Hedge funds are stepping up their short positions against Bitcoin on the Chicago Mercantile Exchange (CME). Even though Bitcoin exchange-traded funds (ETFs) benefited from a 19-day entry streak.

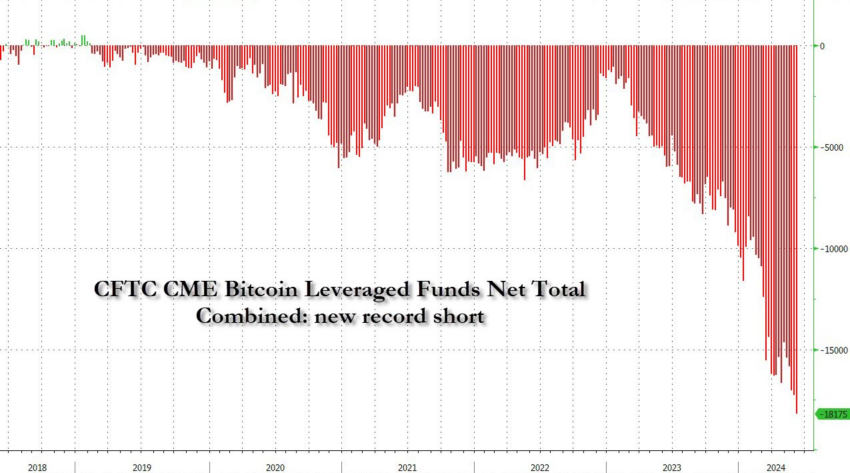

According to Zerohedge, the Commodity Futures Trading Commission (CFTC) Commitments of Traders (COT) report revealed a significant increase and a new record high in hedge funds' net short positions in Bitcoin.

Are hedge funds bearish on Bitcoin?

Data shows that hedge funds increased their net short positions in CME benchmark Bitcoin futures contracts. These positions also reached a record high of 18,175 contracts. These contracts. Worth 5 BTC each, they are part of a trading strategy in which traders sell futures contracts to profit from expected declines in the price of the underlying asset.

Learn more: Bitcoin Price Forecast in 2024

Sina Ji, co-founder of BTC-focused 21st Capital, suggested that these record short positions could indicate hedge funds' interest in the carry trade strategy. Carry traders typically sell futures contracts while simultaneously purchasing the asset. With the aim of exploiting price differences between spot and futures markets.

“These are more speculative positions and could indicate a carry trade. Where a hedge fund is long Bitcoin elsewhere, but these positions are less speculative and longer term.” Notice Sina J.

Interestingly, these record short positions coincide with a 19-day series of entries in Bitcoin ETFs. Over the past three weeks, ETFs have seen inflows of over $2 billion. However, despite this large inflow, the Bitcoin price failed to reach its all-time high in March at $73,835. Instead, it posted a modest 2% gain over the past seven days.

Also let the price performance BTC Low Many investors are confused. However, market experts explained that this trend is due to large financial institutions buying Bitcoin ETFs and selling futures contracts at the same time to profit from the price difference. This has led to significant inflows of funds from ETFs. With little impact on the spot price of Bitcoin.

Learn more: Bitcoin Halving 2024: Will it lead to a big price increase?

However, the SamsonCEO of JAN3, is convinced that “all short positions in Bitcoin will eventually be closed, voluntarily or involuntarily”.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بتكوين

Comments

Post a Comment