After strong rises on the first day of this week, momentum waned and Tadawul stabilized. Bitcoin BTC Price Between the two levels: $68,500 - $71,100. With the state of anticipation and calm that reigns on the market after several weeks of bullish unrest.

Last week I witnessed Passive Bitcoin ETF Flows For the first time since its launch, the price of the main currency is rising. This has led many analysts to say that the strength of the latter's influence on market developments is declining. More precisely, its effect on investors diminishes as they become accustomed to it.

On the other hand, blockchain data indicates that Bitcoin whales have engaged in a huge buying spree over the past week. This is probably one of the main factors that pushed the price of Bitcoin higher.

Bitcoin whales hold over 100,000 BTC

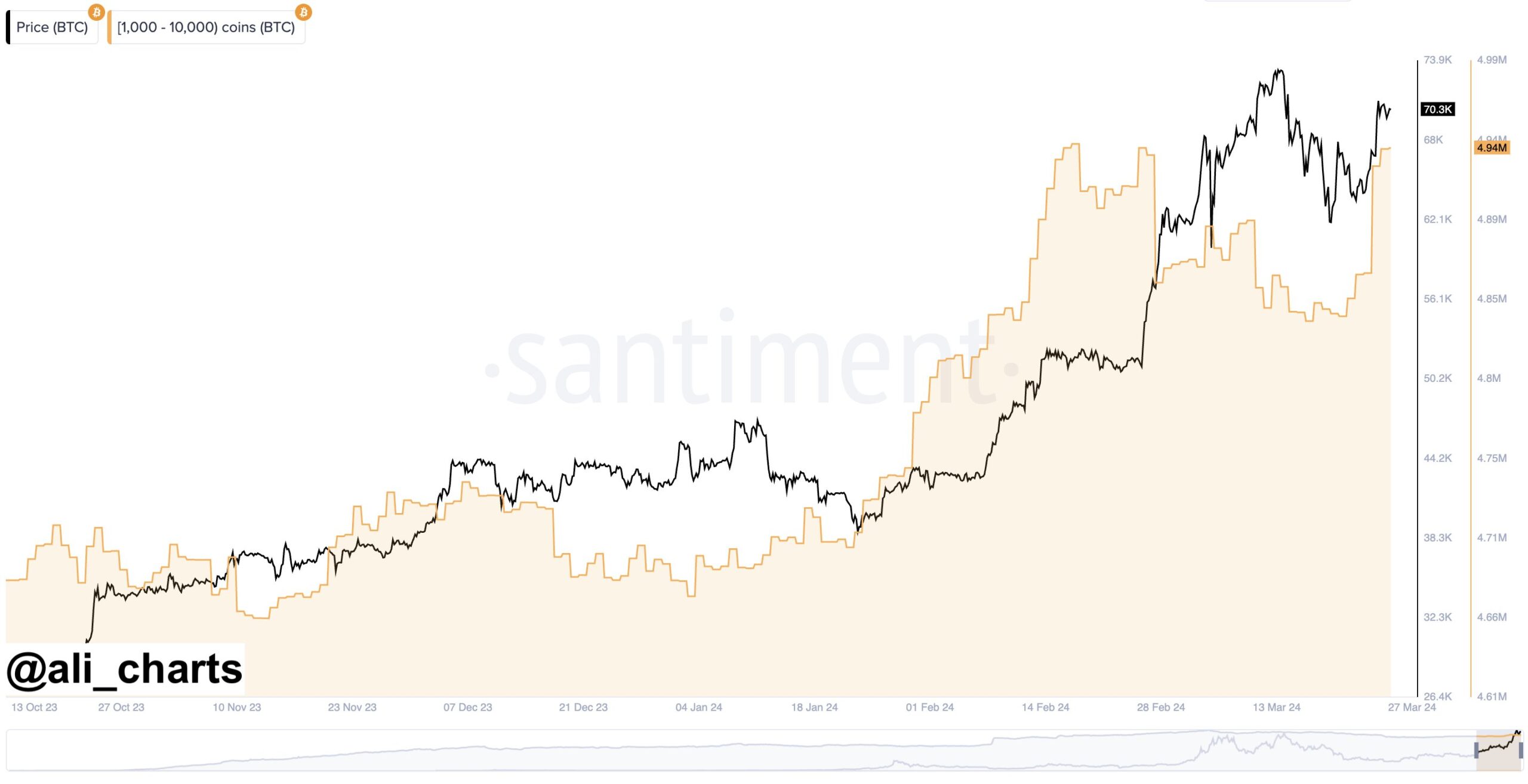

According to the “Supply Distribution” index published by the blockchain analysis company “Santiment”. Bitcoin whales have purchased over 100,000 units of the digital currency over the past week.

Supply distribution index (Supply distribution index) in the digital currency and Bitcoin market refers to the distribution of currency or the total supply of digital currency to various owners.

This indicator helps understand how the total supply of money is distributed between large and small investors. Is there a large accumulation of currency among a small number of parties or an equal distribution among several investors?

Circulation data from cryptocurrency trading analytics firm Santiment gives us an idea of the total amount of Bitcoin that different groups currently own in the market.

Addresses are divided into 4 groups according to their total currency balance.

In the context of this analysis, we focus on the category Whales (Whales) , which refers to holders holding very large quantities of digital currencies. For example, in the case of Bitcoin, any address holding more than 1,000 BTC can be considered a “whale”.

The chart below shows how the “supply distribution” level has changed for Bitcoin whales over the past few months:

As the chart above shows, the total supply of Bitcoin held by the group from 1,000 to 10,000 BTC has increased significantly over the past week.

During the current buying frenzy, Bitcoin whales have added over 100,000 BTC to their holdings. Over seven billion dollars at current prices.

Seizing Opportunities for Bitcoin Price to Fall

This latest whale buying frenzy began when Bitcoin was trading near its recent lows. It is possible that these large investors saw the weakness in prices as an opportunity to capture the currency. This encouraged them to buy intensively.

Alongside these purchases, Bitcoin's bullish movement has regained momentum. Its price exceeded 71,000 US dollars.

It appears that the great whale wave has been one of the main drivers of the rise in recent times.

Between the start of the year and the end of February, these huge entities were constantly purchasing Bitcoin in increasing quantities. As his possessions saw a constant increase.

And with puberty BTC Price At record levels, these investors began to respond to the magic of profit, turning to pure distribution rather than acquisition.

With recent purchases, not only has the trajectory of the net distribution index reversed, but whale supply has actually returned to levels similar to what it was before distribution began.

If Bitcoin whales can continue their purchases in the coming days, the recent trend could also continue, just as it did earlier this year.

Of course, continuing to rise means the possibility of recording a new all-time high price, as Bitcoin is currently not far from achieving this.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,العملات الرقمية,العملات المشفرة,بلوك تشين,بيتكوين,سعر بيتكوين

Comments

Post a Comment