An accelerating bull market is usually associated with a growing influx of new investors. Short-term Bitcoin (STH) holders – as on-chain analysis calls them – join the market during a bull market boom. Motivated by the desire to make quick profits, they do not hold assets for long.

However, if the Bitcoin price corrects, as with last week's price action, short-term holders lose quickly. Despite this, their behavior and presence in the market are essential to maintaining a healthy bull market.

How important are Bitcoin holders in the short term?

Monitoring the behavior of Bitcoin holders in the short term is important because of historical correlations with the price of Bitcoin. The STH category includes addresses that have held Bitcoin for less than 155 days. After crossing this arbitrary threshold, addresses become long-term address holders (LTH). They hold their assets for the long term and tend not to sell them emotionally.

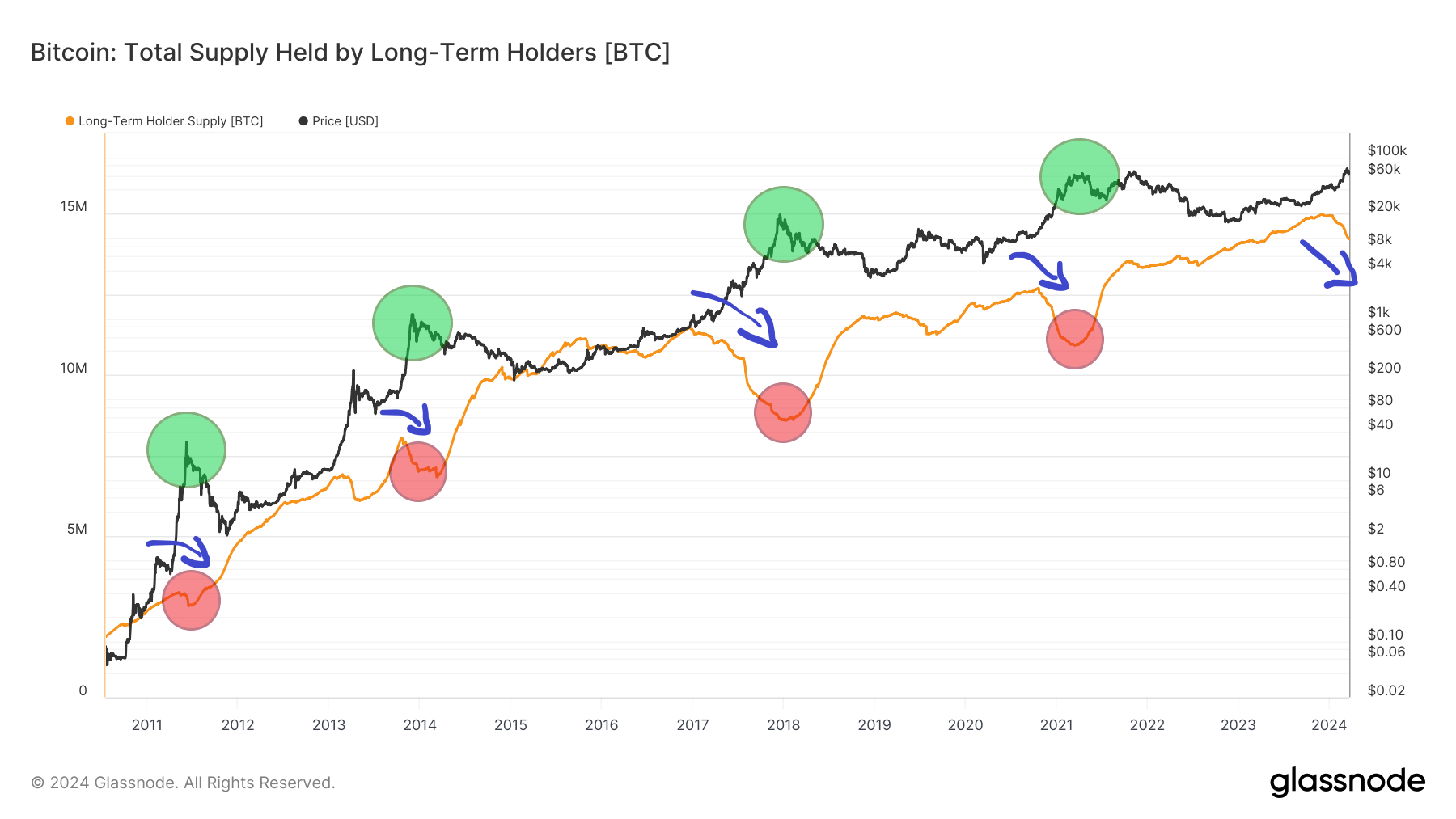

Naturally, the increase in the percentage of Bitcoin supply held by long-term address holders is inversely proportional to the percentage held by long-term address holders. Interestingly, the long term chart of supply in the hands of LTH is also inversely proportional to the price of Bitcoin. This is particularly evident during the peaks of successive cycles. The more Bitcoin is sold by long-term holders (red zones), the higher the price of Bitcoin (green zones).

