The value of Bitcoin has increased (BTC) by around 10% on Wednesday. This rally defied the prevailing trend of net outflows from U.S.-listed Bitcoin exchange-traded funds (ETFs).

These funds were subject to a significant withdrawal of approximately $742 million this week. Notably, a large outflow of $261.5 million occurred on March 20 alone.

Why is the Bitcoin bull cycle not over yet?

Farside Investors provided data showing a stark contrast between entries and exits within the sector. The Grayscale Bitcoin Trust (GBTC) and Invesco Galaxy Bitcoin ETF (BTCO) also saw the biggest losses. He withdrew $386.6 million and $10.2 million, respectively.

Therefore, modest inflows into other approved funds have had little impact on the overall outflow scenario.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

| the date | I BITE | FBTC | BITB | ARKB | BTCO | EZBC | BRRRRR | HODL | BTCW | GBTC | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| March 19, 2024 | 451.5 | 5.9 | 17.6 | 2.7 | 0.0 | 0.0 | 4.8 | 5.7 | 0.0 | -642.5 | -154.3 |

| March 20, 2024 | 75.2 | 39.6 | 2.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | -443.5 | -326.2 |

| March 20, 2024 | 49.3 | 12.9 | 18.6 | 23.3 | -10.2 | 19.0 | 2.9 | 9.3 | 0.0 | -386.6 | -261.5 |

Despite these massive capital outflows, the performance of the Bitcoin market has been remarkably resilient. After falling to $60,775 on Wednesday, Bitcoin rebounded to a high of $68,100. It was then revised to $66,640 early Thursday.

This recovery occurred at the same time Express it Federal Reserve Chairman Jerome Powell on His pessimistic attitude. Additionally, the Federal Reserve has maintained plans to cut interest rates three times this year, even as inflation rises.

Market dynamics in ETF outflows also contrast with rising Bitcoin prices, illustrating the complex relationship between institutional movements and cryptocurrency valuations. While ETF outflows generally indicate bearish sentiment, the strong demand for Bitcoin suggests a different story, highlighting its ability to withstand negative institutional pressures.

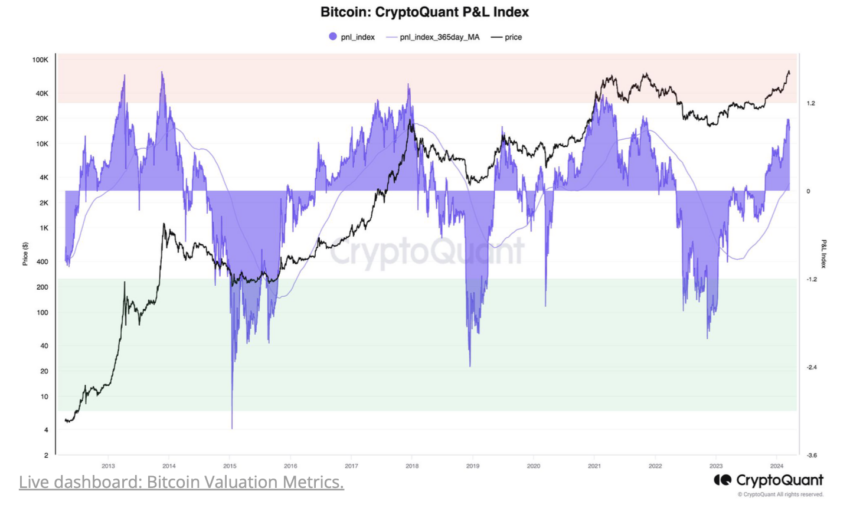

Additionally, CryptoQuant analysts provided long-term forecasts. Which indicates that the Bitcoin bull cycle is not yet over. The company's data also indicates that the current investment flow from short-term currency holders constitutes 48% of total Bitcoin investments. Historically, this figure at the end of a bull cycle has been between 84% and 92%.

Additionally, valuation metrics such as the CryptoQuant P&L Index still fall outside of the market's typical upper zone. It maintains its position above the moving average for one year.

Read more: Bitcoin Price Prediction 2024/2025/2030

This indicates that despite market volatility and ETF outflows, Bitcoin's valuation is not in the zone that typically indicates an impending market downturn.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment