 2 networks.

According to a report from CryptoQuant, this trend has other implications:

“The pace of growth in new Ether (ETH) supply is the fastest on a daily basis since transaction fee burns decreased significantly thanks to the Dunkin update.”

The drop in transaction fees translated into a drop in total fees burned despite the high activity on the network. As a result, the rate at which the circulating supply of Ether (ETH) is burned has slowed, effectively transforming it from a deflationary currency to an inflationary one.

Competition from Solana threatens Ethereum’s throne

In a related context, the Ethereum network faces a competitive threat from the Solana network, which is a blockchain network capable of processing transactions at a lower cost. And he emphasizes Dan Smith, senior research analyst at Blockworks, noted that Solana could soon surpass Ethereum in total transaction fees, perhaps even this week.

Smith's analysis is based on total economic value, which includes transaction fees and maximum extractable value (MEV) returned to validators.

However, the Ethereum network still ranks first in terms of transaction fees. And according to For data from the “DefiLlama” platformThe network generated revenue worth over $2.34 million from transaction fees in the last 24 hours, compared to $1.19 million for the Solana network during the same period.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,التكنولوجيا,أخبار الإيثيريوم (ETH)

Comments

Post a Comment