Increased Bitcoin price BTC To the highest level since November 2021 after It broke the $52,000 barrier.. This growth was mainly driven by inflows into spot Bitcoin ETFs. Source: institutional investors. This has created a state of optimism and interest among traders and individual investors.

This situation is often repeated in financial markets, where large investors lead the way, followed by small traders who often waste time. This may be even more true for Bitcoin, as historical data shows.

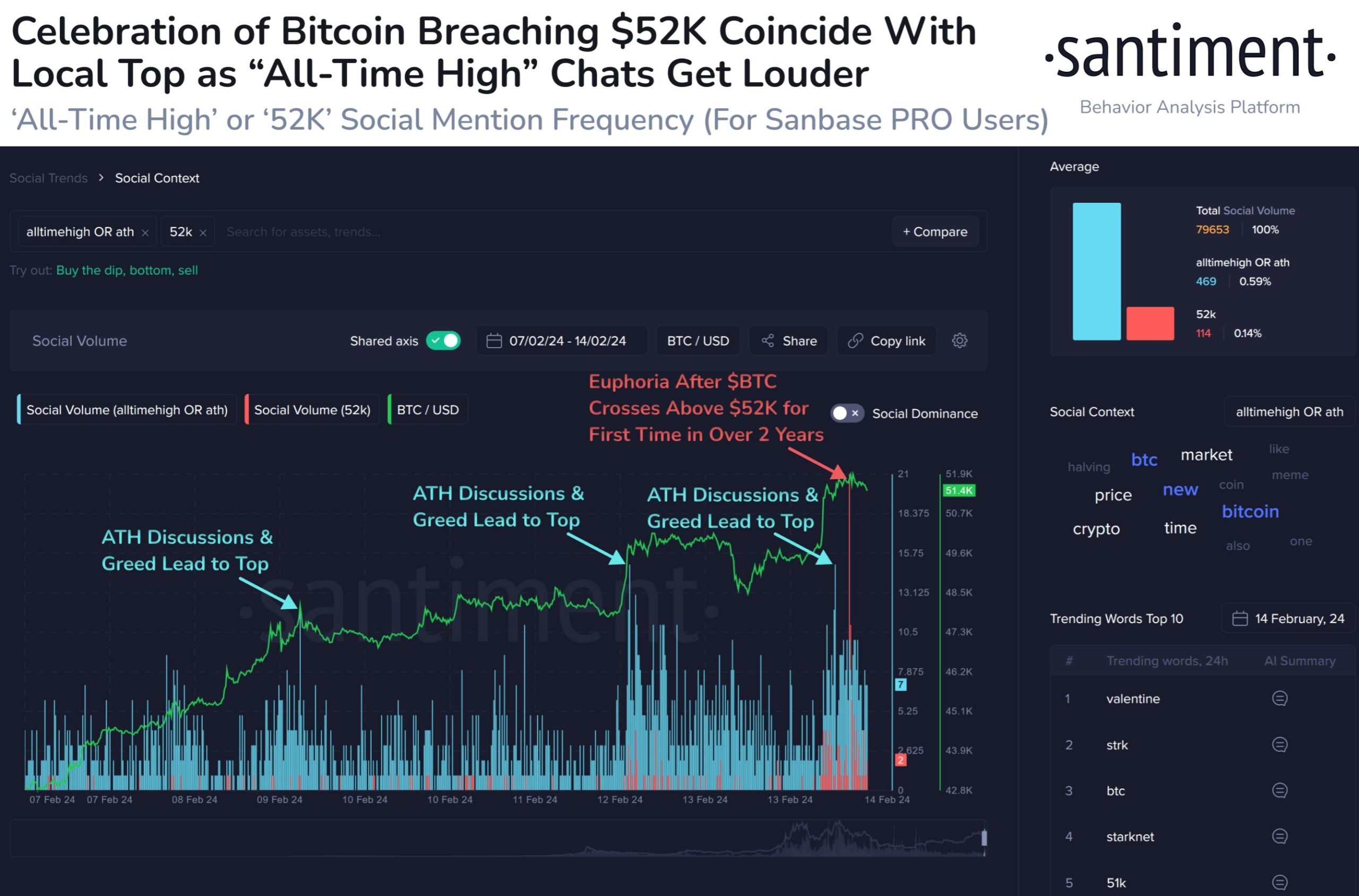

disclosed Data According to analytics company Santiment, there is a rise in optimism among Bitcoin investors, with the currency surpassing the $52,000 level, continuing its upward trend.

In its analysis, the company relies on the Social Media Volume metric, which tracks the number of discussions on a particular topic or term on major social media platforms.

The indicator measures this value by counting the number of posts/topics/messages containing at least one mention of the topic. The company prefers this method of measuring interest rather than simply counting the number of mentions because it is more accurate.

The data shows that the "social volume" of the terms "historic peak" and "$52,000" increased significantly after Bitcoin crossed the $52,000 level. This indicates that the recent rise has generated widespread discussion on social media.

Historical indicator of the formation of the peak and fall of the Bitcoin price

Historically, dramatic price movements in cryptocurrencies have been associated with excessive optimism among investors. Which led to the formation of price bubbles in the market. Any sudden fall In the price of Bitcoin BTC.

Santament notes that "exaggerated crowd celebrations after passing certain thresholds often lead to the immediate subsequent formation of local peaks."

The company adds: “This is especially true when traders on social media begin to raise their expectations unrealistically, such as talking about the possibility of a new all-time high.”

Current data shows that traders' behavior on social media is consistent with this scenario, raising concerns about the possibility of a price bubble forming in the Bitcoin market.

Of course, the repetition of an event in the past does not necessarily mean that its occurrence in the present is certain. Some of them are simply huge probabilities that need to be taken into account when making trading decisions.

This analysis also applies to short-term transactions. A new high is formed and the price decline can be included in the normal corrective movement. After more than two weeks of continuous growth.

As for long-term investment prospects. We need to focus on other fundamentals. Moreover, at this stage, most market participants and analysts are very optimistic.

Denial of responsibility

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in reliance on this information are solely the responsibility of it and its affiliates individually, and the site does not accept any legal liability for these decisions.

Comments

Post a Comment