The daily trading volume of a currency stock increased (Toncoin (TON has reached all-time highs, surpassing $314 million. Despite this recent increase, TON's EMA lines indicate an upward trend and the potential for further price increases.

However, a possible cause for concern is the high incidence dividend holders, This figure is currently at 95%, the highest level since 2021. Historically, this suggests that selling pressure could be on the horizon. Is this a buying opportunity or a waiting signal?

TON Daily Trading Volume Hits New Records

TON's daily trading volume recently reached an all-time high, reaching a new all-time high with an impressive $314 million. This impressive achievement surpasses the previous record, set just two weeks ago on February 28, with a trading volume of $295 million. Notably, a significant and consistent trend was observed between the price movements of TON coin and its trading volume, indicating a strong relationship between the two.

This trend indicates that as trading volume increases, the price of the TON token tends to follow suit, highlighting the growing momentum of the token. This trend is particularly noteworthy as it may indicate a positive outlook for the TON token, indicating that the token is gaining significant momentum in the market.

As a result, investors and market observers are increasingly optimistic that the upward trend in trading volume and token price could continue for the foreseeable future, further strengthening the positive momentum surrounding TON.

The majority of cryptocurrency holders are now making profits

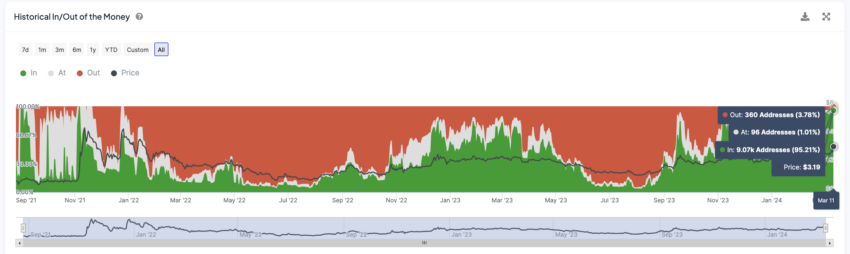

Analyzing the distribution of TON holders based on their profit and loss positions paints a fascinating picture. Over 95% of TON holders are currently profitable, representing the highest level of profitability since 2021. This statistic, derived from the “in/out of the money” metric, provides insight into investor sentiment.

This metric calculates the average price at which different addresses acquired TON tokens. If the current market price exceeds the cost basis (average acquisition price) of a particular security, that security is classified as "in the money", indicating a potential profit. In contrast, addresses whose current price is below cost are considered “out of the money,” indicating unrealized losses.

Although a high percentage of winning shareholders may raise concerns about possible sales, historical trends suggest a more nuanced perspective. There have been cases where few profitable shareholders caused a lasting downtrend. Additionally, TON still has plenty of room to grow before reaching its previous all-time highs. The price needs to rise another 22.10% to see these highs again. This indicates that the market may still be in the accumulation phase. In this case, investors will likely hold their positions in anticipation of further price increases.

However, it is wise to recognize the possibility of selling pressure. The recent 37% price rise has undoubtedly put many holders in a profitable position. Some may be tempted to preserve their gains by liquidating part of their assets. This potential selling pressure should be closely monitored, especially if it coincides with current weak uptrend signals identified by technical analysis.

TON Coin Price Forecast: Could It Hit $4?

The 4-hour chart of TON is giving bullish signals on several fronts. The recent crossover of the short-term exponential moving averages above the long-term lines is a classic technical indicator indicating an uptrend.

Exponential moving averages (EMA) are metrics used in technical analysis to smooth out price fluctuations and identify trends. Adding to the bullish sentiment is the fact that TON price is currently trading above all EMA lines on the chart. This strengthens the uptrend signal because it indicates that the price momentum is currently in an uptrend.

However, it is important to consider potential support levels in case price encounters resistance or pullback. TON has historically found support around $2.6 and $2.38. If the price falls below these two zones, it could indicate temporary weakness and potentially lead to a decline towards $2.10.

On the other hand, good news could continue to push the price of TON higher. An example of this is the news that happened Share it Recently On X who says that Telegram You will reward channel owners with Toncoin:

“The company (@telegram) will pay the rewards using Toncoin on TONNE Blockchain. Channel owners will start receiving 50% of all revenue the company generates from displaying ads on their channels.

If the current uptrend continues to accelerate, TON could see a significant price rise. A break above $4 would represent a breakout to levels not seen since 2021, opening the door to potentially higher prices.

Overall, technical analysis of TON's 4-hour chart indicates a bullish outlook, with the exponential moving averages and current price center providing positive signals. However, traders should be aware of potential support levels and be prepared to adjust their strategies accordingly.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق

Comments

Post a Comment