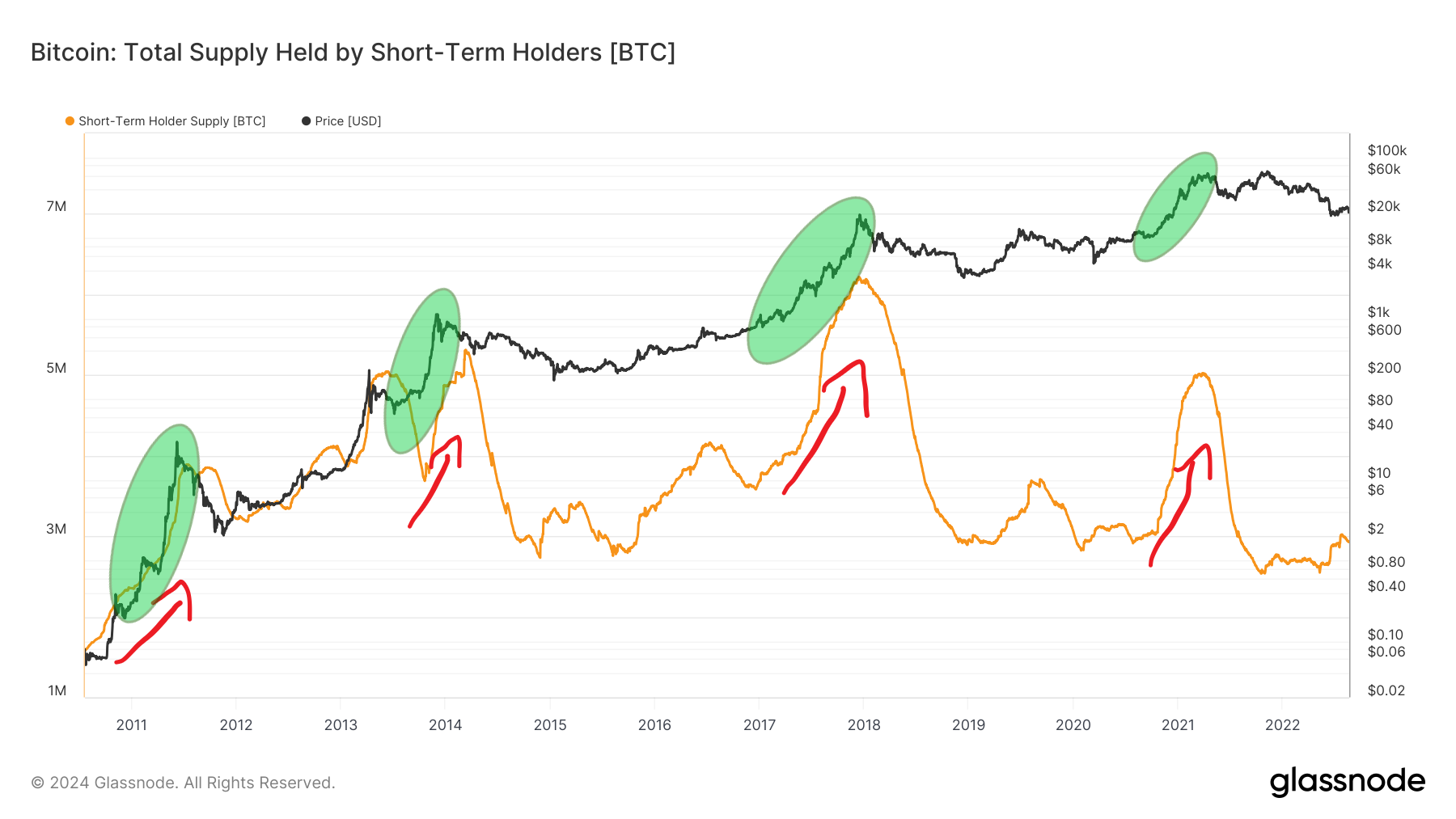

Therefore, the supply in the hands of long-term holders is generally directly proportional to the price of Bitcoin. New, inexperienced market participants buy Bitcoin during peaks (red arrows).

They are convinced that since the cryptocurrency has already increased, it will continue to increase (green zones). This is fueled by a growing circle of new investors and traders who always want to join the bullish momentum of the market. Hence the importance of tracking what short-term currency holders are doing on-chain.

