BlackRock's iShares Bitcoin Trust (IBIT) has made a major impact on the cryptocurrency market by acquiring nearly $780 million worth of Bitcoin (BTC) in just three days.

This increase in investment positions IBIT as a key element in determining investor sentiment and market trends.

BlackRock IBIT attracts massive inflows

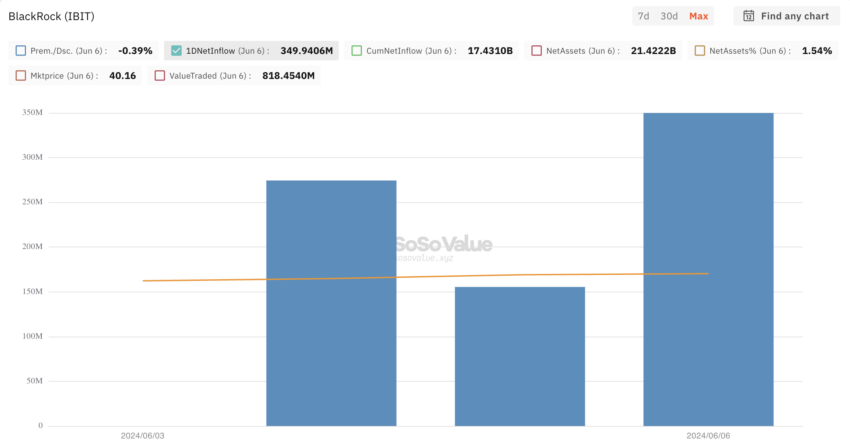

On Monday, the IBIT recorded 0 entries. However, the fund attracted $274.43 million on Tuesday, followed by $155.43 million on Wednesday.

According to SoSoValue data, another $350 million was raised Thursday. As a result, IBIT's total flow this week approached $780 million.

Recently, BlackRock's iShares Bitcoin Trust reached a new level by becoming the world's largest Bitcoin ETF. It now has $21.4 billion in assets, surpassing Grayscale's $20.1 billion. In third place is the Fidelity Wise Origin Bitcoin Fund, worth $12.3 billion.

On Thursday, other funds saw relatively lower inflows than IBIT. Bitcoin ETFs from Fidelity and VanEck received net inflows of $3.1 million and $2 million, respectively.

Conversely, Ark Invest's ARKB experienced one of the largest withdrawals of funds. Net outflows were $96.6 million. GBTC transferred from Grayscale and BITB from Bitwise also faced exits. It lost $37.6 million and $3.1 million, respectively.

Bitcoin spot ETFs have also continued to attract investors. It has achieved the longest series of net collections since its creation. These funds have also raised a total of $15.55 billion since January. Although flows slowed in April and May, they have since rebounded, although they remain below peak levels in March.

Amid these flows, the price of Bitcoin increased slightly. It is currently trading around $71,219, registering an increase of 0.41% in the last 24 hours.

Market analysts are optimistic and predict that Bitcoin will surpass its March high of $73,798.

“It’s great to see trading volumes, both on-chain and off-chain, steadily increasing as prices consolidate. This type of dynamic could be very conducive to an explosive breakout once we finally have reached the top,” said Mati Greenspan, founder of the research. and consulting firm Quantum Economics for BeInCrypto.

This forecast is also driven by strong demand for ETFs and expected interest rate cuts from the Federal Reserve.

“There have been massive inflows into spot Bitcoin ETFs. The macroeconomy continues to shift in favor of cryptocurrencies, with economic growth slowing to a recession-free pace and persistent signs of falling inflation.” He said Sean Farrell, Head of Digital Asset Strategy at Fundstrat Global Advisors.

Other central banks have already started cutting interest rates. The European Central Bank (ECB) lowered its key interest rate to 3.75% and the Bank of Canada (BoC) lowered its interest rate to 4.75%.

These reductions also aim to stimulate economic activity by making borrowing cheaper. Which could lead to an increase in investments in cryptocurrencies. Low interest rates generally reduce the appeal of traditional savings, pushing investors toward riskier assets like cryptocurrencies.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار البيتكوين (BTC)

Comments

Post a Comment