After the successful launch of a Bitcoin exchange-traded fund, BlackRock, the world's largest asset manager, is eyeing Saudi Arabia. The company aims to expand its presence in the Kingdom's financial sector.

Why is BlackRock aiming to expand into Saudi Arabia?

According to Bloomberg, Visit BlackRock CEO Larry Fink frequently travels to Riyadh and communicates directly with Crown Prince Mohammed bin Salman. The company was the first major global investment manager to open an office in Riyadh, underscoring its commitment to the Saudi market.

The strategic move puts BlackRock in a prime position to access the state-owned Public Investment Fund, which controls approximately $925 billion.

“The Middle East is an important market for BlackRock, both in terms of investment opportunities for our clients and in terms of the continued growth of our international business. We have long-standing relationships with clients in Kuwait, Qatar, Saudi Arabia and the United Arab Emirates. .”

👈Read more: What are the most important digital currency trading platforms in Saudi Arabia?

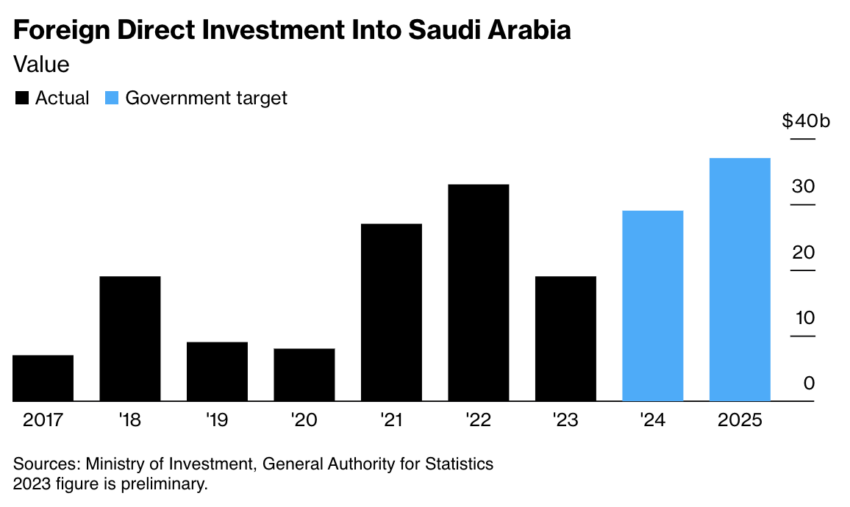

Saudi Arabia presents a complex mix of opportunities and challenges. The Kingdom is actively working to diversify its economy beyond its traditional oil base. The transformation is part of Crown Prince Mohammed bin Salman's vision to modernize the economy, making Saudi Arabia an attractive market for foreign investors. Fink calls for “business engagement” to promote economic and societal changes in the country.

The appeal of investing in Saudi Arabia is further complicated by its geopolitical situation. The region, known for its volatility, poses risks to market stability and investment returns. Despite these challenges, BlackRock's strategy of engaging directly with regional leaders and establishing a local presence aims to mitigate these risks.

BlackRock seizes opportunities in the cryptocurrency market

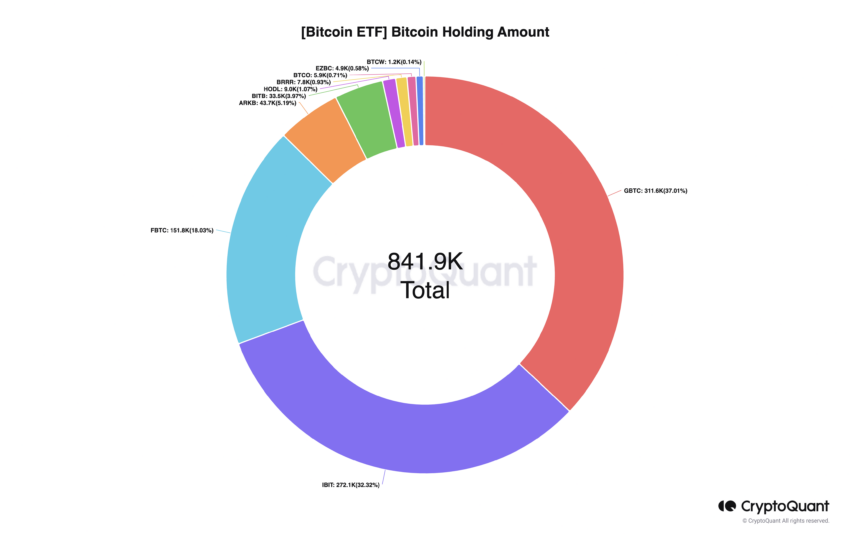

Globally, BlackRock continues to innovate, as evidenced by the launch of iShares Bitcoin Trust. This development represents a strategic diversification of the company.

The fund attracted I BITE, launched last January, generated financial flows worth $15.3 billion. This move also demonstrates BlackRock's flexibility to seize market opportunities at the right time.

👈Read more: How to buy digital currencies in Saudi Arabia

Despite the enthusiasm for Bitcoin ETFs, the market has experienced volatility. For example, overall net inflows into Bitcoin ETFs have recently faced challenges, as... registered BlackRock has less than $100 million in flows this week.

This corresponds to the difficulties of the broader cryptocurrency market, which has declined. Bitcoin Price About 15% below all-time highs.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment