Economist Peter Schiff, known for his harsh criticism, warned For Bitcoin BTCof a bubble in cryptocurrency exchange-traded funds (ETFs), predicting a Bitcoin collapse when gold rises.

Economist Peter Schiff, known as a harsh critic of Bitcoin and defender of gold, warned that... Bitcoin Prices Rise Digital currency exchange-traded funds (Bitcoin ETFs) may be a sign of a bubble about to burst, especially with the possibility of higher gold prices in the future.

Schiff believes that gold will experience an “inevitable” rally and that the price of Bitcoin will fall significantly as investors exit Bitcoin ETFs. He pointed out that “Bitcoin has practically become a bet against gold.”

Warnings of bubble collapse as gold rises

Schiff, V. Tweeter On social media platform

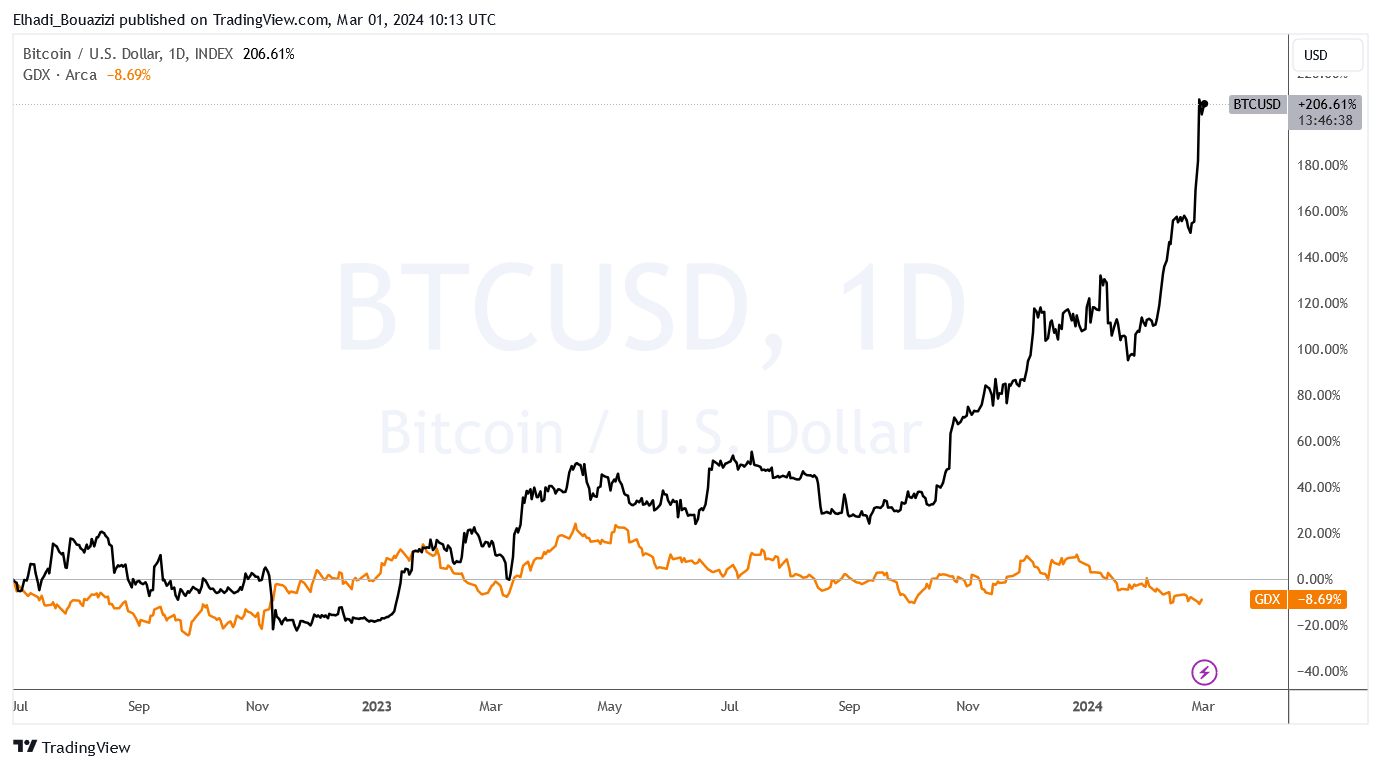

The value of this fund, which tracks shares of gold mining companies, has fallen 11.5% since February 2024, while the price of Bitcoin has increased by more than 40% during the same period, despite relative stability gold prices.

Schiff believes that the poor performance of gold mining stocks is because investors are selling them in order to invest in new Bitcoin ETFs.

Read also: Cathie Wood thinks Bitcoin will overtake gold as a safe haven… for this reason

He added: "This means that Bitcoin has virtually become a bet against gold. So when the price of gold inevitably rises, the money needed to buy shares of gold mining companies will come from Bitcoin ETFs."

However, Schiff expects that a collapse in the price of Bitcoin would result in a much smaller outflow of money than it initially received. “Because the sell-off will lead to the collapse of the digital currency.”

Therefore, it is believed that most of the money that will be invested in gold mining stocks will come from other sources.

“Normally, when an asset bubble develops,” Schiff concluded, “that can explain why it grew so large and persisted for so long.”

Criticism and ridicule of Schiff's predictions

Schiff's social media posts have received mixed reactions, with many mocking him for his constant criticism of Bitcoin.

One described his story as "officially transformed into a therapeutic story for the older generation hooked on the hard money theory of the last century."

While another opined: “Sad to see public tweets from supporters of old gold who don't realize the world has changed. Peter has been raging against Bitcoin for over a decade. It must be painful for him to be wrong time and time again. "

On the other hand, some commentators have partially defended Schiff's view. One says Schiff is "partly right about the first half of what he said," but doubts the validity of his future predictions. He compares the development of Bitcoin to what happened with digital music, e-books and smartphones, which replaced the old ways that were prevalent in the past.

Read also: The boss of the world's largest asset manager praises Bitcoin... and calls it 'digital gold'

This raises Schiff's predictions of a bubble bursting. Bitcoin BTC Price With the rise of gold, a new old controversy. On the idea that Bitcoin is a store of value like gold or… Digital gold.

Although opinions differ on the fate of digital currency, these expectations shed light on the complex relationships between different assets and the fluctuations seen in global financial markets.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

Comments

Post a Comment