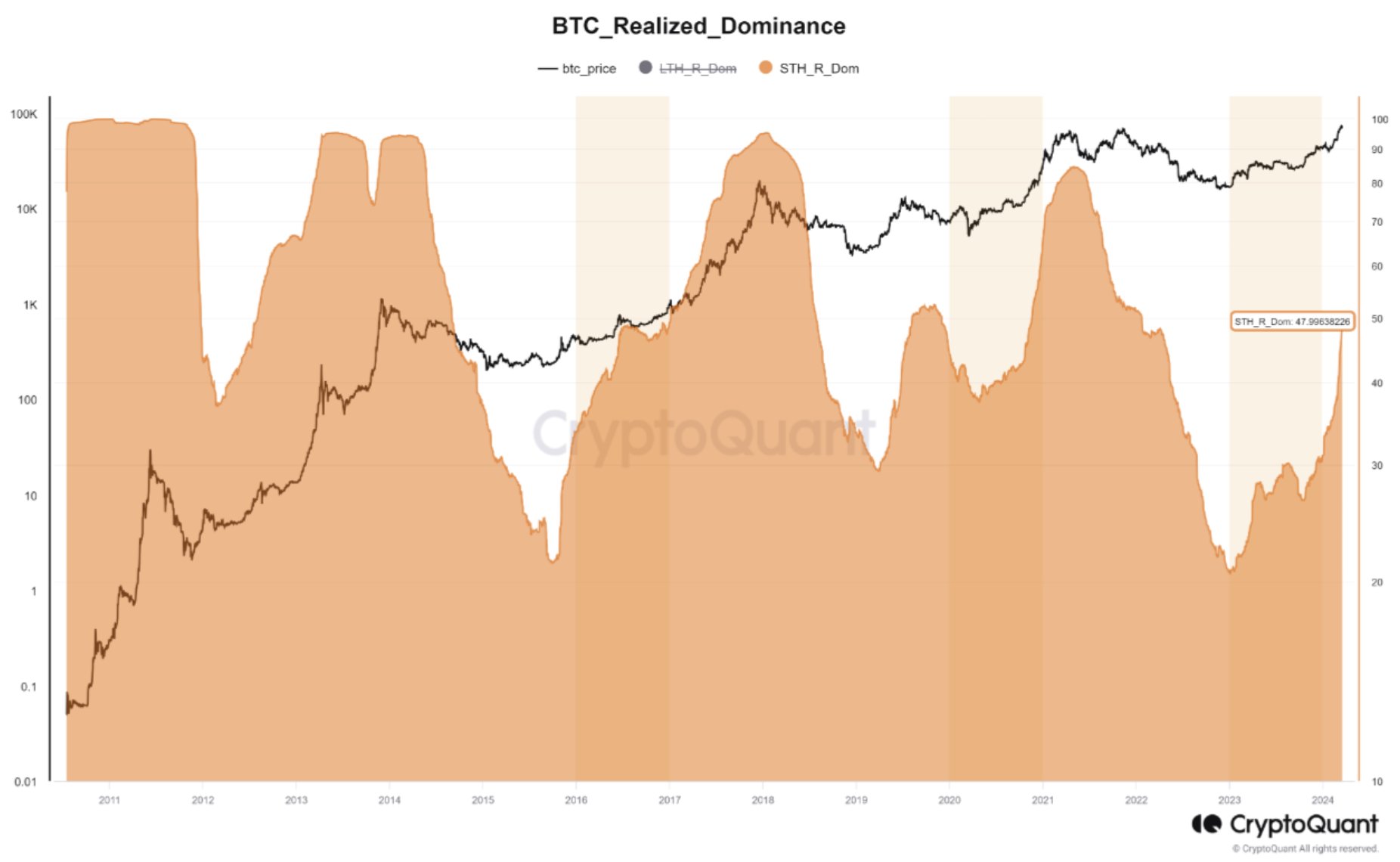

Short position holders represent approximately 50% of the realized value of Bitcoin

In article to publish Recently, Analyst firm CryptoQuant noted that around 50% of Bitcoin's capital is in the hands of short-term currency holders. A particular increase in this indicator can be observed over the last 30 days, when the enthusiasm and pace of STH purchases increased.

“This event, coupled with the indication of higher short-term holder sentiment, reflects higher dominance of this capital in the market over the coming weeks and months.” - Analysts added On the chain.

However, on the other hand, books Another analyst at CryptoQuant This sales rate The assets held by LTH do not yet indicate an advanced stage of the cycle. In other words, there is still great potential for STH to buy and increase the price of Bitcoin in the current cycle.

“However, we have not yet seen this late phase of the cycle, although sporadic corrections are common, in part due to the highly leveraged nature of the current market.”

