BTC towards a possible rebound and ETH growing pre-Merge

The market indicators suggest that the bitcoin price could reconnect with the growth. As for the price ofEthereumits recent rise translated into increased confidence concerning the effects of a merger.

Since June, the prices of the leading cryptocurrencies have been going through a new bearish cycle. Bitcoin fails to break out of the $19-24K range. The cost of the first crypto-asset flirts today with 20,000 dollars.

Bitcoin low?

However, signals suggest that the bitcoin price could now approach its low. Bloomberg mentions in particular the leverage ratios.

This data is obtained by dividing the amount of open interest of the perpetual exchange contracts by the number of tokens kept on the exchanges.

These ratios are currently ” the highest ever recorded for Bitcoin and Ethereum, despite a capitalization decline of more than 50% in 2022.

Another observation: Bitcoin was trading last week in a range of around 5.4%, “the narrowest since October 2020 “. This range designates the price difference between supply and demand. And here again, its value would make it possible to establish a parallel with earlier periods.

The lull of two years ago was followed by a months-long price spike, which eventually sent Bitcoin to a then all-time high in April 2021. And traders are therefore more likely to bet higher and apply leverage.

ETH Open Interest Rebounds

As it concerns Ethereum, the price is up over 24 hours by just over 6% to almost 1700 dollars. The second cryptocurrency on the market is more dynamic than its elder, driven by Merger.

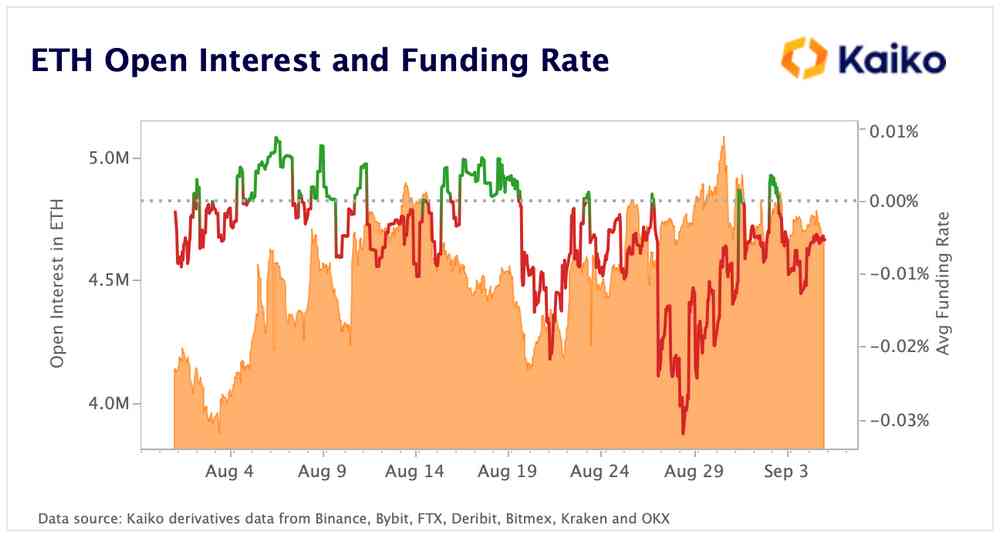

“The open interest inETH rises again after reaching historical heights”, measured Kaiko. The data analysis specialist notes “a significant increase” compared to the decline observed at the end of August.

This could indicate that sentiment regarding ETH pre-merger is improving among futures investors, with a focus on hedging risk pre-merger and a more optimistic outlook post-merger,” Kaiko infers.

This improvement, however, still puts ETH behind BTC. Indeed, “relative to BTC funding rates, sentiment regarding ETH in perpetual futures markets are systematically more bearish due to the non-zero possibility that the merger will fail”.

Follow cryptogamez.xyz on Twitter, LinkedIn, Facebook

Comments

Post a Comment