The United States Securities and Exchange Commission (SEC), led by Gary Gensler, made headlines with its $2.6 billion budget request for fiscal year 2025. The large sum aims to strengthen oversight by the SEC of the cryptocurrency sector.

The proposed budget also highlights the agency's commitment to increasing its workforce. It targets more than 5,000 jobs to improve oversight of digital assets and emerging technologies.

Why does the SEC want to attack cryptocurrencies?

Confirm Gensler said the budget would be offset by transaction fees, ensuring a deficit-neutral approach. Specifically, the SEC plans to strengthen its examination division with 23 new positions in 2025. This move directly responds to the complexities of the crypto market.

"We have witnessed the Wild West of cryptocurrency markets, rife with non-compliance. Investors have put hard-earned assets at risk in a highly speculative asset class. This rapid growth and change also means greater risk of wrongdoing,” the SEC wrote. : “As a police officer, we must be able to stand up to bad actors.”

Under Gensler's watch, the SEC took an aggressive regulatory stance. He has also filed high-profile lawsuits against leading crypto exchanges such as Binance, Kraken, and Coinbase. With a focus on trading unregistered securities.

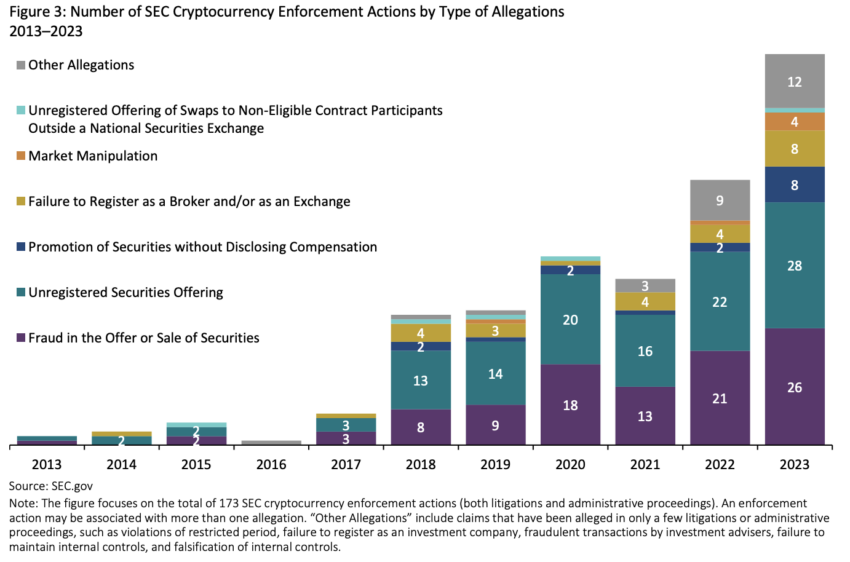

As a result, the SEC's aggressive actions have led to a record number of enforcement actions. This has intensified the regulatory atmosphere in the cryptocurrency sector.

Read more: Gary Gensler warns against cryptocurrencies as market focuses on ETFs

Additionally, the SEC is actively participating in a legal effort to classify Ethereum, the second-largest digital currency, as a security. This effort has included numerous requests for documents from companies that interact with the Ethereum Foundation. As a result, the SEC's aggressive strategy aims to deepen its understanding and control of the crypto environment.

However, the cryptocurrency sector does not stand still. It actively seeks regulatory clarity and challenges the SEC's enforcement actions.

For example, organizations such as the Council for Crypto Innovation (CCI), Paradigm, and the Chamber of Digital Commerce are calling for careful regulation that takes into account the unique aspects of cryptocurrencies.

In response to these challenges, the political influence of the cryptocurrency sector is growing. Increased lobbying efforts and significant financial contributions to pro-crypto political campaigns also reflect the industry's determination to foster a regulatory environment that supports innovation and ensures consumer protection.

Legal battles continue, as Texas-based cryptocurrency company Lejilex and the Texas Crypto Freedom Coalition take a stand against the SEC. Specifically, they argue that the SEC's broad classification of digital assets as securities exceeds its regulatory authority and stifles innovation.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار الذكاء الاصطناعي

Comments

Post a Comment