TAmerican hedge fund manager and billionaire Bill Ackman has caused a stir in the cryptocurrency community with his recent comments on Bitcoin. Ackman, CEO of Pershing Square Capital, also presented his Bitcoin buying scenario.

Why can Bill Ackman buy Bitcoin

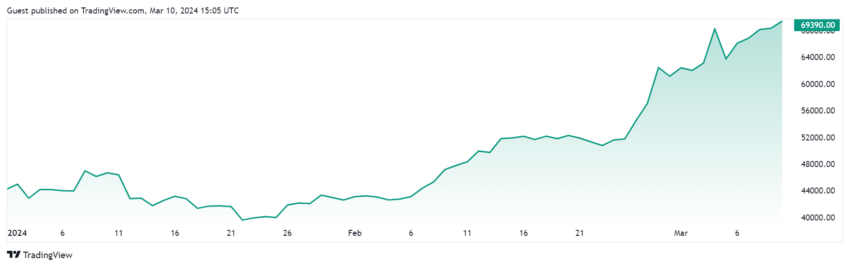

Bill Ackman speculated that a rise in Bitcoin prices driven by increased energy demand and consumption could lead to higher energy costs, inflation, a weaker dollar, and increased demand for Bitcoin . He believed that such a scenario could eventually lead to economic collapse, which led him to consider investing in Bitcoin.

However, I agree Ackman is on the other side of this scenario, aware of its reversibility.

“The rise in the price of Bitcoin leads to an increase in mining and an increase in energy consumption, which leads to an increase in the cost of energy, therefore higher inflation and a fall in the dollar, then an increased demand for Bitcoin and an increase in mining, then higher demand for energy. "And the cycle continues. Bitcoin goes to infinity and the price of Bitcoin rises." "Energy drops dramatically and the economy collapses."

Read more: Latest Bitcoin (BTC) price analysis from BeInCrypto

Ackman had nothing to do with digital currency. But in 2022, the billionaire said he believed Sam Bankman Freed was not a fraud and that FTX failed because its disgraced founder was trying to avoid embarrassment. Before that, he had reveal Cryptocurrencies made up less than 2% of his investment portfolio.

At the time, Ackman said he was a small investor in some cryptocurrency projects and seven cryptocurrency investment funds, adding that his investments were just a hobby.

Company corrects Ackman's statements

Ackman's statements sparked numerous comments from prominent figures in the cryptocurrency market, highlighting the flaw in his logic. For example, He said Alexander Leishman, CEO of River:

"Mining is incredibly competitive and loses money when energy prices rise. The feedback loop of mining actually pushes miners towards more distant/intermittent forms of energy and not towards energy that competes with residential electricity demand. In short, mining does not make mining energy more expensive. It “allows us to invest energy that would otherwise be wasted.”

and at the same time, Encourage MicroStrategy CEO Michael Saylor has also considered buying Bitcoin, but disagrees with his reasoning. Saylor noted that most Bitcoin miners have reduced electricity costs for consumers and invited a one-on-one discussion.

Read more: The best time to buy Bitcoin in 2024

Likewise, Call Pierre Rochard, vice president of research at Riot Platforms, asked Akman to look into the economics of Bitcoin mining. Roshard also highlighted the complex feedback loops and limits of Bitcoin's purchasing power due to the wealth spending effect and holder rebalancing.

Environmentalist and venture capitalist Daniel Batten also said Ackman's reasoning about Bitcoin mining was flawed.

"The logic breaks down when increased energy consumption => leads to higher energy prices. Bitcoin mining is a huge user of stranded/wasted energy."

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بت كوين,بتكوين

Comments

Post a Comment