Major support is $55,000

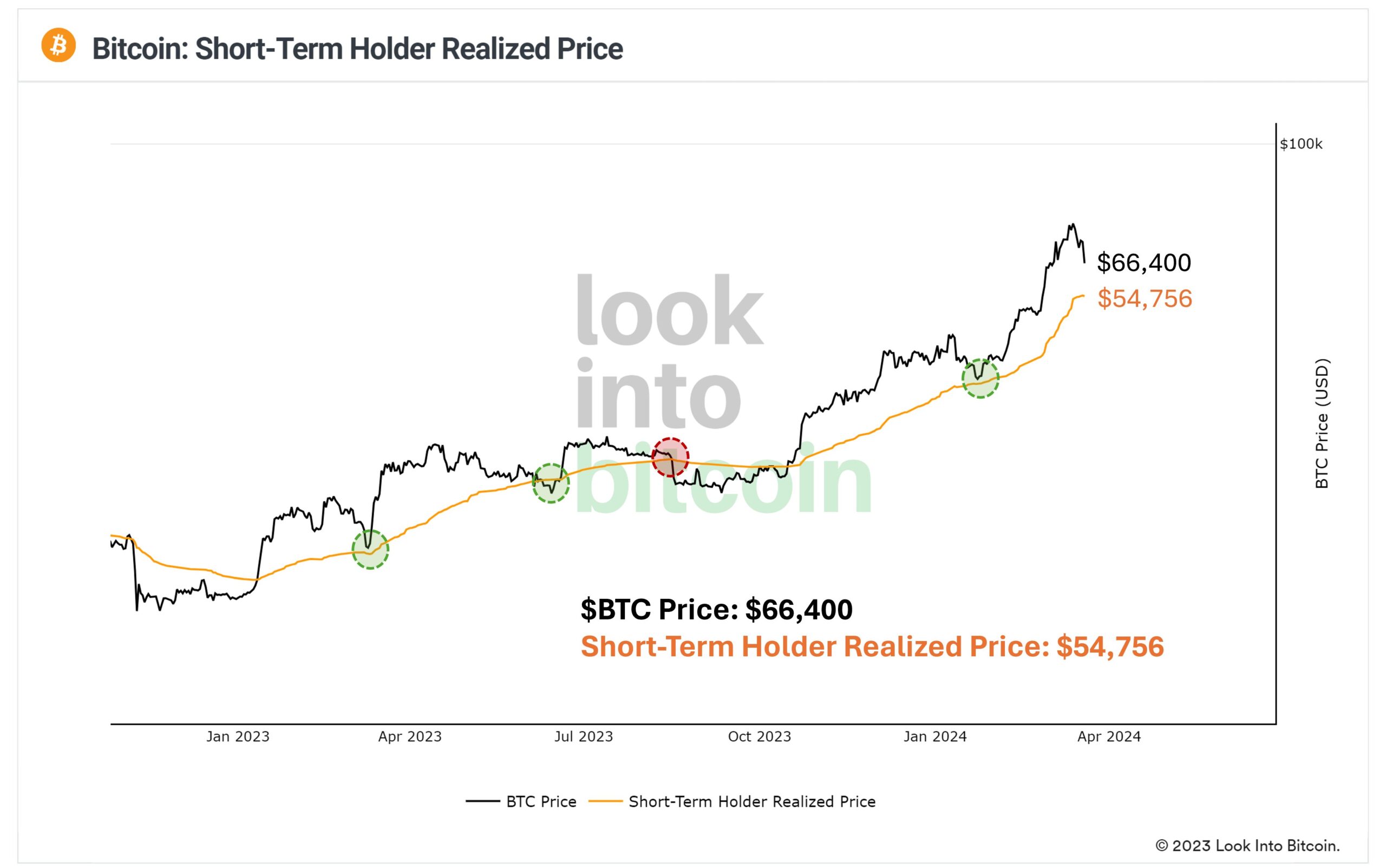

Finally, a well-known cryptocurrency market analyst published @PositiveCrypto His take on STH's behavior on X today. It provided a chart of the realized price for short-term currency holders.

He pointed out that in the ongoing bull market, the curve has already supported the price of Bitcoin three times (green zones). At the same time, he pointed out that at one point, Bitcoin's value fell below this support, triggering a deeper market correction.

Therefore, the analyst predicts that if Bitcoin's continued correction brings back to the reached price zone, Bitcoin will reach the $55,000 zone. Measured from the current all-time high (ATH) of $73,777, this would represent a decline of approximately 25%.

However, even such a deep correction will not disrupt the long-term bullish market structure. Only a loss of this support and deeper declines could lead to a medium-term bear market, which could dominate near the next halving.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment