As the cryptocurrency market approaches the Bitcoin halving expected on April 25, 2024, supply and demand dynamics are setting the stage for a parabolic rally.

Unlike previous cycles, this year marks a turnaround, fueled by growing enterprise adoption and growing use cases, painting an optimistic picture for Bitcoin.

Why is Bitcoin Halving Creating an Upward Trajectory for the Crypto Market?

Consent formed to Bitcoin Spot Exchange Traded Funds (ETFs) Its success constitutes a historic milestone in the journey of digital currency. Since its inception, Bitcoin has seen significant price growth of 60%, with trading volumes reaching unprecedented levels.

It sparked an influx of institutional interest With Bitcoin ETFs More than $30 billion in assets under management in two months. This increase in demand is also reflected in capital inflows which reached $1 billion in a single day. At the same time, net inflows have exceeded $10 billion and daily inflows are three times the daily minted supply.

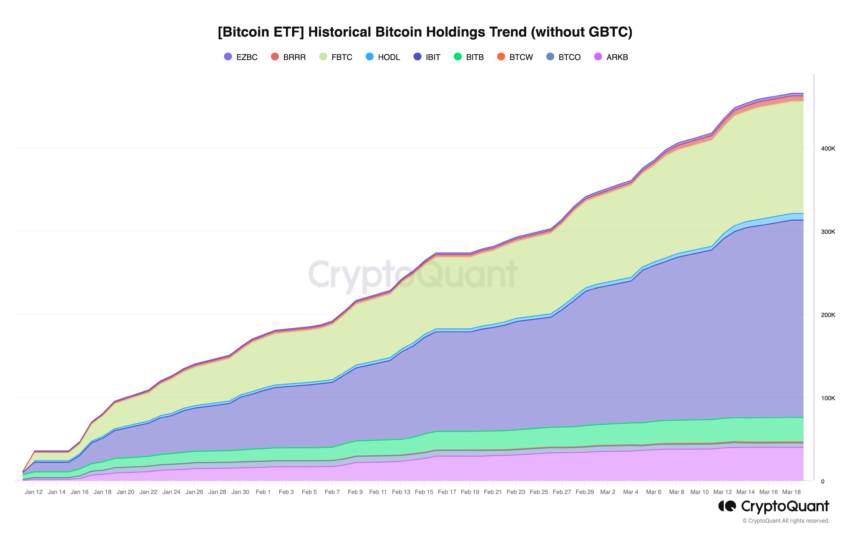

This scenario is expected to become more pronounced post-lockdown, with ETFs holding over 467,000 BTC, excluding Grayscale, far exceeding the annual BTC supply of 164,000 BTC.

The current appetite for Bitcoin already represents around 4.5% of the available supply. Therefore, increased reliance on Bitcoin ETFs could spur supply pressure.

books 21Shares analysts: “With registered investment advisors overseeing approximately $114 trillion in the United States and mandated to wait 90 days after new product launches before investing, even a simple 1% allocation to Bitcoin could trigger large inflows, making their current market "worse" roughly. value and compresses supply in the process.

The unwavering confidence of long-term Bitcoin holders, despite market volatility, embodies the unwavering belief in the value of Bitcoin. The supply held by these long-term investors still represents around 70% of the total circulating supply.

At the same time, supply held by short position holders increased by more than 33%, further limiting available supply and signaling an imminent price rise.

According to analysts at 21Shares, the upcoming Bitcoin halving on April 25, 2024, in this context, indicates that the cryptocurrency market may be on the cusp of a unique and perhaps unprecedented bull cycle. As ETFs attract a new wave of traditional investments and long- and short-term cryptocurrency holders are convinced, Bitcoin's supply constraints are becoming increasingly evident.

“If this trend continues, Bitcoin's supply will become increasingly illiquid, paving the way for a supply squeeze and the potential start of a parabolic upcycle,” 21Shares analysts concluded.

While recognizing Bitcoin's inherent volatility, the current environment appears poised for a significant upward trajectory ahead of the 2024 halving. This cycle may differ from previous ones and could herald a new era of institutional adoption and financial recognition.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار البيتكوين (BTC)

Comments

Post a Comment