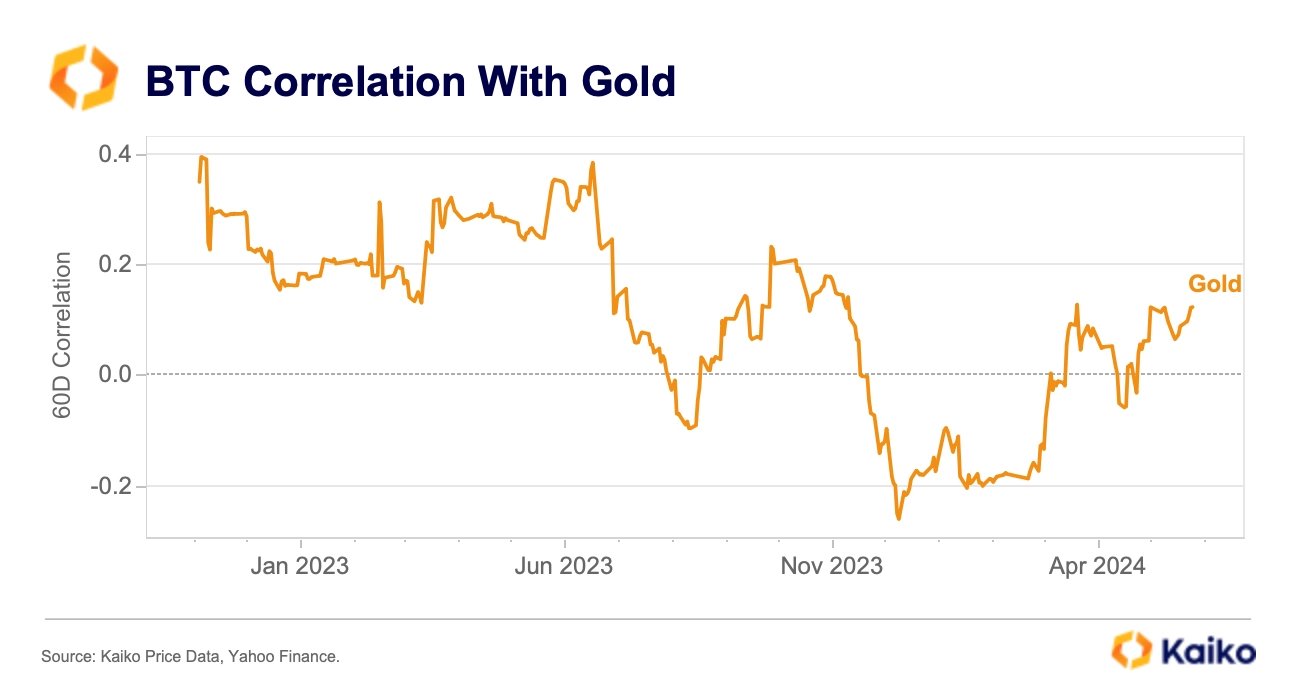

Recent months have witnessed an intensification of the relationship between... Bitcoin Prices And gold. Market data showed an increase in the correlation coefficient between them over a 60-day period. According to data published by Kaiko Company on... Tweeter On Twitter.

What does this trend mean for investors and does it indicate a possible change in their strategies?

Correlation coefficient In the context of global financial markets, it is a statistical metric used to measure the relationship between two or more financial assets (such as stocks, bonds, currencies, commodities).

This coefficient shows the strength and direction of the relationship between these assets, whether positive (they move in the same direction), negative (they move in opposite directions) or non-existent (there is no correlation between them).

Correlation coefficient values:

- Correlation coefficient +1: This means that there is a complete direct relationship between the two assets. That is, an increase in the price of the first asset is followed by an increase of the same percentage in the price of the second asset, and vice versa.

- Correlation coefficient 0: This means that there is no relationship between the two asset movements. That is, the price movements of one asset cannot be predicted based on the movements of the other asset.

- Correlation coefficient -1: This means that there is a complete inverse relationship between the two assets. That is, an increase in the price of the first asset is followed by a decrease of the same percentage in the price of the second asset, and vice versa.

In the case of BitcoinBTC And for gold, the correlation coefficient fell into the negative region at the end of 2023, indicating contradictory movements between them.

However, recent months have seen this coefficient become positive, meaning that both assets are moving in the same direction.

Read also: Is it true that investors are abandoning gold for Bitcoin?

Does this mean a change in gold and Bitcoin investment strategies?

Despite the recent rise, the correlation coefficient between Bitcoin and gold remains relatively low (below 0.2), compared to its 2022 peak of 0.5. However, this trend raises the question of whether investors view Bitcoin as a new safe haven, similar to gold.

Historically, gold has been considered a safe haven during times of economic uncertainty. If the correlation coefficient continues to increase, it may indicate that investors are increasingly viewing Bitcoin as an asset similar to gold, which could lead to a change in investment strategies.

Read also: Gold versus Bitcoin: Recession fears spark new investment debate

Correlation is an important factor to consider when diversifying an investment portfolio. Highly correlated assets do not provide good diversification because they will mimic the performance of others.

Since the correlation coefficient between Bitcoin and gold is still relatively low, investors might find it beneficial to add one to their portfolio for better diversification.

The recent increase in the correlation coefficient between Bitcoin and gold indicates a growing relationship between them. While this correlation is still relatively low, it may indicate a potential shift in investors' perception of Bitcoin as a safe haven, which could impact their investment strategies in the future.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,البيتكوين,الذهب,العملات الرقمية,بيتكوين والذهب

Comments

Post a Comment